Posted on June 6, 2025 by Uju Ani -

Producers of HSP need to provide the following information when registering with RPRA:

- Business information (e.g. business name, contact information)

- The year you began marketing or selling HSP into Ontario

- Any PROs you are contracted with

- Your annual HSP Supply Report if you are a producer of

- oil filters,

- non-refillable pressurized containers,

- oil containers,

- antifreeze,

- pesticides,

- solvents, and

- paints and coatings

- Confirmation if gross annual revenue generated from all products and services in Ontario was above or below $2 million in the previous calendar year and list of supplied brands if you are a producer of:

- mercury-containing barometers,

- thermometers and thermostats,

- fertilizers, and

- refillable propane containers

Posted on April 15, 2025 by Uju Ani -

Producers of tires need to provide the following information when registering in RPRA’s Registry:

- Business information (e.g. business name, contact information)

- The year you began marketing or selling tires into Ontario

- Any PROs you are contracted with

- Your annual Tire Supply Report

Posted on June 3, 2024 by Julia Struyf -

Producers of oil filters and non-refillable pressurized containers, oil containers, antifreeze, pesticides, refillable pressurized containers, solvents, paints and coatings

If the producer’s average weight of supply in 2018, 2019, 2020 was above the threshold in the table below, the producer was required to register with RPRA by November 30, 2021. Obligated producers who have not yet registered are out of compliance with the regulation and may face compliance action by RPRA.

If a producer was not required to register in 2021, they must register on or before July 31 of the first calendar year that they exceed the threshold in the table below.

| Type of HSP | Average weight of supply from the previous three calendar years (tonnes) |

| Oil Filters | 3.5 |

| Non-refillable pressurized containers | 3 |

| Antifreeze | 20 |

| Oil Containers | 2 |

| Paints and coatings | 10 |

| Pesticides | 1 |

| Refillable pressurized containers | 8 |

| Solvents | 3 |

For assistance in calculating your average weight of supply, contact RPRA’s Compliance Team at registry@rpra.ca.

Producers of mercury-containing barometers, thermometers and thermostats, fertilizers and refillable propane containers

If a producer met the definition of an HSP producer in 2021, they were required to register with RPRA by November 31, 2021.

If you meet the definition of an HSP producer after November 31, 2021, you must register with RPRA within 30 days.

How to register as a producer

- Go to RPRA’s Registry at https://registry.rpra.ca/s/login/?language=en_US

- Note: The Registry will not work with the Internet Explorer web browser. Google Chrome is the recommended web browser to use.

- Click “Don’t have an Account? Create a new Account”.

- Follow the prompts to fill out your account details.

- Information needed at time of registration:

- CRA business number, business name, address, contact information, and

- Name, contact information of the person who will be responsible for completing registration.

- You’ll receive an email with a link to create your password.

- Select the program you want to enroll in.

- Submit a supply report with the total weight of each type of HSP that was supplied to consumers in Ontario in the previous years.

For more information and step by step instructions on how to submit a supply report, view our supply reporting guides here.

Posted on December 6, 2023 by Julia Struyf -

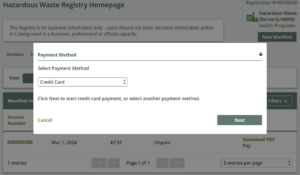

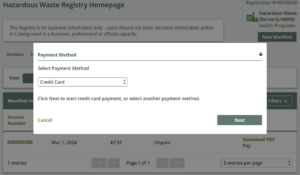

When your HWP invoice total is $500 or less, the default method for paying that invoice is automatically set to credit card. This feature aims to simplify transactions for smaller amounts and ensure a smoother payment process.

As seen in the image below, if your HWP invoice is $500 or less, the payment method will automatically be set to credit card. Once you click next, you will input your credit card details, then click pay. Your payment will process automatically. If an alternate payment method is required, please contact us.

Note: As of April 2024, all programs except for HWP, have the option to select from various payment methods, including bank withdrawal, credit card, electronic data interchange, electronic bill payment, and cheque, regardless of the invoice amount.

If your company is unable to pay an invoice by credit card, please contact RPRA’s Compliance Team at registry@rpra.ca or (833) 600-0530.

Posted on March 23, 2023 by Uju Ani -

A tire producer qualifies for an exemption if their average weight of supply for that calendar year is less than 1,175 kg.

