Producers of fertilizers have no management requirements.

Topic: Management activities

As an HSP producer of mercury-containing barometers, thermometers or thermostats, what are my management requirements?

Producers shall ensure that, no later than three months after the day the material is collected, the HSP is processed by an HSP processor who is registered with RPRA.

On and after January 1, 2023, producers or PROs on behalf of producers shall ensure that the HSP is processed by an HSP processor at a facility in respect of which the HSP processor reported an average recycling efficiency rate for that type of HSP that is at least the percentage set out in the table below.

| Type of HSP | Average Recycling Efficiency Rate (RER) |

|---|---|

| Barometers, Thermometers and Thermostats | 90% |

As an HSP producer of oil containers, antifreeze, pesticides, refillable pressurized containers, solvents, paints or coatings, what are my management requirements?

As of October 1, 2021, producers, or PROs acting on their behalf, are required to establish and operate a system for managing HSP by satisfying their management requirements as follows:

- All oil containers, antifreeze, refillable pressurized containers, solvents, paints and coatings picked up from a collection site must be processed within three months from the date of the pickup

- Producers of pesticides must ensure that pesticides are properly disposed of at an HSP disposal facility registered with the Authority no later than three months after the day the pesticides are collected

- Producers must ensure that materials are processed by an HSP processor registered with the Authority. On and after January 1, 2023, producers or PROs on behalf of producers shall ensure that the HSP is processed by an HSP processor at a facility in respect of which the HSP processor reported an average recycling efficiency rate for that type of HSP that is at least the percentage set out in the table below

| Type of HSP | Average Recycling Efficiency Rate (RER) |

|---|---|

| Antifreeze | 90% |

| Oil Containers | 95% |

| Paints and Coatings | 75% |

| Refillable Pressurized Containers | 95% |

| Solvents | 10% |

As an HSP producer of oil filters or non-refillable pressurized containers, what are my management requirements?

As of October 1, 2021, producers, or PROs acting on their behalf, are required to establish and operate a management system and must:

- process all oil filters and non-refillable pressurized containers picked up from a collection site within three months from the date of the pickup

- ensure that materials are processed by an HSP processor registered with the Authority that has achieved the minimum recycling efficiency rate (RER)

Beginning January 1, 2022, producers are required to recover an amount of material based on their average supply into Ontario and report on it starting in 2023. For the purposes of accounting for a weight of recovered resources from oil filters and/or non-refillable pressurized containers with respect to 2022, a producer may count the weight of recovered resources from that type of HSP from October 1, 2021 to December 31, 2022.

How will RPRA determine a producer is using ‘best efforts’?

In determining whether an obligated producer used best efforts to meet their management requirements, the Compliance Team will consider whether the producer, acting in good faith, took all reasonable steps to meet the requirements outlined in the applicable regulation.

For example, best efforts in the context of management requirements may involve a producer regularly monitoring the volume of material being collected and managed, and implementing plans for increasing those volumes if the requirements are unlikely to be met.

Producers can contact the Compliance Team to ask specific questions about fulfilling their obligations.

Can a producer change PROs?

Yes, a producer can change PROs at any time. Producers must notify RPRA of any change in PROs within 30 days of the change.

What is a rule creator?

The rule and allocation table creation process has been removed from the Blue Box Regulation and is therefore no longer required to create and maintain the system for collecting Blue Box materials across the province, as per regulatory amendments made by the government on April 14, 2022. As such, rule creators are no longer applicable under the regulation. Learn more about the amendments.

To replace these tools, the amended regulation now requires PROs to submit a report that outlines how they will operate the Blue Box collection system on behalf of producers, ensuring that materials are collected from all eligible communities (i.e., communities outside of the Far North) across the province. Learn more about what PROs need to include in the report.

Are there are any differences in what needs to be reported between the current Stewardship Ontario program and the new Blue Box Regulation?

Yes, there are some key changes to the data reported to Stewardship Ontario and what needs to be reported under the new regulation, which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- There are fewer reporting categories than under the Stewardship Ontario program

- Certified compostable packaging and products now must be reported separately, but this category does not have management requirements

- There are only two deductions permitted under the Blue Box Regulation, and producers must report total supply and then report any weight to be deducted separately

- Exemptions are based on tonnage supply under each material category instead of a total supply weight threshold of less than 15 tonnes as in Stewardship Ontario’s program

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”; “Are there exemptions for Blue Box producers?“; “Are there any differences in Blue Box producer hierarchies between the current Stewardship Ontario program and the new Blue Box Regulation?”; and “Are there are any differences in obligated Blue Box materials between the current Stewardship Ontario program and the new Blue Box Regulation?”

Why do I have to pay the RPRA Registry fee for Blue Box in 2021 if the program doesn’t transition until 2023?

