Frequently Asked Questions

Results (30)

Click the question to read the answer.

-

When paying fees to RPRA, you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI; also commonly known as ACH or EFT)

- Electronic bill payment

- Cheque

For instructions on how to submit payment by the method you chose, read one of the following FAQs:

- How do I pay my fees to RPRA by credit card?

- How do I pay my fees to RPRA by bank withdrawal (pre-authorized debit)?

- How do I pay my fees to RPRA by electronic bill?

- How do I pay my fees to RPRA by cheque?

- How do I pay my fees to RPRA by electronic data interchange (EDI)?

To note, Registry invoices are considered due on receipt. Invoices are in CAD funds and payments must be sent in CAD.

-

As required under the regulation, Project Leaders, Owners and Site Operators are required to use the Excess Soil Registry to file notices for certain Project Areas, Reuse Sites, and Residential Development Soil Depot sites where Excess Soil is generated, transported, temporarily placed, and deposited.

Project Leaders, Owners and Site Operators can also assign an Authorized Person to file a notice and pay fees in the Registry on their behalf.

Role definitions

Project Leader

In O. Reg. 406/19, the Project Leader means, in respect of a project, the person or persons who are ultimately responsible for making decisions relating to the planning and implementation of the project.

The Project Leader is responsible for ensuring that a Project Area Notice is filed if required. They must always complete and sign the required declarations that are a component of the notice being filed and pay Registry fees.

Owner

A person who owns the land, with an interest upon whose credit, behalf, privity or direct benefit an improvement is made to the premises.

For a Reuse Site or a Residential Development Soil Depot, an Operator may complete all aspects of the relevant notice filing in the Registry.

Operator

A person who has the charge, management, or control of a site. An Operator may be an owner of a property, lease a property or be contracted to operate a Project Area Site, Reuse Site or Residential Development Soil Depot.

For a Reuse Site or a Residential Development Soil Depot, an Operator may complete all aspects of the relevant notice filing in the Registry.

Authorized Person

A person who is authorized by the Project Leader, Owner, or Operator of a site, to complete a notice filing and pay fees on their behalf.

The Authorized Person can initiate a notice in the Registry if permitted to by the Project Leader, Owner, or Operator of a site, and can complete all required notice information and pay applicable fees on their behalf.

Qualified person (QP)

QPs under the regulation have the same meaning as section 5 and 6 of Ontario Regulation 153/04 (O. Reg. 153/04).

Section 5 of O. Reg. 153/04 defines a Qualified Person as professional engineers and geoscientists – these are the persons who may oversee or conduct environmental site assessments or complete certifications in a Record of Site Condition. Section 6 of O. Reg. 153/04 sets out the requirements for Qualified Persons who conduct or oversee a risk assessment.

A QP may be designated as an Authorized Person by the Project Leader or by an Owner/Operator to file a notice to the Excess Soil Registry on their behalf.

-

The regulation requires notices to be filed for three types of activities:

1. Notice filings for excess soil from Project Areas that can be made by a Project Leader or Authorized Person and may require retaining a Qualified Person. These notices will be required starting January 1st, 2022, before soil that will become excess soil is removed from the Project Area. There will be two fillings for each notice:

- An initial filing before the soil is removed, which will require the following information to be provided:

-

- a description of the project and Project Area including the location of each property within the project area

- the contact information of the Project Leader, Operator or Authorized Person and the person responsible for transportation, and if applicable, the qualified person

- an estimated amount of the soil that will be generated broken down by quality standard

- a list of substances/materials that were added to the soil

- the location of temporary or final sites that the soil will be transported to

- details of the Reuse Site(s) where the soil will be moved to

- information on any peer review or certification processes if applicable

- and a declaration by the Project Leader.

