Frequently Asked Questions

Results (24)

Click the question to read the answer.

-

A brand is any mark, word, name, symbol, design, device or graphical element, or a combination thereof, including a registered or unregistered trademark, which identifies a product and distinguishes it from other products.

A brand holder is a person who owns or licenses a brand or otherwise has rights to market a product under the brand.

Note:

- If there are two or more brand holders, the producer most directly connected to the production of the material is the brand holder.

- If more than one material produced by different brand holders are marketed as a single package, the producer who is more directly connected to the primary product in the package is the brand holder.

-

Where a municipality distributes documents on behalf of another brand holder, the municipality is not obligated to report the paper in its supply. That obligation falls to the brand holder.

For example: A municipality may distribute documents issued by the provincial government (such as marriage licences and court documents) which are usually branded with the provincial agency or ministerial logos and names. In these cases, the provincial government would be the brand holder responsible for reporting these materials in their annual supply data report.

Please see FAQ “Who is a brand holder?” for more information.

-

You are a tire producer if you supply new tires to consumers in Ontario and you have a permanent establishment in Canada. New tires are supplied to Ontario in two ways – sold on new vehicles or sold as loose tires. The definition for tires producers (as outlined in section 3 of the Tires Regulation) applies in both cases.

New loose tires that are marketed to consumers in Ontario

- For new tires where there is a brand holder resident in Canada: you are the producer for those new tires if you are the brand holder of the new tires (the legislation defines brand holder to mean a person who owns or licenses a brand or who otherwise has rights to market a product under the brand) and resident in Canada.

- For new tires where there is no brand holder resident in Canada: you are the producer for the new tires if you are the importer of those new tires and resident in Ontario.

- For new tires where there is no brand holder or importer resident in Ontario: you are the producer for the new tires if you are the first person to market those tires in Ontario and resident in Ontario.

- For new tires where there is no brand holder, importer or marketer resident in Ontario: you are the producer for the new tires if you are the person that marketed those new tires and non-resident in Ontario.

New vehicles with new tires that are marketed to consumers in Ontario

- For new vehicles where there is a brand holder resident in Canada: you are the producer for the new tires on those new vehicles if you are the manufacturer of the vehicles (the legislation defines vehicle to include motor vehicles, muscular-powered equipment and trailers) and resident in Canada.

- For new vehicles where there is no manufacturer resident in Canada: you are the producer for the new tires on those new vehicles if you are the importer of those new vehicles and resident in Ontario.

- For new vehicles where there is no manufacturer or importer resident in Ontario: you are the producer for the new tires on those new vehicles if you are the marketer of those new vehicles in Ontario and resident in Ontario.

- For new vehicles where there is no manufacturer, importer or marketer resident in Ontario: you are the producer for the new tires on those new vehicles if you are the marketer of those new vehicles and non-resident in Ontario.

-

A person is considered a lighting producer under the Electrical and Electronic Equipment (EEE) Regulation if they supply lighting into Ontario and:

- Are the brand holder for the lighting and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import lighting from outside of Ontario;

- If there is no resident importer, have residency in Ontario and market directly to consumers in Ontario (e.g. online sales); or

- If there is no resident marketer, do not have residency in Ontario and market directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Electrical and Electronic Equipment Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

See our FAQ to understand “What is lighting under the EEE Regulation?”, “Who is a brand holder?”

-

You are a hazardous and special products (HSP) producer if you market antifreeze and oil filters (excluding those provided in new vehicles, for which a separate hierarchy applies as outlined below), oil containers, solvents, paints and coatings, pesticides, fertilizers, pressurized containers or refillable propane containers to consumers in Ontario and:

- You are the brand holder and have residency in Canada;

- If there is no resident brand holder, you have residency in Ontario and import from outside of Ontario;

- If there is no resident importer, you have residency in Ontario and market directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, you do not have residency in Ontario and market directly to consumers in Ontario (e.g., online sales).

