Frequently Asked Questions

Results (21)

Click the question to read the answer.

-

Yes, a Blue Box producer or PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can voluntarily choose to collect Blue Box materials that are not marketed to consumers.

Blue Box materials not marketed to consumers cannot be counted towards meeting a producer’s collection or management requirements under the Blue Box Regulation.

If Blue Box materials that are marketed to consumers are co-collected with Blue Box materials not marketed to consumers, a person must use a methodology or process acceptable to the Authority to account for materials supplied to a consumer or not. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if Blue Box materials supplied to a consumer in Ontario are collected along the same collection route as Blue Box materials that were not supplied to a consumer, they must be accounted for separately. When those materials are then sent to a processor, they must also be accounted for separately.

See the FAQ: Who is a consumer under the Blue Box Regulation?

-

Businesses have the choice to recover the cost of recycling their products by incorporating those costs into the overall cost of their product (as they do with other costs, such as materials, labour, other regulatory compliance costs, etc.) or by charging it as a separate fee to consumers.

Environmental fees are not mandatory and are applied at the discretion of the business charging them, including the amount of the fee.

-

Public sector institutions, such as colleges and universities, are suppliers of Blue Box materials to consumers in Ontario. They supply Blue Box materials to consumers on-site (e.g., food service packaging, unprinted paper in photocopiers, etc.) and off-site (e.g., mailings).

For the purposes of supply reporting, colleges, universities, and other public sector institutions must determine the total amount of Blue Box material they supply to consumers in Ontario. One way to gather this data is by canvassing internal departments to obtain annual weights of Blue Box materials supplied to consumers on-site and off-site.

Also see:

FAQ: What deductions are available to producers under the Blue Box Regulation?

Compliance Bulletin: What Blue Box materials need to be reported? -

See our FAQ to understand “What is blue box product packaging?”.

Product packaging added to a product can be added at any stage of the production, distribution and supply of the product. A person adds packaging to a product if they:

- make the packaging available for another person to add the packaging to the product

- cause another person to add the packaging to a product

- combine the product and the packaging

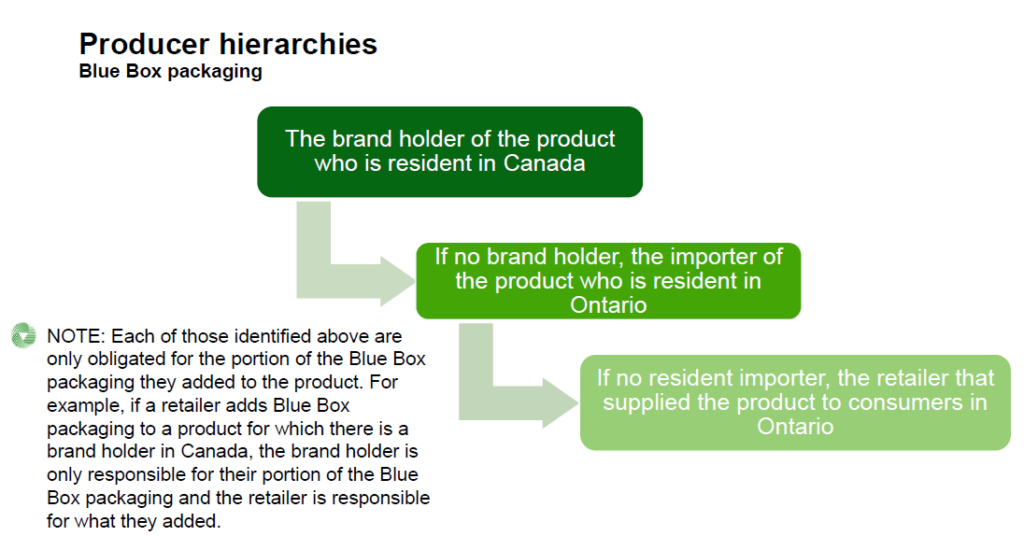

For the portion of the product packaging that a brand holder added to the product, a person is considered a producer:

- if they are the brand holder of the product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For the portion of the product packaging that an importer of the product into Ontario added to the product, a person is considered a producer:

- if they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For any portion of the packaging that is not described above, the producer is the retailer who supplied the product to consumers in Ontario.

-

Yes, reusable bags made from Blue Box materials ( e.g. plastic, paper) and used as convenience packaging are obligated under the Blue Box Regulation and must be reported annually by producers in their supply report.

Convenience packaging refers to material that is provided with a product for consumers to handle or transport that product, in addition to the product’s primary packaging. This includes items such as bags and boxes that are supplied to consumers at check out.

For additional clarity:

- Reusable bags made primarily from plastic, paper, or any other Blue Box material, or a combination of these materials, are obligated. Reusable bags made from textile fibres such as cotton, hemp, bamboo, etc., are not obligated.

- Recycled content of the material has no impact on whether a reusable bag is obligated. For example, reusable bags containing post-consumer recycled plastic content are obligated.

