There is no set environmental fee for any product, the amount of the fee charged is decided by the business.

Topic: Producer

What are the rules around charging an environmental fee?

Consumer protection laws in Ontario prohibits the misrepresentation of charges, which means that producers or retailers cannot misrepresent any visible fees as a regulatory charge, tax, RPRA fee or something similar. Consumers who have questions or concerns about a specific transaction or want to report a misrepresentation can contact the Ministry of Public and Business Service Delivery at 1-800-889-9768.

As of March 2023, the promotion and education requirements related to environmental fees have been removed from the Tires, Batteries, Electrical and Electronic Equipment, and Hazardous and Special Products regulations. No changes were made to the Blue Box Regulation as it never contained promotion and education requirements related to these fees.

RPRA’s compliance bulletin Charging Tire Fees to Consumers has since been revoked and RPRA has ceased its enforcement of promotion and education requirements for visible fees across all materials.

Can businesses charge consumers an environmental fee?

Businesses have the choice to recover the cost of recycling their products by incorporating those costs into the overall cost of their product (as they do with other costs, such as materials, labour, other regulatory compliance costs, etc.) or by charging it as a separate fee to consumers.

Environmental fees are not mandatory and are applied at the discretion of the business charging them, including the amount of the fee.

Is the data I report to the Authority the same as what I reported to Ontario Electronic Stewardship?

No. The list of products obligated under the EEE Regulation is different from the list of products included in the OES Program. The OES Program required producers to report the number of units they supplied, while the EEE Regulation requires producers to report the total weight of products.

To help producers calculate the weight of their products, we have included weight conversion factors in our Verification and Audit procedure, which is included as a weight conversion tool on the registration form. Once a producer determines the units of products on which they are obligated to report, they can enter the units into the conversion tool to get a calculated weight to report to the Authority.

For more information, see the Determining Supply Data section of the Registry Procedure: EEE Verification and Audit.

Has the Authority replaced Ontario Electronic Stewardship?

No. RPRA is the regulator for the purposes of the new EEE Regulation. Producers and PROs are required to register with RPRA and meet the mandatory performance and reporting requirements under the regulation. RPRA is responsible for overseeing compliance with the regulation and has a range of enforcement tools that include compliance orders, administrative penalties, and prosecutions.

As a regulator, RPRA will not provide collection and management services. Instead, producers will be served by a competitive market comprised of processors, refurbishers, haulers, and PROs. Producers can contract with PROs to meet their obligations under the EEE Regulation, but producers will always remain responsible for meeting those requirements regardless of who they contract with.

As a retailer, what are my responsibilities under the EEE Regulation?

You may have obligations as an ITT/AV producer. To determine if you are a producer, see the FAQ Am I an ITT/AV producer?

If you are not a producer, then under the EEE Regulation you are not required to report supply data to the Authority or anyone else.

As an EEE producer who has registered, what other requirements do I need to meet?

As of January 1, 2021, producers are required to establish and operate a collection system for ITT/AV that meets the accessibility requirements in the regulation. Producers must ensure that all ITT/AV collected is managed regardless of what their minimum management requirements are.

Producers have the choice of establishing and operating their own collection and management systems or working with one or more producer responsibility organizations (PROs) registered with the Authority to meet their obligations.

Please contact the Compliance Team at 833-600-0530 or registry@rpra.ca to discuss other requirements under the EEE Regulation.

How do I determine if I am an exempt ITT/AV producer?

An ITT/AV producer qualifies for an exemption if its management requirement for a performance period is not more than 3.5 tonnes with respect to ITT/AV or not more than 350 kg with respect to lighting. The producer is exempt from the following:

- Registering and reporting to the Authority;

- Establishing a collection and management system and meeting a management requirement; and

- Promotion and education requirements.

The management requirement percentage increases each year in 2023, 2024, and 2025, therefore while you may be exempt in 2021 and 2022, you might not be exempt in subsequent years. Therefore, a producer must verify that they continue to meet the exemption each year.

If a producer is exempt and therefore not required to register with the Authority, they must retain records related to the weight of ITT/AV supplied into Ontario each year and provide them to the Authority upon request.

Producers are encouraged to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

What is ITT/AV supply data used for?

Producer supply data is used to calculate their individual minimum management requirements under the EEE Regulation.

To learn how calculations are formulated, visit the FAQ How are ITT/AV producer minimum management requirements determined?

How are ITT/AV producer minimum management requirements determined?

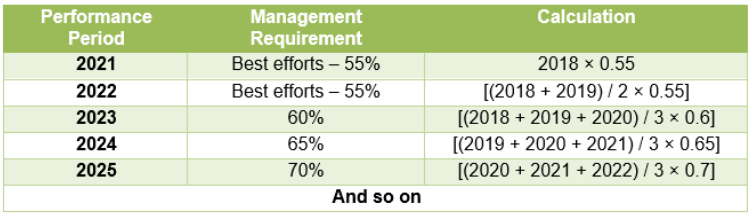

A producer’s individual management requirements are determined by the following formulas found in section 14 of the Regulation, summarized in the following chart:

It is important to note that producer’s must ensure that all ITT/AV collected is managed regardless of what their minimum management requirement is.

If I am already registered with the Authority under a different Regulation, do I have to register again to comply with the EEE Regulation?

Yes. You are still required to register with the Authority Registry even if you already have an existing account.

As a producer, can other companies (e.g., retailers or distributors of my products) report my supply data to RPRA on my behalf?

Yes. If you are a producer with retailers or distributors supplying your obligated EEE into Ontario, you can email us at registry@rpra.ca to discuss options on how to report your supply data. There are several options available, including an easy-to-use sales formula and weight conversion factors. See the EEE Verification and Audit procedure for more information.

One option is to have your supply data reported by each of your retailers or distributors on a piecemeal basis. The piecemeal option requires that extra steps be undertaken by you and the Authority. You must contact the Authority in advance if you wish to pursue this option.

Note that even if you have a retailer or distributor providing data on your behalf, it remains the producer’s obligation to ensure that all the required data gets reported and that it is reported accurately to the Authority in accordance with the EEE Regulation. The entry of inaccurate information by someone on your behalf is not a defense to non-compliance.

As a producer, am I required to provide an audit report with my ITT/AV supply data?

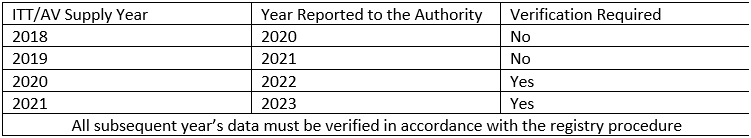

As shown in the table below, verification of the ITT/AV supply data reported in 2020 and 2021 is not required. Verification of supply data for ITT/AV will be required starting in 2022 for products supplied in 2020. All subsequent years of supply data are required to be verified when the data is reported.

For more information on the required verification and audit of data, view the Registry Procedure: EEE Verification and Audit.