Frequently Asked Questions

Results (15)

Click the question to read the answer.

-

Producers can reference the chart below to determine if they are a small, large or exempt HSP producer.

Producer categories use the average weight of material (in tonnes) supplied in Ontario in the previous calendar year.

Type of HSP Exempt (Less than <) Small Producer Large Producer (Equal to or greater than >) Oil Filters 3.5 ⟷ 100 Non-refillable Pressurized Containers 3 ⟷ 100 Antifreeze 20 ⟷ 300 Oil Containers 2 ⟷ 55 Solvents 3 ⟷ 70 Paints and Coatings 10 ⟷ 1,000 Pesticides 1 ⟷ 9 Refillable Pressurized Containers N/A Mercury-containing Devices Fertilizers Propane Containers (refillable) Note that ‘⟷’ indicates a value greater than ‘Exempt’ but less than ‘Large Producer’ threshold.

Average supply weight is determined using the following formula:

Average weight of HSP supply = (Y1 + Y2 + Y3) / 3

E.g. 2025 average weight of supply = (2024 + 2023 + 2022) / 3

-

You may be required to provide a verification report for the annual tire supply report. You will be required to provide verification if you meet the definition of a medium or large producer. Small producers will not be required to submit a verification report, however a percentage of small producers selected annually by the Registrar will be subject to an inspection. If exceptions are identified during the inspection, a comprehensive review may be carried out. For more information on this, read Tires Registry Procedure – Audit.

-

For the purposes of battery supply reporting verification:

- “Large single-use battery producer” means a battery producer with a minimum management requirement greater than or equal to 50,000 kilograms of single-use batteries in the previous calendar year.

- “Large rechargeable battery producer” means a battery producer with a minimum management requirement greater than or equal to 5,000 kilograms of rechargeable batteries in the previous calendar year.

To view your management requirements, log into your Registry account, download a copy of your previous year’s Supply Report and review the section with your minimum management requirements for your reporting year.

Beginning in 2023, only large producers are required to submit a Supply Data Verification Report. Small producers will no longer be required to submit a verification report but will be subject to inspections. Review the Registry Procedure – Verification and Audit for more information.

-

For the purposes of ITT/AV supply reporting verification:

- “Large ITT/AV producer” means an ITT/AV producer with a minimum management requirement greater than or equal to 200,000 kilograms in the previous calendar year.

To view your management requirements, log into your Registry account, download a copy of your previous year’s Supply Report and review the section with your minimum management requirements for your reporting year.

Beginning in 2023, only large producers are required to submit a Supply Data Verification Report. Small producers will no longer be required to submit a verification report but will be subject to inspections. Review the Registry Procedure – Verification and Audit for more information.

-

Each Blue Box producer is required to report the Blue Box packaging they add to a product.

For example: a college or university bookstore plans to ship a book to a consumer in Ontario. The bookstore staff packages the book in a small box with the packing slip and inserts the box into a plastic mailer supplied by the delivery service with the required label affixed.

In this scenario, the college or university is the obligated producer of the small box and packing slip and must report these materials in their supply report, whereas the delivery company is the obligated producer of the plastic mailer and label and must report these materials in their supply report.

-

An HSP producer qualifies for an exemption if their average weight of supply for the previous calendar year is less than or equal to the weight specified in the chart below:

Exempt (Less than <) Oil Filters 3.5 Non-refillable Pressurized Containers 3 Antifreeze 20 Oil Containers 2 Solvents 3 Paints and Coatings 10 Pesticides 1 Refillable Pressurized Containers N/A Mercury-containing Devices Fertilizers Propane Containers (refillable) See our FAQ “Am I a small, large, or exempt HSP producer?” to determine how to calculate if you are an exempt HSP producer.

HSP producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of HSP supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 1-833-600-0530 or registry@rpra.ca.

-

As of October 1, 2021, producers are required to establish and operate a collection system that meets the accessibility requirements in the regulation. Producers must ensure that all HSP collected is managed regardless of what their minimum management requirements are.

Producers have the choice of establishing and operating their own collection and management systems or working with one or more producer responsibility organizations (PROs) registered with RPRA to meet their obligations.

Large producers have an additional requirement to provide call-in collection services. Learn more.

Please contact the Compliance Team at 1-833-600-0530 or registry@rpra.ca to discuss other requirements under the HSP Regulation.

See our FAQ to understand “Am I a small, large or exempt HSP producer?“. For more guidance, read the Hazardous and Special Products Collection Systems Compliance Bulletin.

-

Collection sites are required to accept used tires that are of similar rim size and weight as the new tires (or tires on new vehicles) that they sell. Use the Authority’s Find a Collection Site map to find a drop-off location and call ahead to confirm that the collection site will accept your tires.

