Posted on January 19, 2021 by Michelle Hoover -

You are an information technology, telecommunications, audio-visual (ITT/AV) producer if you market ITT/AV into Ontario and:

- Are the brand holder of the EEE and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import EEE from outside of Ontario;

- If there is no resident importer, have residency in Ontario and market directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, do not have residency in Ontario and market directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Electrical and Electronic Equipment Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

Posted on January 19, 2021 by Michelle Hoover -

As of July 1, 2020, producers are required to establish and operate a collection system for batteries that meets the accessibility requirements in the regulation. Producers must ensure that all batteries collected are managed regardless of their minimum management requirements.

For producers to meet their obligations, they have the choice of establishing and operating their own collection and management system or working with one or more producer responsibility organizations (PROs) that are registered with the Authority.

Please contact the Compliance Team at 833-600-0530 or registry@rpra.ca to discuss other requirements under the Batteries Regulation.

Posted on January 19, 2021 by Esther Filer -

A battery producer qualifies for an exemption if their average weight of supply for that calendar year is:

- Less than or equal to 2,500 kg of rechargeable batteries, or

- Less than or equal to 5,000 kg of primary batteries.

Average supply weight is determined using the following formula:

Average weight of rechargeable batteries = (Y3 + Y4 + Y5) / 3

- Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Average weight of primary batteries = (Y2 + Y3 + Y4) / 3

- Eg. 2025 average weight of supply = (2023 + 2022 + 2021) / 3

Battery producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA.

- Establishing a collection and management system.

- Meeting management requirements.

- Promotion and education requirements.

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of batteries (by category) supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

Also see our FAQ: ‘How are battery producers’ minimum management requirements determined?‘

Posted on January 19, 2021 by Michelle Hoover -

Yes. You are still required to register with the Authority Registry even if you already have an existing account.

Posted on January 19, 2021 by Michelle Hoover -

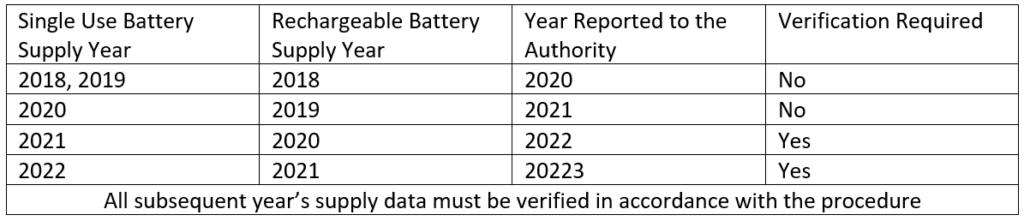

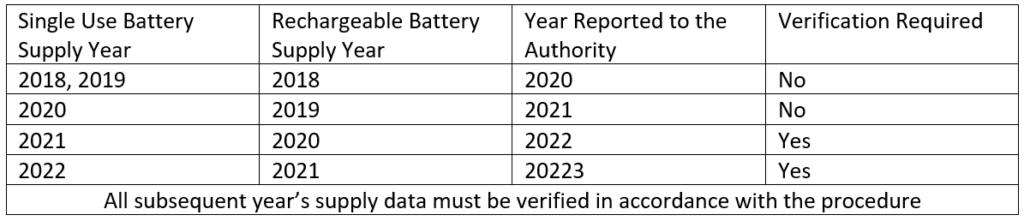

There is no audit verification requirement for the first two supply data reports submitted to the Authority. Therefore, data submitted for single-use batteries supplied in 2018, 2019, and 2020, as well as rechargeable batteries supplied in 2018 and 2019 will not have to be verified in accordance with the Registry Procedure – Verification and Audit.

As shown in the table below, under section 15 of the Battery Regulation, the first supply data report for which there are audit and verification requirements will be submitted in 2022. This supply data report is for single-use batteries supplied in 2021 and rechargeable batteries supplied in 2020.

Posted on January 19, 2021 by Esther Filer -

Producers are required to report single-use (primary) and rechargeable batteries that:

- Weigh 5 kg or less, and

- Are sold separately from products.

