Posted on April 30, 2025 by Jess Turchet -

If a producer or service provider needs to adjust the performance data reported to RPRA, they must contact the Compliance Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., tonnage purchase or sale contract, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly as possible to ensure that it has accurate performance data from all registrants.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.

Posted on April 25, 2025 by Monica Ahmed -

Yes, reusable bags made from Blue Box materials ( e.g. plastic, paper) and used as convenience packaging are obligated under the Blue Box Regulation and must be reported annually by producers in their supply report.

Convenience packaging refers to material that is provided with a product for consumers to handle or transport that product, in addition to the product’s primary packaging. This includes items such as bags and boxes that are supplied to consumers at check out.

For additional clarity:

- Reusable bags made primarily from plastic, paper, or any other Blue Box material, or a combination of these materials, are obligated. Reusable bags made from textile fibres such as cotton, hemp, bamboo, etc., are not obligated.

- Recycled content of the material has no impact on whether a reusable bag is obligated. For example, reusable bags containing post-consumer recycled plastic content are obligated.

- A reusable bag is obligated regardless of whether it is supplied to the consumer for free or at a cost. Examples include bags supplied at checkout to consumers at retail locations.

If you haven’t been reporting reusable bags as part of your annual supply data, please contact the Compliance Team immediately at registry@rpra.ca.

Also see our FAQ: ‘What do I do if I misreported my supply data?’

Posted on April 15, 2025 by Uju Ani -

Yes, any tire type collected and managed within a collection system can be used to meet a producer’s management requirement.

Producers who supplied large tires have to ensure that large tires recovered equals at least 60 per cent of their average weight of supply.

Posted on July 22, 2024 by Monica Ahmed -

Where a municipality distributes documents on behalf of another brand holder, the municipality is not obligated to report the paper in its supply. That obligation falls to the brand holder.

For example: A municipality may distribute documents issued by the provincial government (such as marriage licences and court documents) which are usually branded with the provincial agency or ministerial logos and names. In these cases, the provincial government would be the brand holder responsible for reporting these materials in their annual supply data report.

Please see FAQ “Who is a brand holder?” for more information.

Posted on May 30, 2024 by Uju Ani -

Beginning in 2024, only large producers are required to submit a Supply Data Verification Report. Small producers will no longer be required to submit a verification report but will be subject to inspections. Review the Hazardous and Special Products Registry Procedure – Verification and Audit Procedure for more information.

For the purposes of HSP supply reporting verification:

“Large HSP producer” means an HSP producer whose average supply in the previous calendar year meets the large producer threshold outlined in the chart below:

| Type of HSP | Large producer’s average weight of supply (tonnes) |

| Oil Filters | 100 or more |

| Non-refillable Pressurized Containers | 100 or more |

| Antifreeze | 300 or more |

| Oil Containers | 55 or more |

| Solvents | 70 or more |

| Paints and Coatings | 1,000 or more |

| Pesticides | 9 or more |

| Refillable Pressurized Containers | N/A |

| Mercury-containing Devices |

| Fertilizers |

| Propane Containers (refillable) |

Posted on April 26, 2024 by Julia Struyf -

“In April 2024, the Government of Ontario finalized amendments to Reg. 406/19: On-Site and Excess Soil Regulation (Excess Soil Regulation) and the Rules for Soil Management and Excess Soil Quality Standards (Soil Rules), which came into effect April 23, 2024. A key amendment made to the regulation means: Enhanced usability of project leader-owned or controlled storage sites (Class 2 soil management sites and local waste transfer facilities) and soil depots to allow for larger volumes of soil being managed without requiring a waste approval, now up to 25,000 m3 (previously 10,000 m3) with additional flexibility for public bodies and having greater alignment of rules across sites.

If you have questions about the Excess Soil Regulation or the amendments, contact the ministry at MECP.LandPolicy@ontario.ca. See our FAQ to see “Who needs to file notices?”

Posted on March 11, 2024 by Monica Ahmed -

For the purposes of supply data reporting, ‘refillable packaging’ is defined as packaging surrounding a supplied product that a consumer can return to the product manufacturer for cleaning and reuse.

A producer who supplies its products in refillable packaging should only report weights (under the appropriate material category) the first time the packaging is supplied to consumers.

