Frequently Asked Questions

FAQ filtered results:

-

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , ITT/AV , Lighting , TiresTopic: RPRA Program and Registry Fees

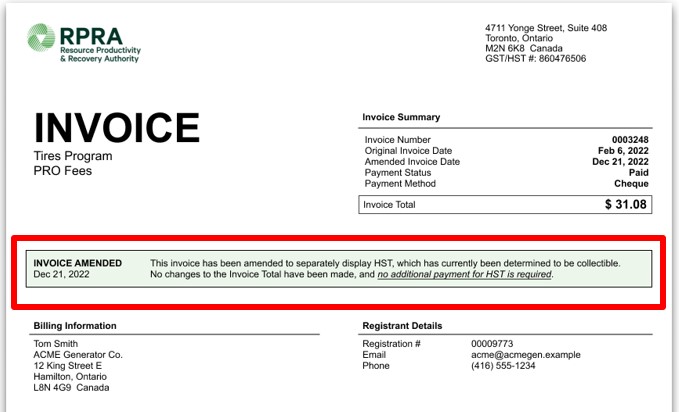

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. A banner will be displayed that highlights whether an invoice has been amended to include HST as well as the date the amended invoice was reissued. This will show on all invoices with an invoice date before December 21, 2022. See sample screenshot below.

-

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , Hazardous Waste , ITT/AV , Lighting , TiresTopic: RPRA Program and Registry Fees

Starting January 1, 2023, RPRA will collect 13% HST on all fees at the time of fee payment.

This decision is based on a ruling RPRA received from the CRA in which HST must be charged on its fees under the Resource Recovery and Circular Economy Act, 2016 (RRCEA). RPRA has determined that this ruling applies to all RRCEA producer responsibility programs and the Excess Soil and Hazardous Waste programs.

On December 22, 2022, RPRA will reissue invoices that were issued prior to January 1, 2023, amended to indicate that 13% HST was paid. From December 22 onwards, registrants will be able to access the amended invoices in their Registry accounts under a new tab labelled “Invoices”. The amended invoice will show an HST amount as well as the date the amended invoice was reissued.

Important notes:

- On the amended invoices there have been no changes to the Invoice Total and registrants will not be required to pay any additional monies to RPRA for past invoices.

- Registrants may be able to claim input tax credits for the HST collected on RPRA fees, for both the amended invoices and new invoices issued January 1, 2023, onwards. However, RPRA is not in a position to provide tax advice and suggests you consult your internal or external accountants to seek their counsel.

- All new invoices issued effective January 1, 2023, will contain appropriate information identifying the amount of the HST and other relevant details. These invoices will also be displayed under the “Invoices” tab in a registrants’ Registry account.

-

Program: Batteries , Blue Box , Hazardous and Special Products , ITT/AV , Lighting , TiresTopic: Producer , Registry

Account admins have access to all information within a registrant’s account. They can create and assign primary and secondary users’ access to the account, edit and submit reports, and pay fees. They are the only ones who can manage PROs. Account admins can view all activities users undertake. They will also be the recipient of emails from the Registry portal.

Primary users can only assign secondary users’ access to the account, edit and submit reports and pay fees.

Secondary users can only edit and submit reports and pay fees.

-

Program: Batteries , Blue Box , Hazardous and Special Products , ITT/AV , LightingTopic: PRO , Producer , Registry

The Manage PRO option will appear on the dashboard below your list of supply data reports when your supply data reporting is complete and if you have management requirements. If your supply data reporting is below the supply exemption threshold you will not have management requirements, and therefore not need to assign a PRO to assist with your obligations.

Also note that Account Admin are the only portal users that can manage your PRO’s responsibility, so this widget is not viewable to primary and secondary users.

-

Program: LightingTopic: Collection systems , Management activities , Reporting

As of January 1, 2023, lighting producers are required to establish and operate a lighting collection system that meets the accessibility requirements in the EEE Regulation. A producer must ensure that all lighting collected is managed regardless of what their minimum management requirements is.

A producer has the choice of establishing and operating their own collection and management systems or working with one or more producer responsibility organizations (PROs) registered with the Authority to meet their obligations.