You are a hazardous and special products (HSP) producer if you market oil filters and antifreeze provided in new vehicles into Ontario and:

- You are the manufacturer of the new vehicle and have residency in Canada;

- If there is no resident vehicle manufacturer, you have residency in Ontario and import the vehicle from outside of Ontario;

- If there is no resident importer, you have residency in Ontario and market the vehicle directly to consumers in Ontario; or

- If there is no resident marketer, you do not have residency in Ontario and market the vehicle directly to consumers in Ontario.

You are a hazardous and special products (HSP) producer if you market mercury-containing barometers, thermometers or thermostats into Ontario and:

- You are the brand holder and have residency in Canada; or

- You are the brand holder of barometers, thermometers or thermostats marketed to consumers in Ontario that do not contain mercury

You are a hazardous and special products (HSP) producer if you market fertilizers into Ontario and:

- You are the brand holder and have residency in Canada

Even if you do not meet the above definitions, there may be circumstances where you qualify as a producer. Read the Hazardous and Special Products Regulation for more details or contact the Compliance Team for guidance at registry@rpra.ca or toll-free at 1- (833) 600-0530.

Related FAQs:

-

Impacts on producers of antifreeze and/or oil filters provided in new vehicles

Supply reporting

Vehicle brand holders, importers and marketers are now obligated for antifreeze and/or oil filters that are supplied in new vehicles sold in Ontario.

Subsection 7(2) of the amended HSP Regulation states that these producers must report to RPRA the weights of antifreeze and/or oil filters that were supplied in new vehicles sold in Ontario in 2022, 2023 and 2024. This change to the producer hierarchy may impact supply reports previously submitted to RPRA. It may also require producers to submit a supply data verification report if they meet the definition of a large producer, based on the newly submitted supply data. Producers who need to submit adjusted supply data as a result of this change to the producer hierarchy should contact RPRA before July 31, 2025.

Although there may be adjustments to the historical supply data, the collection and management requirements for the 2025 calendar year remain unchanged.

Management requirements

Beginning January 1, 2026, these vehicle brand holders, importers and marketers of antifreeze and/or oil filters supplied in new vehicles will also be required to fulfill collection and management obligations, including reporting on their performance in meeting their obligations.

This includes ensuring there are sufficient collection sites in a community based on the size of the producer and that the HSP material is managed within 3 months of being collected. Specifically, oil filter producers must ensure that the weight of the recovered resources from managing oil filters in 2026, and every year thereafter, meets or exceeds their individual management requirement as calculated under subsection 31(3) of the HSP Regulation.

Impacts on producers of antifreeze and/or oil filters not supplied in new vehicles

The producer hierarchy for antifreeze and/or oil filters supplied in containers (i.e., not supplied in new vehicles) remains unchanged.

These producers may have reported tonnage for antifreeze and/or oil filters supplied in new vehicles as part of their supply reports in previous years and, if so, they should contact RPRA before July 31, 2025 to clarify their obligations and make changes to their supply data, as required.

-

See our FAQ to understand “What is blue box product packaging?”.

Product packaging added to a product can be added at any stage of the production, distribution and supply of the product. A person adds packaging to a product if they:

- make the packaging available for another person to add the packaging to the product