- A reusable bag is obligated regardless of whether it is supplied to the consumer for free or at a cost. Examples include bags supplied at checkout to consumers at retail locations.

If you haven’t been reporting reusable bags as part of your annual supply data, please contact the Compliance Team immediately at registry@rpra.ca.

Also see our FAQ: ‘What do I do if I misreported my supply data?’

-

Consumer protection laws in Ontario prohibits the misrepresentation of charges, which means that producers or retailers cannot misrepresent any visible fees as a regulatory charge, tax, RPRA fee or something similar. Consumers who have questions or concerns about a specific transaction or want to report a misrepresentation can contact the Ministry of Public and Business Service Delivery at 1-800-889-9768.

As of March 2023, the promotion and education requirements related to environmental fees have been removed from the Tires, Batteries, Electrical and Electronic Equipment, and Hazardous and Special Products regulations. No changes were made to the Blue Box Regulation as it never contained promotion and education requirements related to these fees.

RPRA’s compliance bulletin Charging Tire Fees to Consumers has since been revoked and RPRA has ceased its enforcement of promotion and education requirements for visible fees across all materials.

-

No, beverage containers are not eligible for this deduction.

The allowable deduction is permitted for Blue Box materials that are deposited into a “non-eligible source,” meaning a place where consumers dispose of Blue Box materials that are not included in the producer-run collection system.

Under the Blue Box Regulation, beverage containers that are supplied to Ontario consumers for personal, family, household or business purposes are obligated Blue Box materials. The inclusion of “business purposes” is unique to the beverage container material category.

Because supplying a beverage container can mean either supplying for “personal, family and/or household purposes” that will likely be consumed and disposed of in a residential context (e.g., a home, apartment, long-term care facility, etc.) or supplying for “business purposes” that will likely be consumed and disposed of in a commercial or institutional context (e.g., a restaurant, college or gym), there are no “non-eligible sources” for beverage containers. All beverage containers must be reported and collected from all sources, whether they are residential, business, commercial or institutional.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

For the purposes of supply data reporting, ‘refillable packaging’ is defined as packaging surrounding a supplied product that a consumer can return to the product manufacturer for cleaning and reuse.

A producer who supplies its products in refillable packaging should only report weights (under the appropriate material category) the first time the packaging is supplied to consumers.

For example:

A milk producer that used 1000 new glass bottles to supply its product to consumers in 2022, reported the weight of all 1000 bottles under the beverage container category in their 2023 supply data report.

In 2023, the producer added 500 new glass bottles to its supply, bringing the total of supplied material to 1500 bottles. Their 2024 supply data report should only reflect the weights of the 500 new bottles, not the total currently being used by the producer (1500).

Important: Products supplied in beverage containers should be reported in the ‘beverage container’ category, not the category the container is made of (plastic, metal, glass).

See Compliance Bulletin: What blue box materials need to be reported?

-

Individual Producer Responsibility (IPR) means that producers are responsible and accountable for collecting and managing their products and packaging after consumers have finished using them.

For programs under the Resource Recovery and Circular Economy Act, 2016 (RRCEA), producers are directly responsible and accountable for meeting mandatory collection and recycling requirements for end of life products. With IPR, producers have choice in how they meet their requirements. They can collect and recycle the products themselves, or contract with producer responsibility organizations (PROs) to help them meet their requirements.

-

See our FAQs to understand “What are paper products?” and “What are packaging-like products?”.

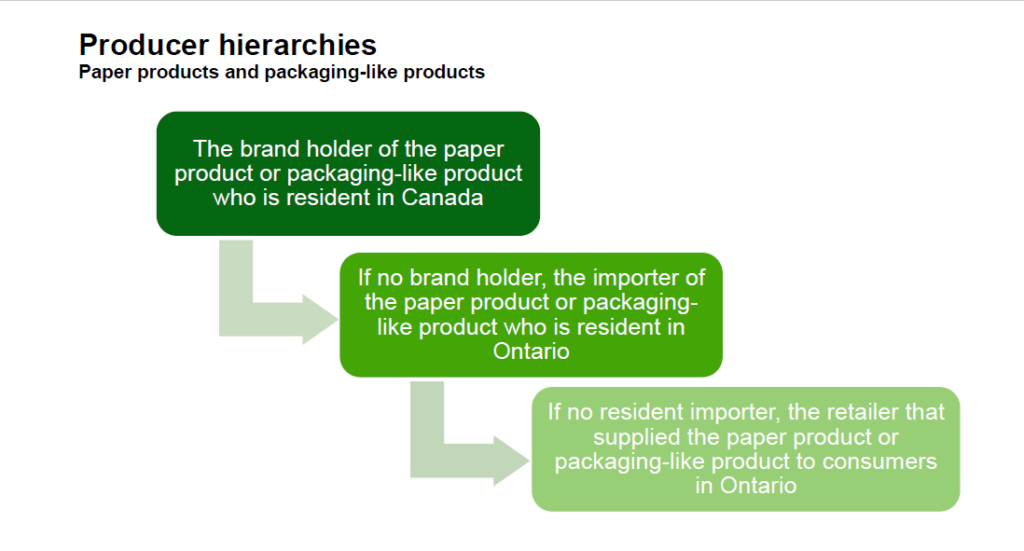

For paper products and packaging-like products, a person is considered a producer:

- if they are the brand holder of the paper product or packaging-like product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the paper product or packaging-like product from outside of Ontario

- if no resident importer, they are the retailer that supplied the paper product or packaging-like product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

-

The brand holder is the obligated producer.