For detailed information on lighting producer requirements, visit our Lighting Producer webpage.

If you have further questions about lighting producer requirements, contact the Compliance and Registry Team at registry@rpra.ca or 1-833-600-0530.

-

Program: LightingTopic: Producer , Reporting

In 2022, lighting producers will report the total weight of obligated lighting supplied into Ontario from 2018, 2019 and 2020. Producers will report the total weight (kg) for each year required.

Starting in 2023, lighting producers will report data from two preceding years (i.e., 2021 supply data reported in 2023).

Producers can use the actual weight of the obligated lighting, or RPRA’s weight conversion factors found in the EEE Verification and Audit Procedure.

For further questions, contact the Compliance and Registry Team at registry@rpra.ca or 1-833-600-0530.

-

Program: LightingTopic: Collection systems , Management activities , Producer , Registration , Reporting

A lighting producer qualifies for an exemption if their management requirement isn’t more than 350 kg. The lighting producer is exempt from the following:

- Registering and reporting to RPRA;

- Establishing a collection and management system and meeting a management requirement; and

- Promotion and education requirements.

Management requirements are calculated using the formulas in the table below. For the 2022 reporting period, producers need to determine if they will be exempt for the 2023 performance period.

Performance Period Formula Exemption threshold (kg) Exempt if average annual supply less than (kg) 2023 (2018 supply + 2019 supply + 2020 supply) / 3×30% 350 1167 2024 (2019 supply + 2020 supply + 2021 supply) / 3×30% 350 1167 2025 (2020 supply + 2021 supply + 2022 supply) / 3×30% 350 1167 2026 (2021 supply + 2022 supply + 2023 supply) / 3×40% 350 875 2027 (2022 supply + 2023 supply + 2024 supply) / 3×50% 350 700 Producers not required to register and report are required to keep records as set out in section 30 of the regulation. Note: The minimum management requirement percentage increases for the 2025 supply report (2026 performance year) and subsequent years. While some producers may be exempt one year, they might not be exempt in subsequent years. Producers must verify that they continue to meet the exemption each year using the table above.

Producers are encouraged to confirm their exemption with the Compliance Team at registry@rpra.ca or 1-833-600-0530.

See our FAQ to understand “How are lighting producers’ minimum management requirements determined?” and “What do I have to do if I am an exempt lighting producer?”

-

Program: LightingTopic: Collection systems , Management activities , Producer , Registration , Reporting

An exempt producer is not required to:

- Register and report to RPRA;

- Establish a collection and management system and meet a management requirement; and

- Promotion and education requirements.

Exempt producers must retain records related to the weight of lighting supplied into Ontario each year and provide them to the Authority upon request.

See our FAQ to understand “How do I determine if I am an exempt lighting producer?”

-

Program: LightingTopic: Producer , Registration

A producer’s individual minimum management requirement is determined by the following formulas, found in section 14 of the Electrical and Electronic Equipment (EEE) Regulation, summarized in the following chart:

Performance Period Formula Exception 2023 (2018 supply + 2019 supply + 2020 supply) / 3×30% 350 kg 2024 (2019 supply + 2020 supply + 2021 supply) / 3×30% 350 kg 2025 (2020 supply + 2021 supply + 2022 supply) / 3×30% 350 kg 2026 (2021 supply + 2022 supply + 2023 supply) / 3×40% 350 kg 2027 (2022 supply + 2023 supply + 2024 supply) / 3×50% 350 kg Producers are exempt if their management requirement is 350 kg or less.

It is important to note that producers must ensure that all lighting collected is managed regardless of what their minimum management requirement is.

-

Program: LightingTopic: Producer

For the purposes of the Electrical and Electronic Equipment (EEE) Regulation, a fixture is an electrical device supporting one or several electric lamps that provide illumination. Fixtures are not obligated as lighting under the EEE Regulation.

Fixtures require an electrical connection to a power source, whether it is directly connected to alternative current or batteries.

Fixtures can be hardwired, free standing, portable and even solar powered.

Examples of fixtures include table lamps, floor lamps, etc.