- cause another person to add the packaging to a product

- combine the product and the packaging

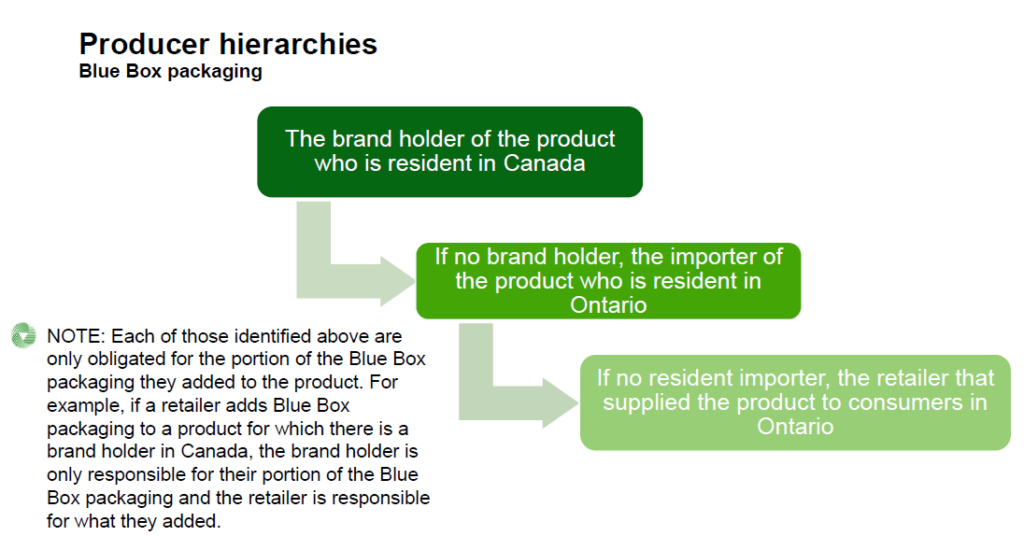

For the portion of the product packaging that a brand holder added to the product, a person is considered a producer:

- if they are the brand holder of the product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For the portion of the product packaging that an importer of the product into Ontario added to the product, a person is considered a producer:

- if they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For any portion of the packaging that is not described above, the producer is the retailer who supplied the product to consumers in Ontario.

-

The brand holder is the obligated producer.

A marketplace facilitator only becomes obligated for products supplied through its marketplace where the producer would have been a retailer. If the producer is a brand holder or an importer, they remain the obligated producer even when products are distributed by a marketplace facilitator.

A retailer is a business that supplies products to consumers, whether online or at a physical location.

-

For the purpose of reporting supply data under the Blue Box Regulation, the weight of newspaper, including any protective wrapping and supplemental advertisements and inserts, must be reported in the appropriate material categories. For example, newsprint must be reported in the ‘paper’ category, while any protective plastic wrapping must be reported as ‘flexible plastic’.

Then, producers will be asked to indicate what percentage of their total Blue Box material supply was newspaper, including any protective wrapping and supplemental advertisements and inserts, in that calendar year.

When reporting either their total supply or the percentage of their total supply that is newspaper, a producer should only include the weight of Blue Box materials for which they are the producer. For example, if flyers for which there is a different brand holder resident in Canada are supplied along with a newspaper and those flyers have a different brand holder resident in Canada, their weight should not be reported by the newspaper producer. Instead, it is the brand holder of those flyers who would be required to include the weight of those flyers in their own supply report.

See our FAQ: “What is a newspaper?”

-

A volunteer organization is a person who:

- Is a brand holder who owns a brand that is used in respect of batteries or EEE;

- Is not a resident in Canada;

- Has registered with the Authority; and

- Has entered into a written agreement with a producer for the purpose of carrying out one or more producer responsibilities.

A volunteer organization is not a producer but can take on the registration and reporting responsibilities for producers in relation to its brand. Under the Regulation, producers remain responsible for meeting their management requirements and cannot pass off their obligations through voluntary remitter agreements or any other commercial agreement.

Any brand holder or producer who is interested in making any agreement as indicated (or described) above, should contact the Compliance Team at registry@rpra.ca, 647-496-0530 or toll-free at 1-833-600-0530.

-

A brand supply list is a list of brands of obligated products that a producer supplies to consumers in Ontario. A producer must provide a brand supply list that makes up their supply data annually to RPRA. Each program has different requirements regarding how a producer must submit a brand supply list. For more information, consult the applicable programs’ walkthrough guide or contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca.

