Frequently Asked Questions

Results (26)

Click the question to read the answer.

-

Consumer protection laws in Ontario prohibits the misrepresentation of charges, which means that producers or retailers cannot misrepresent any visible fees as a regulatory charge, tax, RPRA fee or something similar. Consumers who have questions or concerns about a specific transaction or want to report a misrepresentation can contact the Ministry of Public and Business Service Delivery at 1-800-889-9768.

As of March 2023, the promotion and education requirements related to environmental fees have been removed from the Tires, Batteries, Electrical and Electronic Equipment, and Hazardous and Special Products regulations. No changes were made to the Blue Box Regulation as it never contained promotion and education requirements related to these fees.

RPRA’s compliance bulletin Charging Tire Fees to Consumers has since been revoked and RPRA has ceased its enforcement of promotion and education requirements for visible fees across all materials.

-

Starting January 1, 2023, RPRA will collect 13% HST on all fees at the time of fee payment.

This decision is based on a ruling RPRA received from the CRA in which HST must be charged on its fees under the Resource Recovery and Circular Economy Act, 2016 (RRCEA). RPRA has determined that this ruling applies to all RRCEA producer responsibility programs and the Excess Soil and Hazardous Waste programs.

On December 22, 2022, RPRA will reissue invoices that were issued prior to January 1, 2023, amended to indicate that 13% HST was paid. From December 22 onwards, registrants will be able to access the amended invoices in their Registry accounts under a new tab labelled “Invoices”. The amended invoice will show an HST amount as well as the date the amended invoice was reissued.

Important notes:

- On the amended invoices there have been no changes to the Invoice Total and registrants will not be required to pay any additional monies to RPRA for past invoices.

- Registrants may be able to claim input tax credits for the HST collected on RPRA fees, for both the amended invoices and new invoices issued January 1, 2023, onwards. However, RPRA is not in a position to provide tax advice and suggests you consult your internal or external accountants to seek their counsel.

- All new invoices issued effective January 1, 2023, will contain appropriate information identifying the amount of the HST and other relevant details. These invoices will also be displayed under the “Invoices” tab in a registrants’ Registry account.

-

No. An environmental fee is not a government tax and cannot be represented as mandatory, a regulatory charge, or a RPRA fee. It is a fee charged at the discretion of a business to recover their costs related to recycling the product.

-

If you are concerned about the fee you were charged, you should contact the business that charged you the fee to request a more detailed explanation of how the fee was determined.

-

Businesses have the choice to recover the cost of recycling their products by incorporating those costs into the overall cost of their product (as they do with other costs, such as materials, labour, other regulatory compliance costs, etc.) or by charging it as a separate fee to consumers.

Environmental fees are not mandatory and are applied at the discretion of the business charging them, including the amount of the fee.

-

No, only producers are required to pay RPRA program fees. The decision to make producers pay fees and cover the Authority’s costs was made to reflect the fact that the Resource Recovery and Circular Economy Act, 2016 (RRCEA) is based on a producer responsibility framework. Although producers may hire service providers to help meet their obligations, the responsibility remains with the producer.

-

There is no set environmental fee for any product, the amount of the fee charged is decided by the business.

-

Program fees are charges that producers obligated under the Resource Recovery and Circular Economy Act, 2016, are required to pay to RPRA annually to recover its operational costs, including costs related to building and operating the registry, providing services to registrants, and compliance and enforcement activities.

All current and past fee schedules can be found here.

-

No. Recycling drop-off locations displayed on the map cannot:

- charge the public a fee to drop off materials that the location accepts.

- refuse the drop-off of materials displayed on the map. However, recycling locations can request reasonable requirements when consumers drop off an item to ensure health and safety. For example, sites may require that used oil filters are dropped off in sealed containers, light tubes are taped together, etc.

If you are charged a fee or refused drop off, you can report an issue about that specific location to RPRA (see our other FAQ for further instructions).

-

If you select credit card as your method of payment, this method of payment is done through your Registry account.

Follow these steps to complete your payment:

- When you are in the payment method section in the Registry, select credit card as your preferred method.

- Input your credit card details.

- Click submit and payment will process automatically.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- Once your transaction has been approved, your payment will be reflected in your Registry account immediately.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select bank withdrawal as your method of payment, this authorizes the Resource Productivity and Recovery Authority to make a one-time withdrawal for the Registry invoice payment from the account you provided.