For example:

A milk producer that used 1000 new glass bottles to supply its product to consumers in 2022, reported the weight of all 1000 bottles under the beverage container category in their 2023 supply data report.

In 2023, the producer added 500 new glass bottles to its supply, bringing the total of supplied material to 1500 bottles. Their 2024 supply data report should only reflect the weights of the 500 new bottles, not the total currently being used by the producer (1500).

Important: Products supplied in beverage containers should be reported in the ‘beverage container’ category, not the category the container is made of (plastic, metal, glass).

See Compliance Bulletin: What blue box materials need to be reported?

Posted on December 6, 2023 by Julia Struyf -

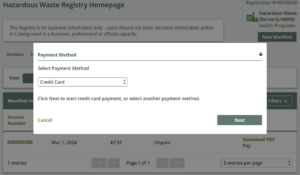

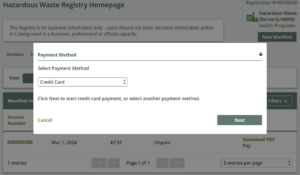

When your HWP invoice total is $500 or less, the default method for paying that invoice is automatically set to credit card. This feature aims to simplify transactions for smaller amounts and ensure a smoother payment process.

As seen in the image below, if your HWP invoice is $500 or less, the payment method will automatically be set to credit card. Once you click next, you will input your credit card details, then click pay. Your payment will process automatically. If an alternate payment method is required, please contact us.

Note: As of April 2024, all programs except for HWP, have the option to select from various payment methods, including bank withdrawal, credit card, electronic data interchange, electronic bill payment, and cheque, regardless of the invoice amount.

If your company is unable to pay an invoice by credit card, please contact RPRA’s Compliance Team at registry@rpra.ca or (833) 600-0530.

Posted on July 19, 2023 by Michelle Hoover -

Reporting for 2022 waste shipments through the prior HWIN system is closed.

Users can pay outstanding fees or request refunds related to 2022 balances by logging into HWIN.ca. For questions related to outstanding fees and refunds email HazardousWasteProgram@ontario.ca

Posted on July 10, 2023 by Monica Ahmed -

Each Blue Box producer is required to report the Blue Box packaging they add to a product.

For example: a college or university bookstore plans to ship a book to a consumer in Ontario. The bookstore staff packages the book in a small box with the packing slip and inserts the box into a plastic mailer supplied by the delivery service with the required label affixed.

In this scenario, the college or university is the obligated producer of the small box and packing slip and must report these materials in their supply report, whereas the delivery company is the obligated producer of the plastic mailer and label and must report these materials in their supply report.

Also see:

Am I a producer of Blue Box product packaging?

Posted on July 10, 2023 by Monica Ahmed -

For the purposes of supply reporting, a book is defined as a series of written, printed, or illustrated pages encased in a protective cover bound with glue or sewn with thread.

If you are unsure whether your product qualifies as a book, please contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca.

Also see:

Compliance Bulletin: What Blue Box materials need to be reported?

Posted on July 10, 2023 by Monica Ahmed -

Eligible Ontario institutions are obligated to manage their waste under several regulations, each of which imposes different obligations and requirements.

Under the Ontario Environmental Protection Act, Industrial, Commercial and Institutional (IC&I) sector organizations have obligations to establish and operate an internal collection system that separates the waste generated on-site into different material categories (i.e., a source-separation program).

The Blue Box Regulation, under the Resource Recovery and Circular Economy Act, obligates producers of Blue Box material to collect, manage, and report on the materials that they supply to consumers both on-site and off-site.

Posted on July 10, 2023 by Monica Ahmed -

Public sector institutions, such as colleges and universities, are suppliers of Blue Box materials to consumers in Ontario. They supply Blue Box materials to consumers on-site (e.g., food service packaging, unprinted paper in photocopiers, etc.) and off-site (e.g., mailings).

For the purposes of supply reporting, colleges, universities, and other public sector institutions must determine the total amount of Blue Box material they supply to consumers in Ontario. One way to gather this data is by canvassing internal departments to obtain annual weights of Blue Box materials supplied to consumers on-site and off-site.

Also see:

FAQ: What deductions are available to producers under the Blue Box Regulation?

Compliance Bulletin: What Blue Box materials need to be reported?