Frequently Asked Questions

FAQ filtered results:

-

Program: BatteriesTopic: General , Registry , Reporting

Registry Resources such as Registry Procedures, Compliance Bulletins, and Reporting Guides can be found on our Batteries Registry Resources webpage.

-

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , Hazardous Waste , ITT/AV , Lighting , TiresTopic: General , Registry

RPRA has developed a library of resources to support Registry users navigate the online system and meet their regulatory requirements. RPRA consistently adds to this pool of resources based on upcoming requirements, emerging needs, and questions we receive from stakeholders.

View Registry resources for each program:

-

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , Hazardous Waste , ITT/AV , Lighting , TiresTopic: Registry , RPRA Program and Registry Fees

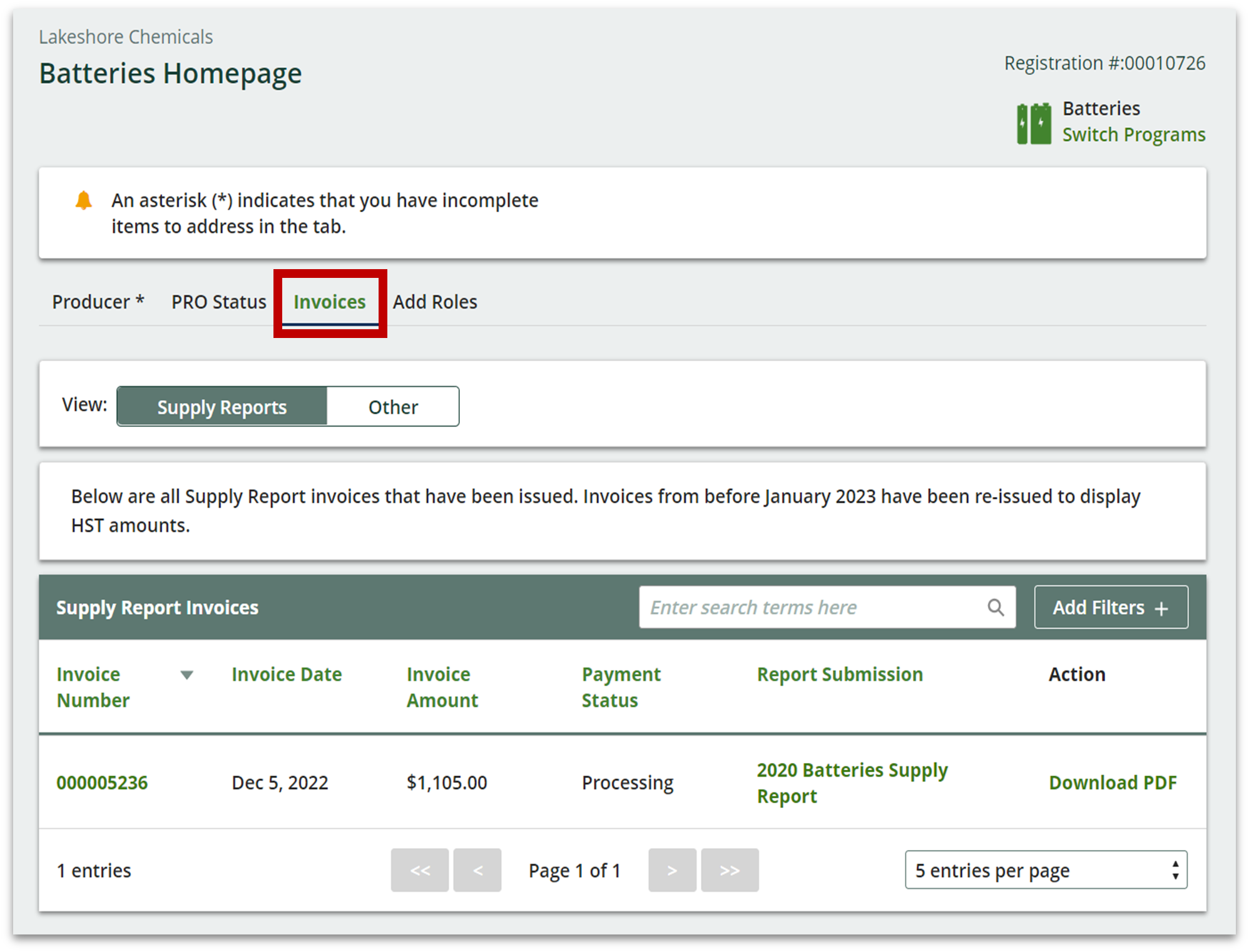

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. See sample screenshot below.

