Frequently Asked Questions

Results (15)

Click the question to read the answer.

-

When your HWP invoice total is $500 or less, the default method for paying that invoice is automatically set to credit card. This feature aims to simplify transactions for smaller amounts and ensure a smoother payment process.

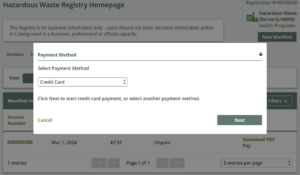

As seen in the image below, if your HWP invoice is $500 or less, the payment method will automatically be set to credit card. Once you click next, you will input your credit card details, then click pay. Your payment will process automatically. If an alternate payment method is required, please contact us.

Note: As of April 2024, all programs except for HWP, have the option to select from various payment methods, including bank withdrawal, credit card, electronic data interchange, electronic bill payment, and cheque, regardless of the invoice amount.

If your company is unable to pay an invoice by credit card, please contact RPRA’s Compliance Team at registry@rpra.ca or (833) 600-0530.

-

When paying fees to RPRA, you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI; also commonly known as ACH or EFT)

- Electronic bill payment

- Cheque

For instructions on how to submit payment by the method you chose, read one of the following FAQs:

- How do I pay my fees to RPRA by credit card?

- How do I pay my fees to RPRA by bank withdrawal (pre-authorized debit)?

- How do I pay my fees to RPRA by electronic bill?

- How do I pay my fees to RPRA by cheque?

- How do I pay my fees to RPRA by electronic data interchange (EDI)?

To note, Registry invoices are considered due on receipt. Invoices are in CAD funds and payments must be sent in CAD.

-

If you select electronic bill payment as your method of payment, this method of payment is done through your online banking account, using the bill payment functionality. It is available at major Canadian banks (e.g., TD, RBC, BMO, Scotiabank, etc.).

Follow these steps to complete your payment:

- Log in to your bank account.

- Go to the bill payment section and choose to add a payee.

- Search for and select “RPRA” as the payee.

- Once “RPRA” is selected, enter your registration number as the account number to make your payment. Your registration number can be found on your invoice.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

The HWP Registry is unable to accept partial payments for invoices issued to an account. Monthly invoices will include the applicable fees for all manifests completed during the previous month and will break fees down by facility. Consider an internal business process to bill back each facility as required.

See FAQ: Can we set up separate invoices for each facility within one account?

See FAQ: What information is included on an invoice for HWP Registry fees? -

If you select electronic data interchange (EDI) as your method of payment, this is an electronic payment through your bank, also commonly known as EFT or ACH.

Follow these steps to complete your payment:

- Submit your payment using RPRA’s banking information provided on your invoice.

- Be sure to reference your Invoice Number when you submit this payment to your bank so that we will be able to identify your payment.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select credit card as your method of payment, this method of payment is done through your Registry account.

Follow these steps to complete your payment:

- When you are in the payment method section in the Registry, select credit card as your preferred method.

- Input your credit card details.

- Click submit and payment will process automatically.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- Once your transaction has been approved, your payment will be reflected in your Registry account immediately.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select bank withdrawal as your method of payment, this authorizes the Resource Productivity and Recovery Authority to make a one-time withdrawal for the Registry invoice payment from the account you provided.

Bank Withdrawal – Important Terms:

- You have authorized RPRA to make one-time debits from your account. RPRA will obtain your authorization before any additional one-time or sporadic withdrawal is debited from your account. You have agreed that this confirmation may be provided at least three (3) calendar days before the first payment is withdrawn from your account. You have waived any and all requirements for pre-notification of the account being debited.

- Your payments are being made on behalf of a business.

- Your agreement may be cancelled provided notice is received thirty (30) days before the next withdrawal. If any of the above details are incorrect, please contact us immediately at the contact information below. If the details are correct, you do not need to do anything further and your Pre-Authorized Debits (PAD) will be processed. You have certain recourse rights if any debit does not comply with these terms. For example, you have the right to receive a reimbursement for any PAD that is not authorized or is not consistent with this PAD Agreement. To obtain more information on your recourse rights, contact your financial institution or visit www.payments.ca.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for the involved banks to process your payment.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select cheque as your method of payment, follow these steps to complete your payment:

- Make your cheque payable to “Resource Productivity and Recovery Authority”

- Enter your Invoice Number on the memo line of the cheque

- Please send your cheque to*:

-

- Resource Productivity Recovery Authority

- PO Box 46114, STN A

- Toronto, ON

- M5W 4K9

*As of January 20, 2023, the address for mailing cheques to RPRA has been revised. Please update your records and send cheques to the above address going forward.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 2-4 weeks for your payment to be reflected in your Registry account once you have mailed your cheque due to mail and cheque processing times.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

Admin Primary Secondary Receive invoice notifications via email ⚫ ⚫ Pay invoices in the Registry ⚫ ⚫ ⚫ Download invoices in the Registry ⚫ ⚫ ⚫ Filter invoices by facility, date, invoice number, payment status ⚫ ⚫ ⚫ View manifests with fees ⚫ ⚫ ⚫ Download manifests with fees reports ⚫ ⚫ ⚫ Receive separate invoices for each facility within one account Not Applicable Pre-payment of invoices Not Applicable Make partial payment to invoices Not Applicable -

See sample invoices here. The three examples included in the PDF are:

- Manifest Invoice – Generator Variant (aggregates fees for multiple manifests over a month; includes a facility-level breakdown)

- Manifest Invoice – AGD Variant (aggregates fees for multiple manifests over a month; includes a company- and facility-level breakdown)

- On-site Waste Activity Invoice (fees for a single On-site waste activity)

Manifest invoices will be issued on the first day of each month and will include all manifests completed in the previous month, For example, an invoice issued on February 1 will include completed manifests from January 1 to January 31.