Average supply weight is determined using the following formula:

Average weight of tire supply = (Y3+Y4+Y5) / 3

E.g. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Tire producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of tires supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

Posted on March 10, 2023 by Jess Turchet -

Producers are obligated parties under the Resource Recovery and Circular Economy Act and are ultimately responsible for their data submitted through RPRA’s Registry. Producers can choose to contract with an external consultant to support their data submission, but third parties have limited permissions in the Registry as they are not regulated parties.

A producer can choose to assign a primary or secondary user profile in their Registry account to an external consultant. An external consultant may submit supply data reports and/or pay registry fees on the producer’s behalf.

External consultants cannot submit and/or sign registration, executive attestations, account admin changes or supply data adjustment documentation on behalf of a producer. External consultants cannot be account admins, nor can they manage a PRO within the Registry on behalf of a producer.

Posted on March 3, 2023 by RPRA Communications -

Producers of batteries need to provide the following information when registering in RPRA’s Registry:

- Business information (e.g. business name, contact information)

- The year you began marketing or selling batteries into Ontario

- Any PROs you are contracted with

- Your annual Supply Report

Posted on March 3, 2023 by RPRA Communications -

Producers of ITT/AV equipment need to provide the following information when registering in RPRA’s Registry:

- Business information (e.g. business name, contact information)

- The year you began marketing or selling ITT/AV equipment into Ontario

- Any PROs you are contracted with

- Your annual ITT/AV Supply Report

Posted on February 6, 2023 by Michelle Hoover -

No. Effective February 6, 2023, RPRA will no longer accept requests for extensions to registration or reporting deadlines. Obligated parties should make every effort to ensure they meet all submission deadlines as part of their obligations under their associated regulation.

For more guidance, read the Late Registration or Report Submissions Compliance Bulletin.

Posted on November 16, 2022 by Esther Filer -

A lighting producer qualifies for an exemption if their average weight of supply for that calendar year is less than or equal to 700 kg.

Average supply weight is determined using the following formula:

Average weight of lighting supply = (Y3 + Y4 + Y5) / 3

Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Lighting producers that meet the exemption criteria are exempt from:

- Registering with and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Producers that are exempt must keep records of the materials they supplied, as set out in section 30 of the regulation.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

See our FAQs: “How are lighting producers’ minimum management requirements determined?” and “What do I have to do if I am an exempt lighting producer?”

Posted on November 16, 2022 by Esther Filer -

An exempt producer is not required to:

- Register and report to RPRA

- Establish a collection and management system

- Meet a management requirement

- Meet promotion and education requirements

Exempt producers must retain records related to the weight of lighting supplied into Ontario each year and provide them to RPRA upon request.

See our FAQ: ‘How do I determine if I am an exempt lighting producer?’

Posted on November 16, 2022 by Esther Filer -

A producer’s individual minimum management requirement is determined by the following formulas, found in section 14 of the Electrical and Electronic Equipment (EEE) Regulation, summarized in the following chart:

| Performance Year | Supply Report Year | Formula |

| 2025 | 2024 | (2020 supply + 2021 supply + 2022 supply) / 3×30% |

| 2026 | 2025 | (2021 supply + 2022 supply + 2023 supply) / 3×30% |

| 2027 | 2026 | (2022 supply + 2023 supply + 2024 supply) / 3×30% |

| 2028 | 2027 | (2023 supply + 2024 supply + 2025 supply) / 3×30% |

| 2029 | 2028 | (2024 supply + 2025 supply + 2026 supply)/ 3×30% |

| 2030 | 2029 | (2025 supply + 2026 supply + 2027 supply)/ 3×30% |

| 2031 | 2030 | (2026 supply + 2027 supply + 2028 supply)/ 3×35% |

It is important to note that producers must ensure that all lighting that is collected is managed, regardless of their minimum management requirement.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA. See our FAQ ‘How do I determine if I am an exempt lighting producer?’ to learn more.

Posted on October 31, 2022 by Jess Turchet -

If you select electronic data interchange (EDI) as your method of payment, this is an electronic payment through your bank, also commonly known as EFT or ACH.

Follow these steps to complete your payment:

- Submit your payment using RPRA’s banking information provided on your invoice.

- Be sure to reference your Invoice Number when you submit this payment to your bank so that we will be able to identify your payment.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.