Frequently Asked Questions

FAQ filtered results:

-

Program: Blue BoxTopic: Producer , Registration

Producers are required to provide the following information when registering with RPRA:

- Contact information

- PRO information (if a PRO has been retained at time of reporting), including what services they have retained a PRO for

- Their 2020 supply data in each of the seven material categories– beverage container, glass material, flexible plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

Please note that this information must be submitted to RPRA directly.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

Program: Blue BoxTopic: Collection systems , General , PRO , Processor , Producer

The following are the types of Blue Box Materials obligated under the Blue Box Regulation:

- Blue box packaging (primary, transport, convenience, service accessories, ancillary elements)

- Paper products

- Packaging-like products

-

Program: Blue BoxTopic: Producer

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

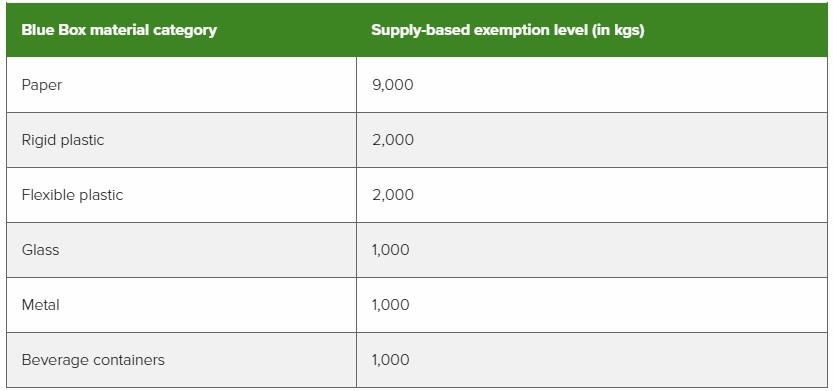

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.