-

Tire collection sites are established to facilitate the responsible recycling and management of used tires. The types of tires accepted at these sites include, but are not limited to:

Examples of Accepted Tires:

- Automobile tires (cars, SUVs, light-duty trucks)

- Motorcycle tires

- Motor assisted bicycle tires (e.g., mopeds, non-kick scooters)

- Tractor tires

- Tires on industrial and agricultural vehicles and equipment

- Transport truck tires

- Trailer tires (e.g., boat trailers, RVs)

- All-terrain vehicle (ATV) tires

- Riding lawn mower tires

- Aircraft tires (if not supplied on an aircraft)

- Snow blower tires

- Small tires (1 kg to <5 kg), such as:

- Wheelbarrow tires

- Dolly tires

Examples of Tires That Are Not Accepted:

- Bicycle tires (muscle-powered)

- Stroller and kick scooter tires (non-motorized)

- Power-assisted bicycle tires (e.g., electric bicycles)

- Personal mobility device tires (e.g., wheelchairs, medical scooters)

Tires can be dropped off on or off the rim. Collection sites must accept tires on rims.

-

Producers are required to report single-use (primary) and rechargeable batteries that:

- Weigh 5 kg or less, and

- Are sold separately from products.

Examples include button cells, AA, AAA, C, D, 9V, lantern batteries, small, sealed lead acid (SLA) batteries, and replacement batteries for products such as drills, cell phones, and laptops.

Batteries that do not need to be reported are those that:

- Are sold with or in products (e.g., batteries included with cordless power tools, cell phones, laptops, toys, vapes, fire alarms)

- Weigh over 5 kg (e.g., car batteries, forklift batteries, stationary batteries)

Producers who wish to confirm if they are exempt because the type(s) of batteries they supply do not need to be reported should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

-

The Short-form Datacall is a streamlined version of the Long-form Datacall developed for smaller municipalities. The Short-form Datacall has Section 3.3, and all of Section 5 removed. This means that eligible municipalities do not have to report any Non-Blue Box information. The Short-form Datacall still collects the necessary data for calculating the municipal program’s Blue Box funding (i.e. if a municipal program elects to complete the Short-form, their Blue Box funding will not be affected). Since Non-Blue Box sections are removed, the Authority will not calculate a diversion rate for municipal programs who report into the Short-form Datacall. If a municipal program would still like to receive a diversion rate, then they must report into the standard Datacall.

Through consultation with municipal programs and the Municipal Industry Program Committee (MIPC), a committee of the Authority’s, it was determined that municipal programs with populations of 30,000 or less may be eligible for the Short-form Datacall.

-

White goods, including small appliances, are to be reported in the WEEE tab of the Non-Blue Box Contracts/Services Section in Section 3.3.

Scrap metal, not including white goods, are to be reported in the Non-Blue Box Services tab – Other Recyclables sub-tab.

-

As per page 10 of the Datacall User Guide, all IC&I tonnes must be removed from reported tonnages and from reported costs. Page 10 of the User Guide specifies that business improvement areas (BIA), are to be reported as IC&I; however, apartments above these businesses can be included as residential.

We advise to keep a record of how the allocation was calculated. If you would like additional assistance with calculating the IC&I rate on your BIA, contact datacall@rpra.ca.

-

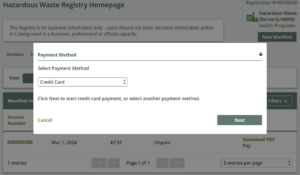

When your HWP invoice total is $500 or less, the default method for paying that invoice is automatically set to credit card. This feature aims to simplify transactions for smaller amounts and ensure a smoother payment process.

As seen in the image below, if your HWP invoice is $500 or less, the payment method will automatically be set to credit card. Once you click next, you will input your credit card details, then click pay. Your payment will process automatically. If an alternate payment method is required, please contact us.

Note: As of April 2024, all programs except for HWP, have the option to select from various payment methods, including bank withdrawal, credit card, electronic data interchange, electronic bill payment, and cheque, regardless of the invoice amount.

If your company is unable to pay an invoice by credit card, please contact RPRA’s Compliance Team at registry@rpra.ca or (833) 600-0530.

-

Beginning in 2024, only large producers are required to submit a Supply Data Verification Report. Small producers will no longer be required to submit a verification report but will be subject to inspections. Review the Hazardous and Special Products Registry Procedure – Verification and Audit Procedure for more information.

For the purposes of HSP supply reporting verification:

“Large HSP producer” means an HSP producer whose average supply in the previous calendar year meets the large producer threshold outlined in the chart below:

Type of HSP Large producer’s average weight of supply (tonnes) Oil Filters 100 or more Non-refillable Pressurized Containers 100 or more Antifreeze 300 or more Oil Containers 55 or more Solvents 70 or more Paints and Coatings 1,000 or more Pesticides 9 or more Refillable Pressurized Containers N/A Mercury-containing Devices Fertilizers Propane Containers (refillable)