Posted on January 19, 2021 by Michelle Hoover -

Yes. If you are a producer with retailers or distributors supplying your obligated EEE into Ontario, you can email us at registry@rpra.ca to discuss options on how to report your supply data. There are several options available, including an easy-to-use sales formula and weight conversion factors. See the EEE Verification and Audit procedure for more information.

One option is to have your supply data reported by each of your retailers or distributors on a piecemeal basis. The piecemeal option requires that extra steps be undertaken by you and the Authority. You must contact the Authority in advance if you wish to pursue this option.

Note that even if you have a retailer or distributor providing data on your behalf, it remains the producer’s obligation to ensure that all the required data gets reported and that it is reported accurately to the Authority in accordance with the EEE Regulation. The entry of inaccurate information by someone on your behalf is not a defense to non-compliance.

Posted on January 19, 2021 by Michelle Hoover -

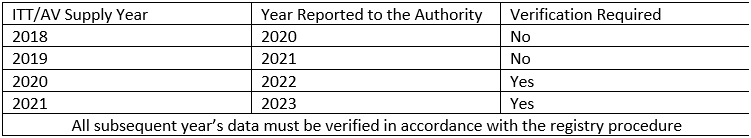

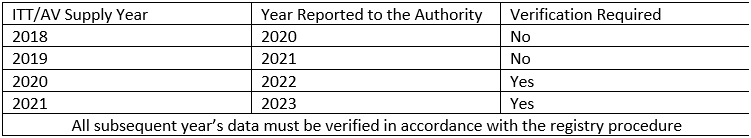

As shown in the table below, verification of the ITT/AV supply data reported in 2020 and 2021 is not required. Verification of supply data for ITT/AV will be required starting in 2022 for products supplied in 2020. All subsequent years of supply data are required to be verified when the data is reported.

For more information on the required verification and audit of data, view the Registry Procedure: EEE Verification and Audit.

Posted on January 19, 2021 by Michelle Hoover -

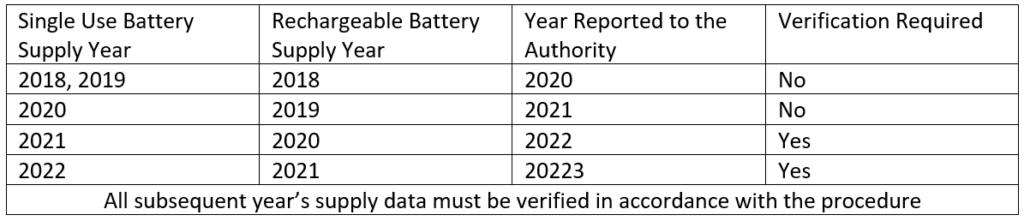

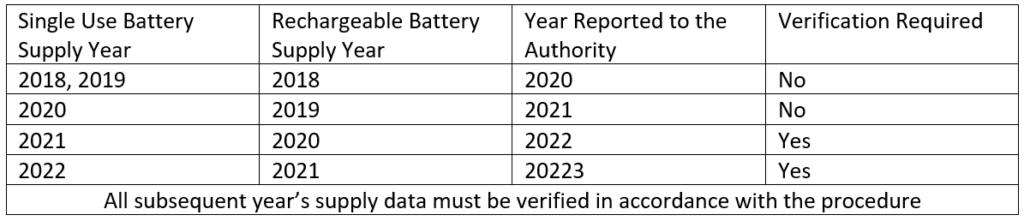

There is no audit verification requirement for the first two supply data reports submitted to the Authority. Therefore, data submitted for single-use batteries supplied in 2018, 2019, and 2020, as well as rechargeable batteries supplied in 2018 and 2019 will not have to be verified in accordance with the Registry Procedure – Verification and Audit.

As shown in the table below, under section 15 of the Battery Regulation, the first supply data report for which there are audit and verification requirements will be submitted in 2022. This supply data report is for single-use batteries supplied in 2021 and rechargeable batteries supplied in 2020.

Posted on July 17, 2020 by Michelle Hoover -

Brand holders and producers that supply products and packaging are required by legislation to meet individual mandatory collection and resource recovery requirements and may face compliance and enforcement consequences for failing to do so. The executive attestation ensures that executives responsible for managing the brand holder’s or producer’s business are aware of these requirements and can ensure that appropriate measures are put in place to achieve compliance with the regulations.

Posted on July 16, 2020 by Monica Ahmed -

You may be required to provide a verification report for the annual tire supply report. You will be required to provide verification if you meet the definition of a medium or large producer. Small producers will not be required to submit a verification report, however a percentage of small producers selected annually by the Registrar will be subject to an inspection. If exceptions are identified during the inspection, a comprehensive review may be carried out. For more information on this, read Tires Registry Procedure – Audit.

Posted on July 16, 2020 by Michelle Hoover -

Program fees are charges that producers obligated under the Resource Recovery and Circular Economy Act, 2016, are required to pay to RPRA annually to recover its operational costs, including costs related to building and operating the registry, providing services to registrants, and compliance and enforcement activities.

All current and past fee schedules can be found here.

Posted on July 15, 2020 by Michelle Hoover -

No. A PRO cannot report on behalf of service providers.

Posted on July 15, 2020 by Michelle Hoover -

We recommend using Google Chrome, Mozilla Firefox, Microsoft Edge or Apple Safari when accessing the Registry. If you are experiencing an issue with the Registry, try clearing your cache or updating the browser to the latest version.

If you are using a different browser, the Registry will not function.

Posted on July 15, 2020 by Michelle Hoover -

When paying fees to RPRA, you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI; also commonly known as ACH or EFT)

- Electronic bill payment

- Cheque

For instructions on how to submit payment by the method you chose, read one of the following FAQs:

To note, Registry invoices are considered due on receipt. Invoices are in CAD funds and payments must be sent in CAD.