-

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

You are an information technology, telecommunications, audio-visual (ITT/AV) producer if you market ITT/AV into Ontario and:

- Are the brand holder of the EEE and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import EEE from outside of Ontario;

- If there is no resident importer, have residency in Ontario and market directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, do not have residency in Ontario and market directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Electrical and Electronic Equipment Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

See our FAQs to understand “What are paper products?” and “What are packaging-like products?”.

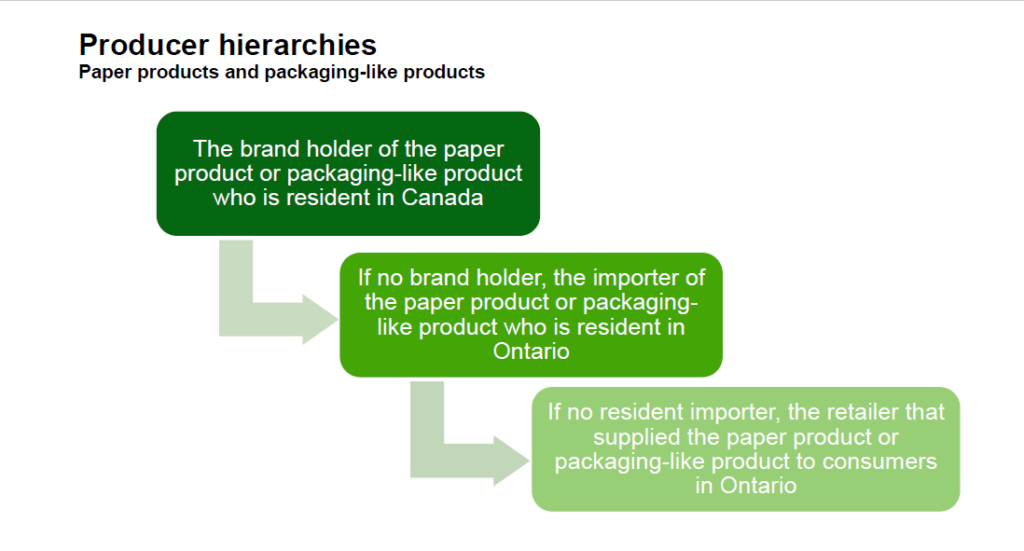

For paper products and packaging-like products, a person is considered a producer:

- if they are the brand holder of the paper product or packaging-like product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the paper product or packaging-like product from outside of Ontario

- if no resident importer, they are the retailer that supplied the paper product or packaging-like product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

-

Yes, there have been some key changes to the producer hierarchies which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- If a retailer is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer.

- Brand holders that are resident in Canada are obligated, which varies from the Stewardship Ontario program where brand holders that are resident in Ontario are obligated.

See our FAQ to understand “Who is a marketplace facilitator?”.

-

There have been some key changes to the producer hierarchies under the Municipal Hazardous or Special Waste (MHSW) program to those under the HSP Regulation. This may affect what a producer is obligated for and should be considered if using previously reported data.

Hierarchy change for producers in all categories (excluding those provided in new vehicles, for which a separate hierarchy applies):

- Brand holders that are resident in Canada are obligated (previously was resident in Ontario)

Hierarchy change for producers of antifreeze and oil filters supplied in new vehicles:

- Vehicle brand holders that are resident in Canada, importers and marketers are obligated

Hierarchy change for producers of oil filters, oil containers, antifreeze, pesticides, non-refillable pressurized containers, refillable pressurized containers, solvents, paints or coatings:

- Producer hierarchy’s introduction of marketers with or without residency in Ontario

See our FAQ to understand “Am I an HSP Producer?”

-

Brand holders and producers that supply products and packaging are required by legislation to meet individual mandatory collection and resource recovery requirements and may face compliance and enforcement consequences for failing to do so. The executive attestation ensures that executives responsible for managing the brand holder’s or producer’s business are aware of these requirements and can ensure that appropriate measures are put in place to achieve compliance with the regulations.

