Frequently Asked Questions

FAQ filtered results:

-

Topic: Refund , Refunds , Registry , RPRA Program and Registry Fees

If you have questions, please contact our Compliance Team at registry@rpra.ca or call 1-833-600-0530.

-

Topic: Refund , Refunds , Registry , RPRA Program and Registry Fees

Yes, RPRA does not process refunds for individual orders amounting to less than $10.00 CAD.

-

Topic: Refund , Refunds , Registry , RPRA Program and Registry Fees

For payments made by credit card, our standard practice is to issue refunds directly to the original credit card used for the payment. This ensures a straightforward and secure refund process.

For payments made by other payment methods, we offer three refund options:

- Electronic Funds Transfer (EFT): Refunds can be transferred directly to your bank account.

- Cheque: Refunds can be issued via cheque only if the initial payment was made by cheque.

- Credit Transfer: Refunds can be applied as a credit toward unpaid orders.

-

Topic: Refund , Refunds , Registry , RPRA Program and Registry Fees

Yes, RPRA may issue a refund in two circumstances:

- Misreported Supply Data: If a producer misreports their supply data, they must contact RPRA immediately to request an adjustment that will be reviewed by the compliance team. For more information on what to do if you misreport supply data, please click here.

- Correction to a Completed Manifest: If a correction to a completed manifest is required, the generator or authorized generator delegate (AGD) must contact RPRA to request a correction.

-

Program: Hazardous WasteTopic: Registration , Registry , Reporting , RPRA Program and Registry Fees

When your HWP invoice total is $500 or less, the default method for paying that invoice is automatically set to credit card. This feature aims to simplify transactions for smaller amounts and ensure a smoother payment process.

As seen in the image below, if your HWP invoice is $500 or less, the payment method will automatically be set to credit card. Once you click next, you will input your credit card details, then click pay. Your payment will process automatically. If an alternate payment method is required, please contact us.

Note: As of April 2024, all programs except for HWP, have the option to select from various payment methods, including bank withdrawal, credit card, electronic data interchange, electronic bill payment, and cheque, regardless of the invoice amount.

If your company is unable to pay an invoice by credit card, please contact RPRA’s Compliance Team at registry@rpra.ca or (833) 600-0530.

-

Program: Batteries , Blue Box , Hazardous and Special Products , ITT/AV , Lighting , TiresTopic: Producer , Registration , Registry , Reporting , RPRA Program and Registry Fees

Producers are obligated parties under the Resource Recovery and Circular Economy Act and are ultimately responsible for their data submitted through RPRA’s Registry. Producers can choose to contract with an external consultant to support their data submission, but third parties have limited permissions in the Registry as they are not regulated parties.

A producer can choose to assign a primary or secondary user profile in their Registry account to an external consultant. An external consultant may submit supply data reports and/or pay registry fees on the producer’s behalf.

External consultants cannot submit and/or sign registration, executive attestations, account admin changes or supply data adjustment documentation on behalf of a producer. External consultants cannot be account admins, nor can they manage a PRO within the Registry on behalf of a producer.

-

Program: Hazardous WasteTopic: AGD , Generator , Registry , RPRA Program and Registry Fees

The HWP Registry is unable to accept partial payments for invoices issued to an account. Monthly invoices will include the applicable fees for all manifests completed during the previous month and will break fees down by facility. Consider an internal business process to bill back each facility as required.

See FAQ: Can we set up separate invoices for each facility within one account?

See FAQ: What information is included on an invoice for HWP Registry fees? -

Program: Hazardous WasteTopic: AGD , Generator , Registry , RPRA Program and Registry Fees

Admin Primary Secondary Receive invoice notifications via email ⚫ ⚫ Pay invoices in the Registry ⚫ ⚫ ⚫ Download invoices in the Registry ⚫ ⚫ ⚫ Filter invoices by facility, date, invoice number, payment status ⚫ ⚫ ⚫ View manifests with fees ⚫ ⚫ ⚫ Download manifests with fees reports ⚫ ⚫ ⚫ Receive separate invoices for each facility within one account Not Applicable Pre-payment of invoices Not Applicable Make partial payment to invoices Not Applicable -

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , Hazardous Waste , ITT/AV , Lighting , TiresTopic: Registry , RPRA Program and Registry Fees

