Frequently Asked Questions

Results (8)

Click the question to read the answer.

-

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

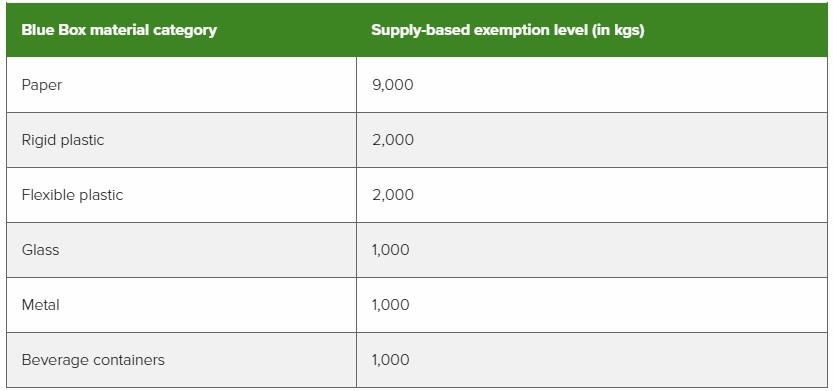

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.

-

There is an exemption in the Blue Box regulation for producers whose gross annual revenue generated from products and services in Ontario less than $2 million. The revenue that counts towards the exemption is revenue from products and services. Charitable donations are not revenue from products and services and therefore does not count towards the exemption. Revenue other than charitable donations that are recorded from registered charities will be considered revenue from products and services.

-

Yes, there are some key changes to the data reported to Stewardship Ontario and what needs to be reported under the new regulation, which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- There are fewer reporting categories than under the Stewardship Ontario program

- Certified compostable packaging and products now must be reported separately, but this category does not have management requirements

- There are only two deductions permitted under the Blue Box Regulation, and producers must report total supply and then report any weight to be deducted separately

- Exemptions are based on tonnage supply under each material category instead of a total supply weight threshold of less than 15 tonnes as in Stewardship Ontario’s program

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”; “Are there exemptions for Blue Box producers?“; “Are there any differences in Blue Box producer hierarchies between the current Stewardship Ontario program and the new Blue Box Regulation?”; and “Are there are any differences in obligated Blue Box materials between the current Stewardship Ontario program and the new Blue Box Regulation?”

-

A producer’s management requirement is how much Blue Box material they must ensure is collected and processed into recovered resources each year. Management requirements are calculated based on what they supplied into Ontario one year prior and the resource recovery percentage as set in the regulation. A producer’s management requirement is calculated separately for each Blue Box material category (beverage container, glass, flexible plastic, rigid plastic, metal and paper).

Some producer are exempt from having a management requirement based on their supply data, for more information on exemptions see the FAQ Are there exemptions for Blue Box producers? A producer that does not have a management requirement does not have any collection, management or promotion and education obligations.

A producer with a management requirement must also provide collection and promotion and education services in Ontario. Most producers will contract the services of a producer responsibility organization (PRO) to meet their collection, management and promotion and education obligations.

To view your management requirement(s), log into your registry account, download a copy of your Blue Box Supply Report and review the section with your minimum management requirements. Management requirement for a given year are determine by supply data from two years prior. For example, 2023 management requirements were based on 2021 supply data (submitted in producers’ 2022 Supply Report).

Unsure if you are a Blue Box producer? See our FAQs Am I a producer of Blue Box product packaging? And Am I a producer of paper products and packaging-like products?

-

A newspaper producer is a person who supplies newspapers to consumers in Ontario. For the purpose of the Blue Box Regulation, newspapers include broadsheet, tabloid or free newspaper. For further information, see the FAQ: What is a newspaper?

Note that a producer of supplemental advertisements or flyers that are supplied with a newspaper would not be considered a newspaper producer as they do not supply the actual broadsheet, tabloid, or free newspaper. This producer cannot use the newspaper exemption percentage to be exempt from Blue Box collection and management requirements. See the FAQ: Are there exemptions for Blue Box producers?

-

There is an exemption in the Blue Box Regulation for producers whose gross annual revenue generated from products and services in Ontario is less than $2 million. The following sources are excluded for the purpose of determining revenue:

- Government tax revenue

- Property taxes

- General assistance funding received under the Ontario Municipal Partnership Fund

- Payments in lieu of taxes

- Canadian or Ontarian government grants available to municipalities with the intent of investing in public infrastructure

-

The Manage PRO option will appear on the dashboard below your list of supply data reports when your supply data reporting is complete and if you have management requirements. If your supply data reporting is below the supply exemption threshold you will not have management requirements, and therefore not need to assign a PRO to assist with your obligations.

Also note that Account Admin are the only portal users that can manage your PRO’s responsibility, so this widget is not viewable to primary and secondary users.

-

No, where a producer is exempt, the regulatory obligations do not become the responsibility of the organization that is next in the producer hierarchy. The exempt producer remains the “producer” for those materials; they are just exempt from certain requirements under the regulation as set out in the relevant provisions providing for the exemption. This is the case in all RRCEA regulations.