A marketplace facilitator only becomes obligated for products supplied through its marketplace where the producer would have been a retailer. If the producer is a brand holder or an importer, they remain the obligated producer even when products are distributed by a marketplace facilitator.

A retailer is a business that supplies products to consumers, whether online or at a physical location.

-

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).

-

Under the Blue Box Regulation, consumers are individuals who use a product and its packaging for personal, family or household purposes, or persons who use a beverage and its container for personal, family, household, or business purposes.

-

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

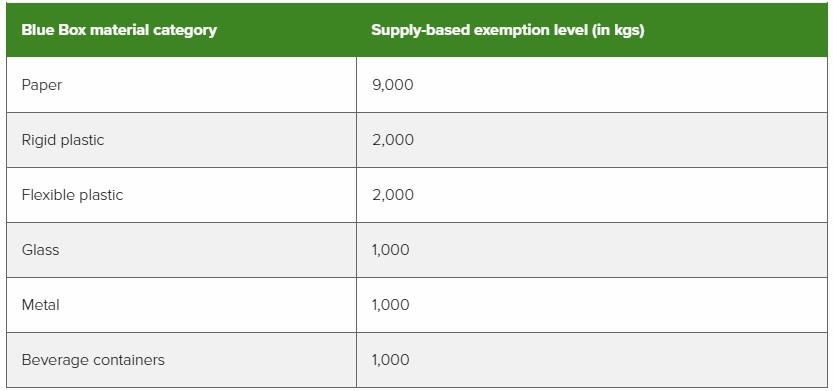

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.

-

For most producers and for all municipalities, little has changed:

- Rule creators and the rule creation process, including the allocation table, have been removed. Instead, each producer is responsible for providing Blue Box collection to every eligible source in Ontario and creating a province-wide system for collection.

- Producer Responsibility Organizations (PROs) are now required to submit a report to RPRA on how they will operate the Blue Box system on behalf of producers.

- Newspaper producers whose newspaper supply accounts for more than 70% of their total Blue Box supply to consumers in Ontario are exempt from collection, management, and promotion and education requirements.

The amendments do not change or impact:

- Producer registration or 2020 supply data reporting to RPRA

- Most producers’ 2021 supply data reporting to RPRA

- The materials collected in the Blue Box system

- The communities that receive collection or the collection requirements

- The transition schedule and its timelines

-

A brand supply list is a list of brands of obligated products that a producer supplies to consumers in Ontario. A producer must provide a brand supply list that makes up their supply data annually to RPRA. Each program has different requirements regarding how a producer must submit a brand supply list. For more information, consult the applicable programs’ walkthrough guide or contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca.

-

A newspaper producer is a person who supplies newspapers to consumers in Ontario. For the purpose of the Blue Box Regulation, newspapers include broadsheet, tabloid or free newspaper. For further information, see the FAQ: What is a newspaper?

Note that a producer of supplemental advertisements or flyers that are supplied with a newspaper would not be considered a newspaper producer as they do not supply the actual broadsheet, tabloid, or free newspaper. This producer cannot use the newspaper exemption percentage to be exempt from Blue Box collection and management requirements. See the FAQ: Are there exemptions for Blue Box producers?

-

Any public sector institution, including colleges and universities, that offers a self-serve hot drink machine for use by students and employees (i.e., consumers) must report all the Blue Box materials supplied with the machine to serve the hot drinks. This includes branded and unbranded single-use cups, lids, etc.

-

Any donated or re-supplied paper products or other Blue Box materials that are supplied to consumers through a reuse store or upcycling event should not be included in your supply report.

-

Public sector institutions must report all branded and unbranded Blue Box packaging supplied or sold with food served in their owned and operated on-site facilities. These facilities include but are not limited to cafeterias, pubs, cafes, and in the case of a college or university, faculty offices.

It is important to consider other situations where food service Blue Box packaging is supplied to consumers. For example, a college must report the packaging used in their Culinary and Hospitality programs that allow students to take home food prepared in class.

-

Eligible Ontario institutions are obligated to manage their waste under several regulations, each of which imposes different obligations and requirements.

Under the Ontario Environmental Protection Act, Industrial, Commercial and Institutional (IC&I) sector organizations have obligations to establish and operate an internal collection system that separates the waste generated on-site into different material categories (i.e., a source-separation program).

The Blue Box Regulation, under the Resource Recovery and Circular Economy Act, obligates producers of Blue Box material to collect, manage, and report on the materials that they supply to consumers both on-site and off-site.