Posted on January 24, 2022 by Michelle Hoover -

Under the HSP Regulation, producers are required to make reasonable efforts to establish and operate at least as many collection sites for each type of HSP in each local municipality, territorial district or reserve as the number of sites that were operated on September 30, 2021.

Producers are also required to make reasonable efforts to hold at least as many collection events for that type of HSP in each local municipality, territorial district or reserve as the number of events that were held in the 2020 calendar year.

Posted on October 20, 2021 by Michelle Hoover -

Yes. You are required to submit 2018, 2019 and 2020 supply data when registering with the Authority if you are a producer of oil filters, oil filters, oil containers, antifreeze, pesticides, solvents, paints and coatings, refillable or non-refillable pressurized containers and:

- supplied materials between January 1, 2018, and October 31, 2021, and

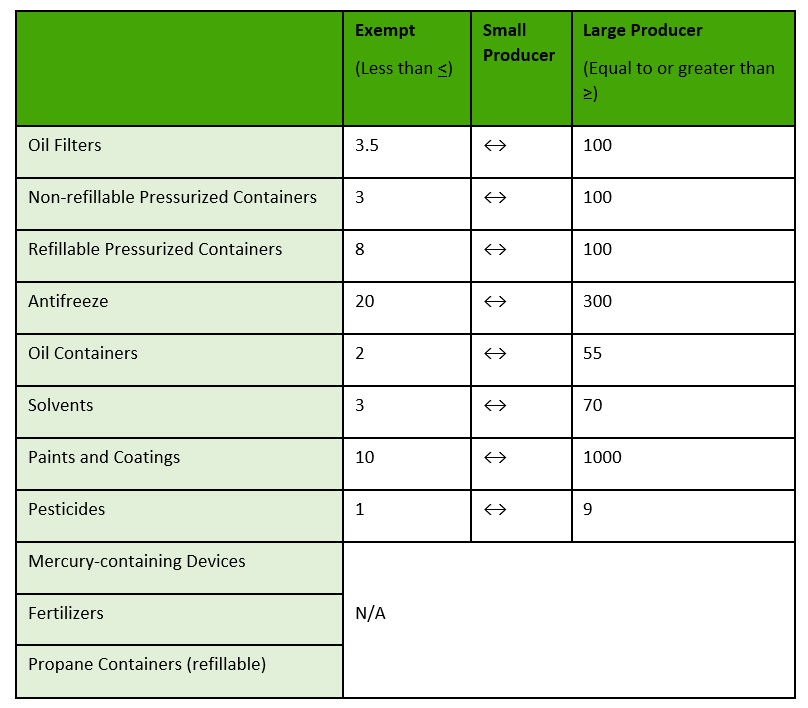

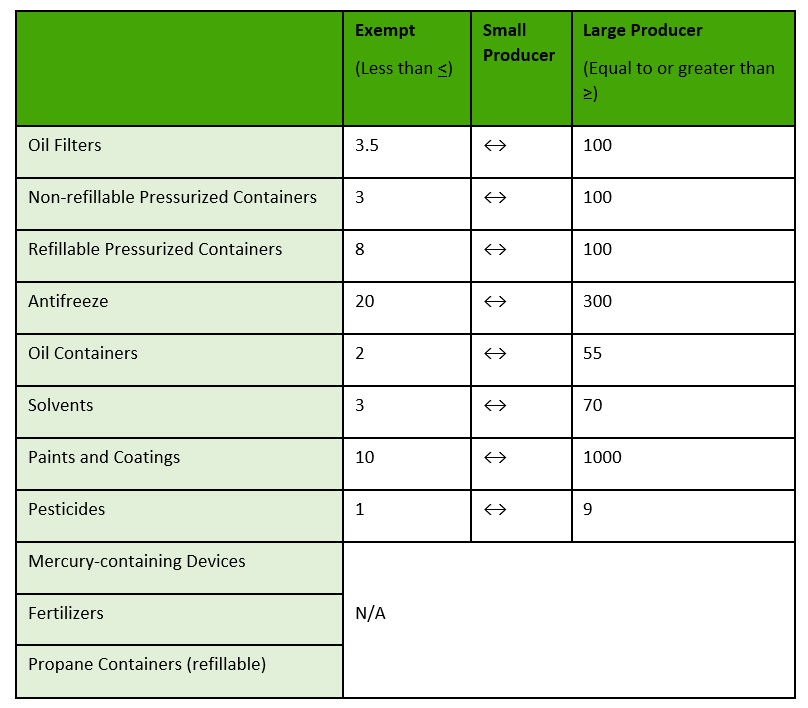

- your average weight of supply is above the threshold stated in the below table

| Type of HSP | Average weight of supply in respect of the previous calendar year (tonnes) |

| Oil Filters | 3.5 |

| Antifreeze | 20 |

| Oil Containers | 2 |

| Paints and Coatings | 10 |

| Pesticides | 1 |

| Non-refillable Pressurized Containers | 3 |

| Refillable Pressurized Containers | 8 |

| Solvents | 3 |

Otherwise, a producer must register on or before July 31 of the first calendar year in which the producer exceeds the above threshold. To calculate your average weight of supply, reference the Registration Form.

Posted on October 20, 2021 by Jess Turchet -

Under the Blue Box Regulation, allowable deductions for producers include Blue Box materials that are deposited into a receptacle at a location that is not an eligible source and where the product related to the Blue Box material was supplied and used or consumed.

This applies to food court restaurants located in a mall or in the base of an office tower. Blue Box materials that were disposed of in the buildings’ recycling receptacles and were supplied and used or consumed within that physical building are an allowable deduction. Blue Box materials that were disposed of in the buildings’ recycling receptacles but were not supplied and used or consumed within that physical building are not deductible.

This does not reduce the obligation of a producer to provide complete and accurate supply data or limit the ability of an Authority inspector to review the data and related records for the purpose of determining compliance.