Bank Withdrawal – Important Terms:

- You have authorized RPRA to make one-time debits from your account. RPRA will obtain your authorization before any additional one-time or sporadic withdrawal is debited from your account. You have agreed that this confirmation may be provided at least three (3) calendar days before the first payment is withdrawn from your account. You have waived any and all requirements for pre-notification of the account being debited.

- Your payments are being made on behalf of a business.

- Your agreement may be cancelled provided notice is received thirty (30) days before the next withdrawal. If any of the above details are incorrect, please contact us immediately at the contact information below. If the details are correct, you do not need to do anything further and your Pre-Authorized Debits (PAD) will be processed. You have certain recourse rights if any debit does not comply with these terms. For example, you have the right to receive a reimbursement for any PAD that is not authorized or is not consistent with this PAD Agreement. To obtain more information on your recourse rights, contact your financial institution or visit www.payments.ca.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for the involved banks to process your payment.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select electronic bill payment as your method of payment, this method of payment is done through your online banking account, using the bill payment functionality. It is available at major Canadian banks (e.g., TD, RBC, BMO, Scotiabank, etc.).

Follow these steps to complete your payment:

- Log in to your bank account.

- Go to the bill payment section and choose to add a payee.

- Search for and select “RPRA” as the payee.

- Once “RPRA” is selected, enter your registration number as the account number to make your payment. Your registration number can be found on your invoice.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select cheque as your method of payment, follow these steps to complete your payment:

- Make your cheque payable to “Resource Productivity and Recovery Authority”

- Enter your Invoice Number on the memo line of the cheque

- Please send your cheque to*:

-

- Resource Productivity Recovery Authority

- PO Box 46114, STN A

- Toronto, ON

- M5W 4K9

*As of January 20, 2023, the address for mailing cheques to RPRA has been revised. Please update your records and send cheques to the above address going forward.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 2-4 weeks for your payment to be reflected in your Registry account once you have mailed your cheque due to mail and cheque processing times.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select electronic data interchange (EDI) as your method of payment, this is an electronic payment through your bank, also commonly known as EFT or ACH.

Follow these steps to complete your payment:

- Submit your payment using RPRA’s banking information provided on your invoice.

- Be sure to reference your Invoice Number when you submit this payment to your bank so that we will be able to identify your payment.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

When paying fees to RPRA, you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI; also commonly known as ACH or EFT)

- Electronic bill payment

- Cheque

For instructions on how to submit payment by the method you chose, read one of the following FAQs:

- How do I pay my fees to RPRA by credit card?

- How do I pay my fees to RPRA by bank withdrawal (pre-authorized debit)?

- How do I pay my fees to RPRA by electronic bill?

- How do I pay my fees to RPRA by cheque?

- How do I pay my fees to RPRA by electronic data interchange (EDI)?

To note, Registry invoices are considered due on receipt. Invoices are in CAD funds and payments must be sent in CAD.

-

Account admins have access to all information within a registrant’s account. They can create and assign primary and secondary users’ access to the account, edit and submit reports, and pay fees. They are the only ones who can manage PROs. Account admins can view all activities users undertake. They will also be the recipient of emails from the Registry portal.

Primary users can only assign secondary users’ access to the account, edit and submit reports and pay fees.

Secondary users can only edit and submit reports and pay fees.

-

No. Section 68 subsection (3) of the Resource Recovery and Circular Economy Act states that “a person responsible for establishing and operating a collection system shall ensure that no charge is imposed at the time of the collection.”

-

Producers are obligated parties under the Resource Recovery and Circular Economy Act and are ultimately responsible for their data submitted through RPRA’s Registry. Producers can choose to contract with an external consultant to support their data submission, but third parties have limited permissions in the Registry as they are not regulated parties.

A producer can choose to assign a primary or secondary user profile in their Registry account to an external consultant. An external consultant may submit supply data reports and/or pay registry fees on the producer’s behalf.

External consultants cannot submit and/or sign registration, executive attestations, account admin changes or supply data adjustment documentation on behalf of a producer. External consultants cannot be account admins, nor can they manage a PRO within the Registry on behalf of a producer.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

Beginning October 1, 2021, producers of oil filters and non-refillable pressurized containers, or PROs acting on their behalf, are required to establish and operate a promotion and education program including the following:

- promote their collection and management services with respect to the type of HSP they are obligated for

- provide the following information on a website with respect to that type of HSP:

- the location of each HSP collection site established or operated by the producer that is accessible to the public and the types of HSP accepted at each site

- the location and date of each HSP collection event held by the producer and the types of HSP accepted at each event

- a description of the collection services provided by the producer, other than HSP collection sites and HSP collection events

- a description of how the producer manages that type of HSP after it is collected