-

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , ITT/AV , Lighting , TiresTopic: RPRA Program and Registry Fees

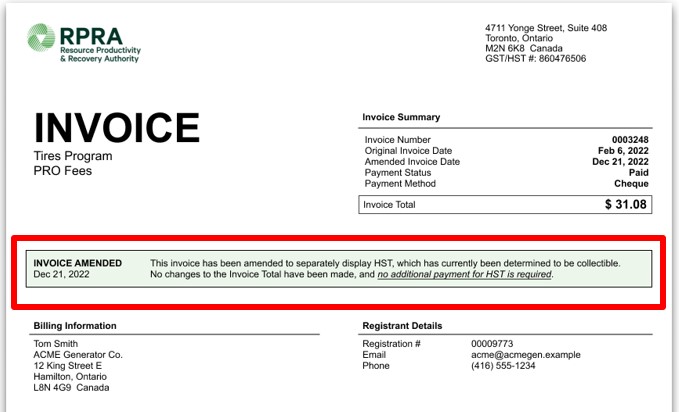

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. A banner will be displayed that highlights whether an invoice has been amended to include HST as well as the date the amended invoice was reissued. This will show on all invoices with an invoice date before December 21, 2022. See sample screenshot below.

-

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , Hazardous Waste , ITT/AV , Lighting , TiresTopic: RPRA Program and Registry Fees

Starting January 1, 2023, RPRA will collect 13% HST on all fees at the time of fee payment.

This decision is based on a ruling RPRA received from the CRA in which HST must be charged on its fees under the Resource Recovery and Circular Economy Act, 2016 (RRCEA). RPRA has determined that this ruling applies to all RRCEA producer responsibility programs and the Excess Soil and Hazardous Waste programs.

On December 22, 2022, RPRA will reissue invoices that were issued prior to January 1, 2023, amended to indicate that 13% HST was paid. From December 22 onwards, registrants will be able to access the amended invoices in their Registry accounts under a new tab labelled “Invoices”. The amended invoice will show an HST amount as well as the date the amended invoice was reissued.

Important notes:

- On the amended invoices there have been no changes to the Invoice Total and registrants will not be required to pay any additional monies to RPRA for past invoices.

- Registrants may be able to claim input tax credits for the HST collected on RPRA fees, for both the amended invoices and new invoices issued January 1, 2023, onwards. However, RPRA is not in a position to provide tax advice and suggests you consult your internal or external accountants to seek their counsel.

- All new invoices issued effective January 1, 2023, will contain appropriate information identifying the amount of the HST and other relevant details. These invoices will also be displayed under the “Invoices” tab in a registrants’ Registry account.

-

Program: Batteries , Blue Box , Hazardous and Special Products , ITT/AV , Lighting , TiresTopic: Producer , Registry

Account admins have access to all information within a registrant’s account. They can create and assign primary and secondary users’ access to the account, edit and submit reports, and pay fees. They are the only ones who can manage PROs. Account admins can view all activities users undertake. They will also be the recipient of emails from the Registry portal.

Primary users can only assign secondary users’ access to the account, edit and submit reports and pay fees.

Secondary users can only edit and submit reports and pay fees.

-

Program: Batteries , Blue Box , Hazardous and Special Products , ITT/AV , LightingTopic: PRO , Producer , Registry

The Manage PRO option will appear on the dashboard below your list of supply data reports when your supply data reporting is complete and if you have management requirements. If your supply data reporting is below the supply exemption threshold you will not have management requirements, and therefore not need to assign a PRO to assist with your obligations.

Also note that Account Admin are the only portal users that can manage your PRO’s responsibility, so this widget is not viewable to primary and secondary users.

-

Program: Batteries , Blue Box , Hazardous and Special Products , ITT/AV , Lighting , TiresTopic: Producer

A brand is any mark, word, name, symbol, design, device or graphical element, or a combination thereof, including a registered or unregistered trademark, which identifies a product and distinguishes it from other products.

A brand holder is a person who owns or licenses a brand or otherwise has rights to market a product under the brand.

Note:

- If there are two or more brand holders, the producer most directly connected to the production of the material is the brand holder.

- If more than one material produced by different brand holders are marketed as a single package, the producer who is more directly connected to the primary product in the package is the brand holder.

-

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , Hazardous Waste , ITT/AV , Lighting , TiresTopic: Producer , Registration , Registry , Reporting , RPRA Program and Registry Fees

If you select electronic data interchange (EDI) as your method of payment, this is an electronic payment through your bank, also commonly known as EFT or ACH.

Follow these steps to complete your payment:

- Submit your payment using RPRA’s banking information provided on your invoice.

- Be sure to reference your Invoice Number when you submit this payment to your bank so that we will be able to identify your payment.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

Program: Batteries , Blue Box , Excess Soil , Hazardous and Special Products , Hazardous Waste , ITT/AV , Lighting , TiresTopic: Producer , Registration , Registry , Reporting , RPRA Program and Registry Fees

If you select cheque as your method of payment, follow these steps to complete your payment:

- Make your cheque payable to “Resource Productivity and Recovery Authority”

- Enter your Invoice Number on the memo line of the cheque

- Please send your cheque to*:

-

- Resource Productivity Recovery Authority

- PO Box 46114, STN A

- Toronto, ON

- M5W 4K9

*As of January 20, 2023, the address for mailing cheques to RPRA has been revised. Please update your records and send cheques to the above address going forward.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 2-4 weeks for your payment to be reflected in your Registry account once you have mailed your cheque due to mail and cheque processing times.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.