-

Yes, cheques are an obligated material and should be reported under the paper material category. If you have questions regarding how to determine whether you are the brand holder and are obligated to report the supply of cheques, please reach out to the Compliance & Registry team at registry@rpra.ca.

-

Yes, producers are legally required to register and report to RPRA. There are some differences between which materials were reported to Stewardship Ontario as a steward and what must now be reported to RPRA as a producer. Differences include:

- newly obligated materials

- brand holder in Canada now obligated (rather than Ontario)

- producer must report total supply, and then report any weight to be deducted separately.

During transition years, stewards must meet their requirements (e.g., paying fees to Stewardship Ontario) under the Blue Box Program Plan and the WDTA. Producers also have requirements under the new Blue Box Regulation and the RRCEA, which includes registering, reporting, paying their program fee to RPRA and establishing collection, management and promotion and education systems for Blue Box materials.

-

Producers are not required to collect and manage their own branded products and materials. Instead, a producer is expected to collect and manage a portion of similar materials in Ontario. The portion of material that a producer collects and manages is known as their minimum management requirement. A minimum management requirement, which is set based on calculations outlined in the applicable Regulation, is the weight of the products or packaging that the producer must ensure is collected and managed. The calculated amount is proportionate to the weight of materials that producer supplied into the province.

For example, a producer who supplied laptops into Ontario does not need to collect and manage their own branded laptops. Instead, they must ensure that they collect and manage an equivalent weight of information technology, telecommunications, and audio-visual equipment (ITT/AV) materials.

Similarly, a producer who supplied cardboard boxes into Ontario does not need to collect and manage those exact cardboard boxes. Rather, they need to ensure that an equivalent weight of paper is collected and managed.

Almost all producers will work with producer responsibility organizations (PROs) for the purposes of meeting their obligations to collect and manage materials. PROs establish collection and management systems across Ontario for different material types. A producer can meet their obligations to collect and manage materials by entering into a contract with a PRO to provide these services on their behalf.

-

Unbranded products are products that do not have any mark, word, name, symbol, design, device or graphical element, or any combination of these, including a registered or unregistered trademark, which identifies a product and distinguishes it from other products.

The retailer who supplied the product to a consumer in Ontario, either online or at a physical location, is the obligated producer for the supply of Blue Box packaging on that unbranded product.

For example: A cucumber in plastic film sold at a grocery store that does not have any stickers, labeling or any other information associated with a brand is considered unbranded. As the retailer for that unbranded product, the grocery store is the obligated producer for the packaging supplied with the cucumber.

-

Any public sector institution, including colleges and universities, that offers a self-serve hot drink machine for use by students and employees (i.e., consumers) must report all the Blue Box materials supplied with the machine to serve the hot drinks. This includes branded and unbranded single-use cups, lids, etc.

-

Public sector institutions must report all branded and unbranded Blue Box packaging supplied or sold with food served in their owned and operated on-site facilities. These facilities include but are not limited to cafeterias, pubs, cafes, and in the case of a college or university, faculty offices.

It is important to consider other situations where food service Blue Box packaging is supplied to consumers. For example, a college must report the packaging used in their Culinary and Hospitality programs that allow students to take home food prepared in class.

-

Producers of HSP need to provide the following information when registering with RPRA:

- Business information (e.g. business name, contact information)

- The year you began marketing or selling HSP into Ontario

- Any PROs you are contracted with

- Your annual HSP Supply Report if you are a producer of

- oil filters,

- non-refillable pressurized containers,

- oil containers,

- antifreeze,

- pesticides,

- solvents, and

- paints and coatings

- Confirmation if gross annual revenue generated from all products and services in Ontario was above or below $2 million in the previous calendar year and list of supplied brands if you are a producer of:

- mercury-containing barometers,

- thermometers and thermostats,

- fertilizers, and

- refillable propane containers