- create promotional and educational materials with respect to that type of HSP that include the following:

- the website URL

- a description of how that type of HSP is collected and managed

- the producer shall make the promotional and educational materials available to retailers that supply that type of HSP, municipal governments and Indigenous communities, and shall solicit and consider feedback on how the promotional and educational materials can be improved

- the producer shall promote each HSP collection event for that type of HSP in the local municipality or territorial district where it will be held for at least one week prior to the date of the event using a combination of two or more forms of media, including but not limited to:

- local print publications

- local print media

- local radio

- local signage or social media

-

Beginning October 1, 2021, producers, or PROs acting on their behalf, of oil containers, antifreeze, pesticides, solvents, paints and coatings are required to establish and operate a promotion and education program including the following:

- Promote their collection and management services with respect to the type of HSP they are obligated for

- Provide the following information on a website with respect to that type of HSP:

- the location of each HSP collection site established or operated by the producer that is accessible to the public and the types of HSP accepted at each site

- the location and date of each HSP collection event held by the producer and the types of HSP accepted at each event

- a description of the collection services provided by the producer, other than HSP collection sites and HSP collection events

- a description of how the producer manages that type of HSP after it is collected

- Create promotional and educational materials with respect to that type of HSP that include the following:

- the address of the website

- a description of how that type of HSP is collected and managed

- The producer shall make the promotional and educational materials available to retailers that supply that type of HSP, municipal governments and Indigenous communities, and shall solicit and consider feedback on how the promotional and educational materials can be improved

- The producer shall promote each HSP collection event for that type of HSP in the local municipality or territorial district where it will be held for at least one week prior to the date of the event using a combination of two or more forms of media, including but not limited to:

- local print publications

- local print media

- local radio

- local signage or social media

-

Beginning October 1, 2021, producers are obligated to:

- establish and operate a promotion and education program starting in 2022

- provide information on their website about how consumers can use, share and properly dispose of fertilizer with local requirements

- create promotional and education materials that include:

- The website URL

- A description of how consumers can use, share and properly dispose of fertilizer

- solicit, consider feedback from, and make the promotional and education materials available to:

- Indigenous communities

- Municipal governments

- Retailers that supply fertilizers

- provide information to municipalities on innovative end-use options for fertilizers as an alternative to disposal

-

Beginning October 1, 2021, producers or PROs acting on their behalf, of mercury-containing devices are required to establish and operate a promotion and education program that:

- Promotes their collection and management services with respect to the type of HSP they are obligated for

- Provides the following information on a website with respect to that type of HSP:

- the presence of mercury in that type of HSP

- how to distinguish that type of HSP from similar products that do not contain mercury

- the hazards to human health and the environment related to mercury

- how consumers can properly dispose of that type of HSP

- a description of the collection services provided by the producer under this Regulation for that type of HSP

- a description of how the producer manages that type of HSP after it is collected under this Regulation

- Creates promotional and educational materials with respect to that type of HSP that include the following:

- the address of the website

- a description of how that type of HSP is collected and managed

- The producer shall make the promotional and educational materials available to retailers that supply that type of HSP or similar products that do not contain mercury, municipal governments, and Indigenous communities, and shall solicit and consider feedback from those retailers, municipal governments and Indigenous communities on how the promotional and educational materials can be improved

-

If you experience an issue when dropping off your recyclables at a location displayed on the map, click the ‘Report an Issue’ link on that specific location. This link will open a form for you to fill out about the issue. RPRA’s Compliance Team will review the issue reported and take action, as necessary.

You may report an issue to RPRA because the recycling location: - Charges you a fee to drop off materials accepted for recycling.

- *Refuses to accept your materials for recycling (only applicable if your materials are in line with the examples provided on the map).

- Displayed on the map does not actually exist.

- Is not open to the public or does not accept the materials during its business hours.

*Note: Recycling locations can request reasonable requirements when consumers drop off an item to ensure health and safety. For example, sites may require that used oil filters are dropped off in sealed containers, light tubes are taped together, etc.