Exceptions

The Project Leader, Operator or Authorized Person may file a notice after soil that will become excess soil has been removed from the project area if:

- conducting the required sampling and analysis at the project area is impractical

- the soil is removed from the project area and delivered to a temporary site to conduct the required sampling, and

- the Project Leader, Operator or Authorized Person makes sure the required sampling is conducted as soon as the soil is delivered to the temporary site

If soil is removed before a notice is filed in the Registry, the Project Leader, Operator, or Authorized Person is required to ensure that the notice is filed in the Registry before the soil that has become excess soil is transported from the temporary site to the final site.

More information about when this type of notice filing is not required can be found under Schedule 2 of the regulation.

The Project Leader or Authorized Person is required to update notice filings that are no longer complete or accurate within 30 days after the day the person becomes aware that the information is no longer complete or accurate.

2. A final notice within 30 days after excess soil has been removed from the Project Area or temporary site which will require the following information:

- the amount of excess soil removed from the Project Area that was deposited at: a class 1 soil management site, a class 2 soil management site, a reuse site, a local waste transfer facility, and a landfilling site or dump

- the date on which the last load of excess soil was removed from the project area or temporary site

- a declaration by the Project Leader

2. Notice filings for Residential Development Soil Depots can be made by an Owner, Operator, or Authorized Person. This notice will be required before excess soil is deposited on a residential development soil depot site if the depot commences operation on or after January 1, 2022, or if the depot was already in operation when the requirement to file a notice comes into effect, the notice should be filed ahead of January 1, 2022.

The Owner or Operator of the Residential Development Soil Depot must ensure that the quality of the excess soil accepted and managed at the depot meets the applicable Excess Soil Quality Standards set out in the regulation. There will be two filings for each notice:

- An initial filing before the soil is received, which will require the following information to be provided:

- the site location

- the contact information of the Site Owner and Operator

- the project commencement date

- the estimated amount of soil (including inventory on-site)

- the site instrument identification

- and a declaration by the Site Owner or Operator.

- A final filling within 90 days of the depot closing indicating the date when the depot ceased operations, and a declaration by the Site Owner or Operator.

3. Notice filings for Reuse Sites can be made by a Site Owner, Operator, or an Authorized Person. These will be required starting January 1st, 2022, and apply to a Reuse Site that expects at least 10,000 m3 of excess soil to be deposited after January 1st, 2022 (including Reuse Sites that were in operation before that date). There will be two filings for each notice:

- An initial filing before the excess soil is deposited, which will require the following information to be provided:

- the site location/property type

- the contact information of the Site Owner and Operator

- a description of the undertaking

- the applicable excess soil quality standards for the site

- the estimated amount of soil by quality standard

- the estimated dates when the first and last soil load will be deposited

- the site instrument identification

- and a declaration by the Site Owner or Operator.

- A final notice filing within 30 days after the final load of excess soil has been deposited at the Reuse Site which will require the following information:

- confirmation that all excess soil that will be reused for a beneficial purpose has been deposited at the reuse site

- the total amount of excess soil that was deposited

- the date the final load of excess soil was deposited

- and a declaration by the owner or operator.

The Site Owner or Operator is required to update notice filings that are no longer complete or accurate within 30 days after the day the person becomes aware that the information is no longer complete or accurate.

Exemptions:

Reuse Sites that are part of infrastructure projects are not required to file notices.

-

Registry fees cover the Authority’s costs to build, deploy and maintain the Registry, and to provide ongoing support to Registry users. As an administrative delegated authority of the Government of Ontario, the Authority does not receive any government funding and funds its operations through fees charged to regulated parties. The Authority operates on a cost-recovery basis.

-

Fees are charged upon completion of the initial notice filing, whether it’s a Project Area Notice, Reuse Site Notice, or Residential Development Soil Depot Notice. For Project Area and Reuse Area Notices, there may be a fee charged at the final filing (close-out), depending on whether the volume of soil generated or accepted has increased from what was reported in the initial notice filing.

-

Fees associated with project area notices are calculated at a variable rate based on the volume of soil being moved. Flat fees will be applied to Project Area Notices for soil volumes below and above certain thresholds.