RPRA’s Registry fees cover the costs related to compliance and enforcement and other activities required to administer the regulations under the RRCEA, and building and operating the Registry.

The Registry fees cover expenses in a given year (e.g., 2021 fees cover 2021 expenses). 2021 fees for Blue Box cover the Authority’s costs to undertake activities to implement the regulation in 2021, which include:

- helping obligated parties understand their requirements

- ensuring producers register and report their supply data by the deadline in the regulation

- compliance, enforcement, and communication activities

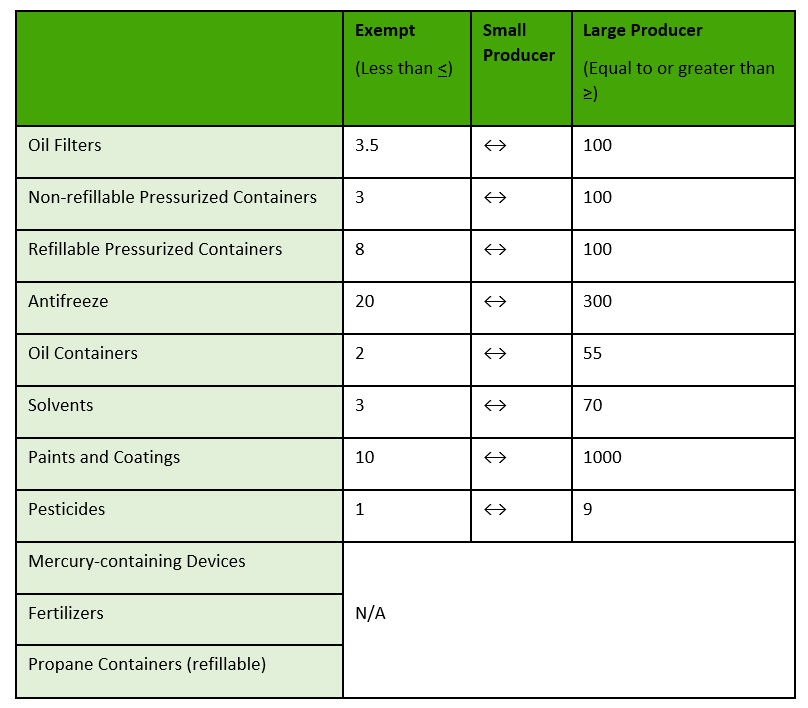

What producer exemptions are under the HSP Regulation?

If a producer is exempt in accordance with the chart below, the producer is exempt from the following requirements:

- Registration with RPRA

- Requirements related to setting up or operating a collection system

- Management requirements

- Promotion and education requirements

Producer categories use the average weight of material (in tonnes) supplied in Ontario in the three previous calendar years. If you have questions on how to calculate your average weight of supply, contact the Registry Support Team at registry@rpra.ca.

What deductions are available to producers under the Blue Box Regulation?

There are only two allowable deductions for Blue Box materials. There are for materials that are:

- collected from an eligible source at the time a related product was installed or delivered (e.g., packaging that is removed from the house by a technician installing a new appliance). This is the “installation deduction”.

- deposited into a receptacle at a location that is collected from a business or institution where Blue Box collection services are not provided under the regulation. This is the “ineligible source deduction” that was expanded by the regulation amendment in July 2023.

Ineligible source deductions:

Blue Box Producers may deduct materials that are collected from a business or institution where producers are not required to provide Blue Box collection services. Examples include offices, stores and shopping malls, restaurants, community centres, recreation facilities, sports and entertainment venues, universities and colleges, and manufacturing facilities.

Producers cannot deduct the following materials collected through the collection systems established under the Blue Box Regulation:

- Material that is generated at a facility (including multi-residential buildings, retirement homes, long-term care homes and schools).

- Material that is collected from a residence through a curbside or depot collection service.

- Material that is collected from a public space (including an outdoor area in a park, playground or sidewalk, or a public transit station).

- Material collected under an alternative or supplemental collection system.

- Beverage containers cannot be deducted.

Materials that are deducted cannot count toward a producer’s management requirement.

Please see the Reporting Guidance Ineligible Source Deductions for the 2024 Blue Box Supply Report for more information on how to determine and use these deductions.

Are Blue Box materials that are supplied to the IC&I sector, such as long-term care homes, obligated?

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).

If a marketplace facilitator supplies products for which there is a brand holder resident in Canada, who is the obligated producer?

The brand holder is the obligated producer.

A marketplace facilitator only becomes obligated for products supplied through its marketplace where the producer would have been a retailer. If the producer is a brand holder or an importer, they remain the obligated producer even when products are distributed by a marketplace facilitator.

A retailer is a business that supplies products to consumers, whether online or at a physical location.