-

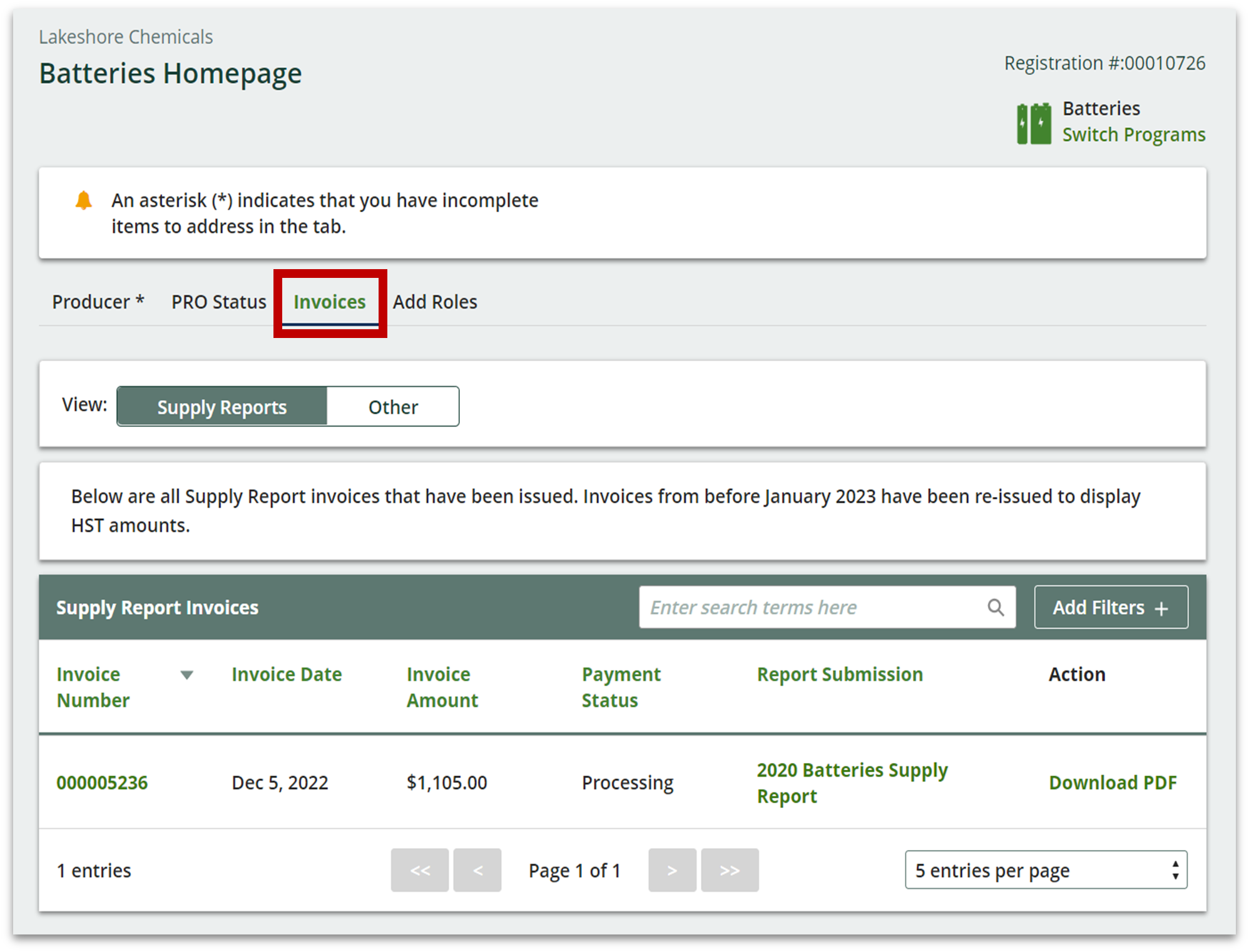

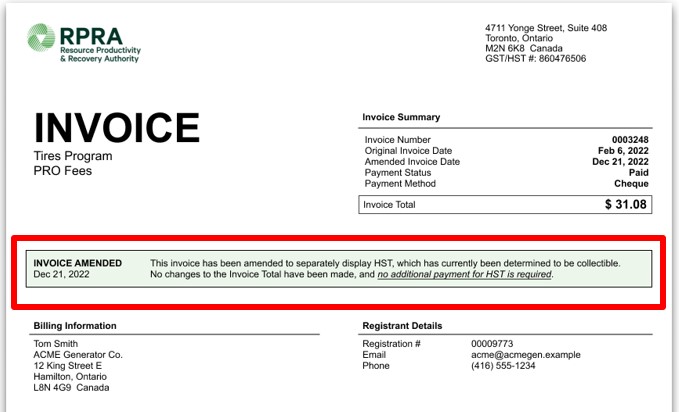

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. A banner will be displayed that highlights whether an invoice has been amended to include HST as well as the date the amended invoice was reissued. This will show on all invoices with an invoice date before December 21, 2022. See sample screenshot below.

-

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. See sample screenshot below.