The primary user of the account will receive an email notification when a manifest invoice is issued. Any primary or secondary user on the account can access and pay an invoice from the Registry homepage.

While the manifest invoice provides a total fee for each facility, users can see the fee per individual manifest from the Invoices tab in their Registry Account.

The easiest way to find individual manifest fees is directly in the Invoices tab under Manifests with Fees. Users can find individual manifest fees under the Manifests tab, but they’ll have to navigate to the “Closed Manifests” section and then search for and open the manifest itself.

On-site waste activity invoices will be issued when the Registry user completes an on-site waste activity report and submits their payment information.

See FAQ: What payment methods are available?

-

Yes, in October 2022, RPRA has migrated the facility and waste stream data identified below to the new registry to minimize the volume of data users would otherwise have to enter from scratch.

Data that has been migrated into the Registry from HWIN includes:

- Active generators accounts:

- Generator ID

- Company details

- Site location

- Company official / alternate HWIN Administrator details

- Site Details

- Waste Identification (for active wastes):

- Waste Class

- Waste Stream

- Land Disposal Restrictions (LDR) Notification Form

- Fee exemptions

- Carrier and Receiver Environmental Compliance Approval (ECA) information:

- ECA number

- Company Name

- Site location

- Company admin / official information

- Waste codes

*The following data has not been migrated:

- Generator accounts where the generator number or ID begins with ONR or ONF

- Inactive waste streams and facilities

- Manifests

- On-site processing, storage and disposal information

- LDR questionnaires (only LDR notification forms will be migrated)

- Financial information (including account balances, payment information)

- Document attachments (such as copies of Environmental Compliance Approvals)

Note: while some recently expired generator accounts might have been migrated to the registry, users should have ensured that their data in the HWIN system is accurate and up to date ahead of the migration in October to ensure their data is accessible in the registry. This may have included reactivating inactive waste streams and facilities in HWIN in order for them to be migrated to the registry.

-

Full delegation: when generators hire service providers to do all the facility and waste stream management, reporting and fee payment in the registry on their behalf, and they never have to set up accounts or use the registry.

Partial delegation: when generators want to set up their own account in the registry and pay their own fees, they can still delegate facility and waste stream management and other reporting activities to a service provider.

Please note delegation is not needed for a service provider to create manifests for your facility. Delegation is needed only for a service provider to help manage a generator’s facility and waste stream information (e.g., register or edit waste streams) or sign off on manifests on the generator’s behalf.

Comparison of delegation options

Function Full delegation Partial delegation No delegation Create my own generator registry account and register my own facilities ⚫ ⚫ Register my own wastes ⚫ ⚫ Create my own manifests ⚫ ⚫ Sign my own manifests (including corrections) ⚫ ⚫ Have an AGD register my facilities ⚫ Have an AGD register my wastes ⚫ ⚫ Have 2 or more AGDs register and manage waste at the same facility ⚫ Have an AGD or other service provider create my manifests ⚫ ⚫ ⚫ Have an AGD sign manifests on my behalf (including corrections) ⚫ ⚫ Note: If you fully delegate to a service provider, you will not have to use the HWP Registry -

No. Fees will be invoiced monthly and will include applicable fees for manifests completed during the previous month. Fees for onsite disposal will be invoiced at the time the disposal activity report is completed.

See FAQ: What payment methods are available in the Registry?

See FAQ: Who pays RPRA’s HWP Registry fees?

See FAQ: What information is included on an invoice for HWP Registry fees?

-

The HWP Registry is unable to issue separate invoices for different facilities managed under one account.

Monthly invoices will include the applicable fees for manifests completed during the previous month and will break fees down by facility. If a user is looking for more details about facility-specific activities, they can find that information in the registry.

See FAQ: What information is included on an invoice for HWP Registry fees?

See FAQ: Can I submit a partial payment for only the facilities I manage? -

Starting January 1, 2023, RPRA will collect 13% HST on all fees at the time of fee payment.

This decision is based on a ruling RPRA received from the CRA in which HST must be charged on its fees under the Resource Recovery and Circular Economy Act, 2016 (RRCEA). RPRA has determined that this ruling applies to all RRCEA producer responsibility programs and the Excess Soil and Hazardous Waste programs.

On December 22, 2022, RPRA will reissue invoices that were issued prior to January 1, 2023, amended to indicate that 13% HST was paid. From December 22 onwards, registrants will be able to access the amended invoices in their Registry accounts under a new tab labelled “Invoices”. The amended invoice will show an HST amount as well as the date the amended invoice was reissued.

Important notes:

- On the amended invoices there have been no changes to the Invoice Total and registrants will not be required to pay any additional monies to RPRA for past invoices.

- Registrants may be able to claim input tax credits for the HST collected on RPRA fees, for both the amended invoices and new invoices issued January 1, 2023, onwards. However, RPRA is not in a position to provide tax advice and suggests you consult your internal or external accountants to seek their counsel.

- All new invoices issued effective January 1, 2023, will contain appropriate information identifying the amount of the HST and other relevant details. These invoices will also be displayed under the “Invoices” tab in a registrants’ Registry account.