Fees associated with Reuse Site Notices are tiered, with increasing flat fees applied according to the volume of soil being accepted at the reuse site.

There is one flat fee associated with Residential Soil Depot Notices.

Fees will be consulted upon annually as required by the RRCEA.

-

Excess Soil is soil that has been dug up, typically during construction and excavation activities. It must be moved off-site because it can’t or won’t be reused at the development site.

-

In December 2019, the Ministry of the Environment, Conservation and Parks (the ministry) released a regulation under the Environmental Protection Act, titled “On-Site and Excess Soil Management” (the regulation) to support improved management of Excess Soil.

This regulation supports proper management of Excess Soils, ensuring valuable resources don’t go to waste and to provide clear rules on managing and reusing Excess Soil. Risk-based standards referenced by this regulation help to facilitate local beneficial reuse promote reduction of greenhouse gas emissions from soil transportation, while ensuring strong protection of human health and the environment. The risk-based standards can be found in the document adopted by reference under this regulation, Rules for Soil Management and Excess Soil Quality Standards.

-

The ministry is responsible for policy and programs related to Excess Soil and will conduct compliance and enforcement activities under the regulation. More information about the regulation is available on the ministry’s Excess Soil webpage.

-

For questions related to the regulation, please email the ministry at MECP.LandPolicy@ontario.ca

For site-specific questions related to Excess Soil movement, please contact the ministry’s local district office. To find an office, please use the District Locator.

-

The Excess Soil Registry is a record of Excess Soil generation and movement established and maintained by the Authority to:

- enable regulated persons to comply with registration and notice filing requirements outlined in the regulation;

- enable the ministry access to notice filings and associated data; and

- enable public access to the information contained in notice filings.

Project Leaders, Reuse Site Owners or Operators, and Residential Development Soil Depot Operators, as defined in the Excess Soil Regulation, are required to ensure notices are filed to the Excess Soil Registry for certain Project Areas (where Excess Soil is generated), Reuse Sites (where Excess Soil is deposited), and Residential Development Soil Depot sites (where Excess Soil is temporarily placed).

-

Please direct all questions related to the Registry to RPRA via registry@rpra.ca

-

No, users that filed notices in the Excess Soil Registry and paid the associated Registry fees before the temporary suspension came into effect on April 21, 2022, were complying with the necessary requirements of the regulation. Notices filed before the pause will continue to be recognized after January 1, 2023. No refunds will be issued.

-

Projects initiated in 2022 that have continued into 2023 and meet the requirements to file a notice will be required to file as of January 1, 2023. This means that if your project began in 2022 and you are still moving excess soil as of January 1, 2023, you may be subject to the filing requirements.

Read our FAQ to see “Who need to file notices?“

-

If you select credit card as your method of payment, this method of payment is done through your Registry account.

Follow these steps to complete your payment:

- When you are in the payment method section in the Registry, select credit card as your preferred method.

- Input your credit card details.

- Click submit and payment will process automatically.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- Once your transaction has been approved, your payment will be reflected in your Registry account immediately.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select bank withdrawal as your method of payment, this authorizes the Resource Productivity and Recovery Authority to make a one-time withdrawal for the Registry invoice payment from the account you provided.

Bank Withdrawal – Important Terms:

- You have authorized RPRA to make one-time debits from your account. RPRA will obtain your authorization before any additional one-time or sporadic withdrawal is debited from your account. You have agreed that this confirmation may be provided at least three (3) calendar days before the first payment is withdrawn from your account. You have waived any and all requirements for pre-notification of the account being debited.

- Your payments are being made on behalf of a business.