Posted on October 19, 2021 by Michelle Hoover -

As an obligated HSP producer, you are required to:

- register and report annual supply and performance data of obligated materials

- meet mandatory and enforceable requirements for collection and management

- meet mandatory and enforceable requirements for promotion and education

- meet mandatory and enforceable requirements for auditing, verification, and record keeping

These requirements vary based on material type and amount of material the producer supplies.

Posted on September 15, 2021 by Davina Gounden -

Posted on September 15, 2021 by Davina Gounden -

RPRA’s Registry fees cover the costs related to compliance and enforcement and other activities required to administer the regulations under the RRCEA, and building and operating the Registry.

The Registry fees cover expenses in a given year (e.g., 2021 fees cover 2021 expenses). 2021 fees for Blue Box cover the Authority’s costs to undertake activities to implement the regulation in 2021, which include:

- helping obligated parties understand their requirements

- ensuring producers register and report their supply data by the deadline in the regulation

- compliance, enforcement, and communication activities

Posted on September 15, 2021 by Michelle Hoover -

If a producer is exempt in accordance with the chart below, the producer is exempt from the following requirements:

- Registration with RPRA

- Requirements related to setting up or operating a collection system

- Management requirements

- Promotion and education requirements

Producer categories use the average weight of material (in tonnes) supplied in Ontario in the three previous calendar years. If you have questions on how to calculate your average weight of supply, contact the Registry Support Team at registry@rpra.ca.

Posted on September 15, 2021 by Monica Ahmed -

There are only two allowable deductions for Blue Box materials. There are for materials that are:

- collected from an eligible source at the time a related product was installed or delivered (e.g., packaging that is removed from the house by a technician installing a new appliance). This is the “installation deduction”.

- deposited into a receptacle at a location that is collected from a business or institution where Blue Box collection services are not provided under the regulation. This is the “ineligible source deduction” that was expanded by the regulation amendment in July 2023.