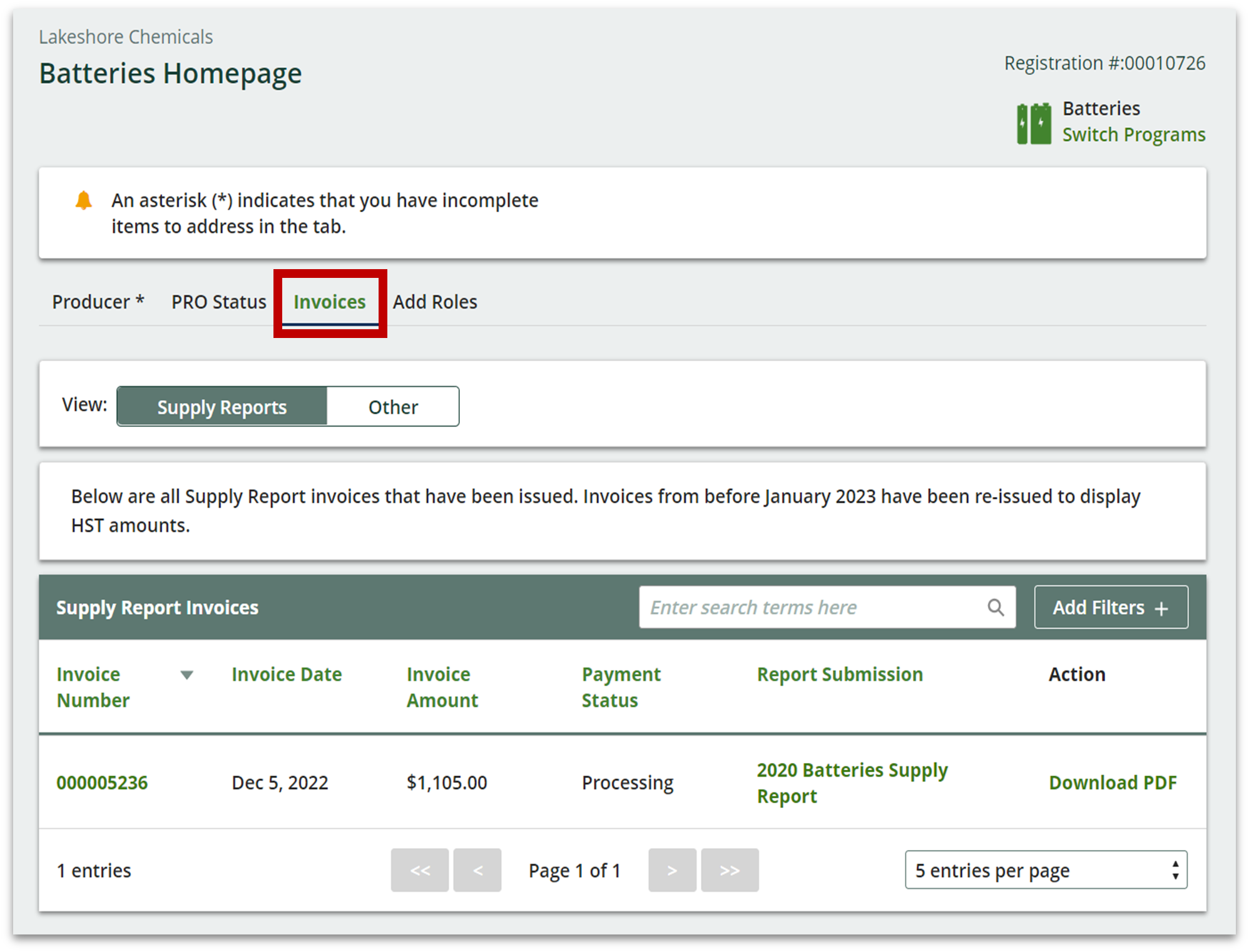

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. See sample screenshot below.

-

Program: Hazardous WasteTopic: RPRA Program and Registry Fees

RPRA received a ruling from the CRA that HST must be charged on its fees under the Resource Recovery and Circular Economy Act, 2016 (RRCEA). RPRA has determined that this ruling applies to all RRCEA producer responsibility programs and the Excess Soil and Hazardous Waste programs.

Before January 1, 2023, you paid Hazardous Waste fees to the Ministry of the Environment, Conservation and Parks. Now, you are paying fees to RPRA to cover the costs of building, operating and providing support for the new HWP Registry. These RPRA fees are subject to HST.