Examples include button cells, AA, AAA, C, D, 9V, lantern batteries, small, sealed lead acid (SLA) batteries, and replacement batteries for products such as drills, cell phones, and laptops.

Batteries that do not need to be reported are those that:

- Are sold with or in products (e.g., batteries included with cordless power tools, cell phones, laptops, toys, vapes, fire alarms)

- Weigh over 5 kg (e.g., car batteries, forklift batteries, stationary batteries)

Producers who wish to confirm if they are exempt because the type(s) of batteries they supply do not need to be reported should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

Posted on January 19, 2021 by RPRA Communications -

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

Posted on September 8, 2020 by Uju Ani -

1. You will need the following information to create a Registry account:

- CRA Business Number (BN)

- Legal Business Name

- Business address and phone number

- Address of where you work (if different from the main office)

- Contact information for your additional users

2. You will need to provide the address and phone number for each site where you retread and/or process tires.

3. You will need to identify which of the following tire categories are applicable to your business:

- Large tires (over 700 kg)

- Other tires (700 kg or less)

4. If you are a processor, you will also need to identify which of the following materials are applicable to your process:

- Crumb rubber

- Tire derived mulch

- Tire derived aggregate

- Tire derived rubber strips and chunks

- Fluff/fibre

- Tire derived steel/metal

- Other

If your business performs multiple roles (e.g., hauler and processor), you only need to create one registry account and identify the additional roles. If you are a producer, use your producer account to add roles.

Posted on July 17, 2020 by Michelle Hoover -

For regulatory purposes, we need to know your legal name — the name you are incorporated under. We also need to know your business operating name if it is different from your legal business name to add to our published list of registrants. The list of registrants will be available on our website to allow registrants to interact with one another and to provide information to the public.

For example, if you are a registered collector and your legal name is 123456789 Ontario Ltd. and your business operating name is “Jack’s Garage,” a member of the public looking for a place to drop off used tires will need to know the name you are operating under to identify your location.

Posted on July 17, 2020 by Michelle Hoover -

To create a Registry account with the Authority, you will need to provide:

- CRA Business Number (BN)

- Legal Business Name

- Business address and phone number

- Address of where you work (if different from the main office)

- Contact information for your billing contact (this may also be added later)

Posted on July 17, 2020 by Monica Ahmed -

You will have to meet the registration requirements for every category that applies to you.

Posted on July 17, 2020 by Michelle Hoover -

Resident in Ontario means a person having a permanent establishment in Ontario within the meaning of the Corporations Tax Act. A permanent establishment is usually a fixed place of business such as an office, factory, branch, warehouse, workshop, etc. In some cases, a corporation will be deemed to operate a permanent establishment in Ontario. These include cases where:

- The corporation produced, grew, mined, created, manufactured, fabricated, improved, packed, preserved or constructed anything in the province, in whole or in part;

- The corporation carries on business through an employee or agent in the province who has general authority to contract for the corporation; or

- The corporation carries on business through an employee or agent in the province who has a stock of merchandise owned by the corporation from which they regularly fill orders that they receive.

- A corporation will also have a permanent establishment in Ontario if it uses substantial machinery or equipment in the province, or if it is has a permanent establishment elsewhere in Canada and owns land in the province.

For more details about what constitutes a permanent establishment, see the definition of “permanent establishment” in the Corporations Tax Act.

Posted on July 17, 2020 by Monica Ahmed -

No. If a municipality has a private company operating a site on their behalf, the company is not required to register the municipally-owned sites as long as the tires are picked up by a registered hauler and delivered to a registered processor or retreader.

If the private company owns or operates collection sites that are not owned by a municipality, it is required to register and report its non-municipally-owned sites.

To ensure tires continue to be picked up from your sites, you will need to make sure those sites are included in the collection systems established by tire producers or producer responsibility organizations (PROs). Since most producers will work with PROs to establish their collection systems, municipalities should contact a registered PRO.

Visit our webpage about PROs for more information.