Ineligible source deductions:

Blue Box Producers may deduct materials that are collected from a business or institution where producers are not required to provide Blue Box collection services. Examples include offices, stores and shopping malls, restaurants, community centres, recreation facilities, sports and entertainment venues, universities and colleges, and manufacturing facilities.

Producers cannot deduct the following materials collected through the collection systems established under the Blue Box Regulation:

- Material that is generated at a facility (including multi-residential buildings, retirement homes, long-term care homes and schools).

- Material that is collected from a residence through a curbside or depot collection service.

- Material that is collected from a public space (including an outdoor area in a park, playground or sidewalk, or a public transit station).

- Material collected under an alternative or supplemental collection system.

- Beverage containers cannot be deducted.

Materials that are deducted cannot count toward a producer’s management requirement.

Please see the Reporting Guidance Ineligible Source Deductions for the 2024 Blue Box Supply Report for more information on how to determine and use these deductions.

Posted on September 15, 2021 by Davina Gounden -

Starting in 2022, producers are required to report their supply data annually to RPRA.

Each year, producers will need to provide the previous years’ supply data in each of the seven material categories – beverage container, glass material, flexible plastic, rigid plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

Posted on August 27, 2021 by Monica Ahmed -

Yes, all eligible communities must submit these reports to the Authority. The Datacall is the source of data for determining the net Blue Box system cost and for allocating funding under the Blue Box Program Plan. The Initial and Transition reports are for a separate and distinct program than Datacall and are required under the new Blue Box Regulation, which requires eligible communities to submit these reports.

While some of the required information in these reports was reported to Datacall, much of the information was not. Where there is overlap between what was reported to Datacall and the information that is required in these reports, please see the guidance below on where to find this information in your Datacall report.

Posted on August 27, 2021 by Monica Ahmed -

There are three reports for eligible communities under the Blue Box Regulation: an Initial Report, a Transition Report and Change Reports.

- The Initial Report will be submitted by all communities in 2021. It will provide an overview of the communities and of the WDTA Blue Box program that operates in that community.

- The Transition Report will be submitted by communities 2 years prior to their transition year. It provides more detailed information about the WDTA Blue Box program that operates in the community.

- Change Reports will be used by communities when there are changes to the information that they submitted in either the Initial Report or Transition Report. At this time, the requirements and formats for change reports have not yet been established. RPRA will provide guidance in the future.

These reports need to be completed by all eligible communities under the Blue Box Regulation.

An eligible community is a local municipality or local services board area that is not located in the Far North, or a reserve that is registered by a First Nation with the Authority and not located in the Far North.

- The Far North has the same meaning as in the Far North Act, 2010. To determine whether a community is in the Far North, use this link.

- A local municipality means a single-tier municipality or a lower-tier municipality. A local services board has the same meaning as “Board” in the Northern Services Boards Act.

- A First Nation means a council of the Band as referred to in subsection 2(1) of the Indian Act (Canada).

If you are an upper-tier municipality or waste association, these reports must be submitted separately for each eligible community in your program.

Visit the Municipal and First Nation webpages for more information.

Posted on August 27, 2021 by Monica Ahmed -

Sections 54 and 55 of the Blue Box Regulation require municipalities and First Nations to submit the information in the Initial Report and Transition Report to the Authority.

Under the Blue Box Regulation, producers will be fully responsible for the collection and management of Blue Box materials that are supplied into Ontario. To ensure that all communities continue to receive Blue Box collection services, communities will be allocated to producers, or PROs on their behalf, who are obligated to provide collection services. The information that is submitted in the Initial and Transition Reports will be used by PROs to plan for collection in each eligible community.

The Authority will also use the information provided by municipalities and First Nations to ensure that producers are complying with their collection obligations under the Blue Box Regulation.

It is important that municipalities and First Nations complete these reports accurately so that all eligible sources (residences, facilities, and public spaces) in their communities continue to receive Blue Box collection after their community transitions to full producer responsibility.

Posted on August 18, 2021 by Jess Turchet -

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).