- Your agreement may be cancelled provided notice is received thirty (30) days before the next withdrawal. If any of the above details are incorrect, please contact us immediately at the contact information below. If the details are correct, you do not need to do anything further and your Pre-Authorized Debits (PAD) will be processed. You have certain recourse rights if any debit does not comply with these terms. For example, you have the right to receive a reimbursement for any PAD that is not authorized or is not consistent with this PAD Agreement. To obtain more information on your recourse rights, contact your financial institution or visit www.payments.ca.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for the involved banks to process your payment.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select electronic bill payment as your method of payment, this method of payment is done through your online banking account, using the bill payment functionality. It is available at major Canadian banks (e.g., TD, RBC, BMO, Scotiabank, etc.).

Follow these steps to complete your payment:

- Log in to your bank account.

- Go to the bill payment section and choose to add a payee.

- Search for and select “RPRA” as the payee.

- Once “RPRA” is selected, enter your registration number as the account number to make your payment. Your registration number can be found on your invoice.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select cheque as your method of payment, follow these steps to complete your payment:

- Make your cheque payable to “Resource Productivity and Recovery Authority”

- Enter your Invoice Number on the memo line of the cheque

- Please send your cheque to*:

-

- Resource Productivity Recovery Authority

- PO Box 46114, STN A

- Toronto, ON

- M5W 4K9

*As of January 20, 2023, the address for mailing cheques to RPRA has been revised. Please update your records and send cheques to the above address going forward.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 2-4 weeks for your payment to be reflected in your Registry account once you have mailed your cheque due to mail and cheque processing times.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select electronic data interchange (EDI) as your method of payment, this is an electronic payment through your bank, also commonly known as EFT or ACH.

Follow these steps to complete your payment:

- Submit your payment using RPRA’s banking information provided on your invoice.

- Be sure to reference your Invoice Number when you submit this payment to your bank so that we will be able to identify your payment.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

Starting January 1, 2023, RPRA will collect 13% HST on all fees at the time of fee payment.

This decision is based on a ruling RPRA received from the CRA in which HST must be charged on its fees under the Resource Recovery and Circular Economy Act, 2016 (RRCEA). RPRA has determined that this ruling applies to all RRCEA producer responsibility programs and the Excess Soil and Hazardous Waste programs.

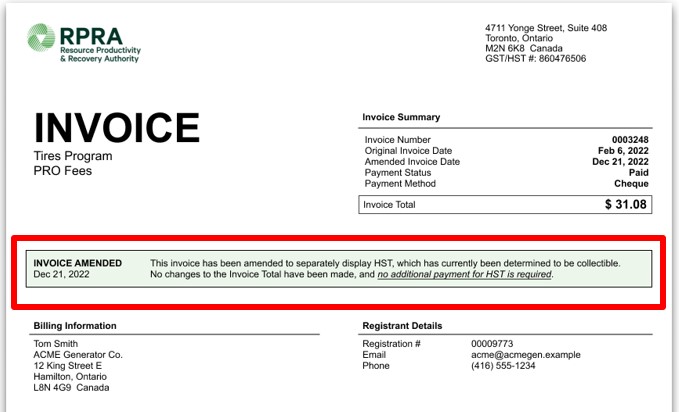

On December 22, 2022, RPRA will reissue invoices that were issued prior to January 1, 2023, amended to indicate that 13% HST was paid. From December 22 onwards, registrants will be able to access the amended invoices in their Registry accounts under a new tab labelled “Invoices”. The amended invoice will show an HST amount as well as the date the amended invoice was reissued.

Important notes:

- On the amended invoices there have been no changes to the Invoice Total and registrants will not be required to pay any additional monies to RPRA for past invoices.

- Registrants may be able to claim input tax credits for the HST collected on RPRA fees, for both the amended invoices and new invoices issued January 1, 2023, onwards. However, RPRA is not in a position to provide tax advice and suggests you consult your internal or external accountants to seek their counsel.

- All new invoices issued effective January 1, 2023, will contain appropriate information identifying the amount of the HST and other relevant details. These invoices will also be displayed under the “Invoices” tab in a registrants’ Registry account.

-

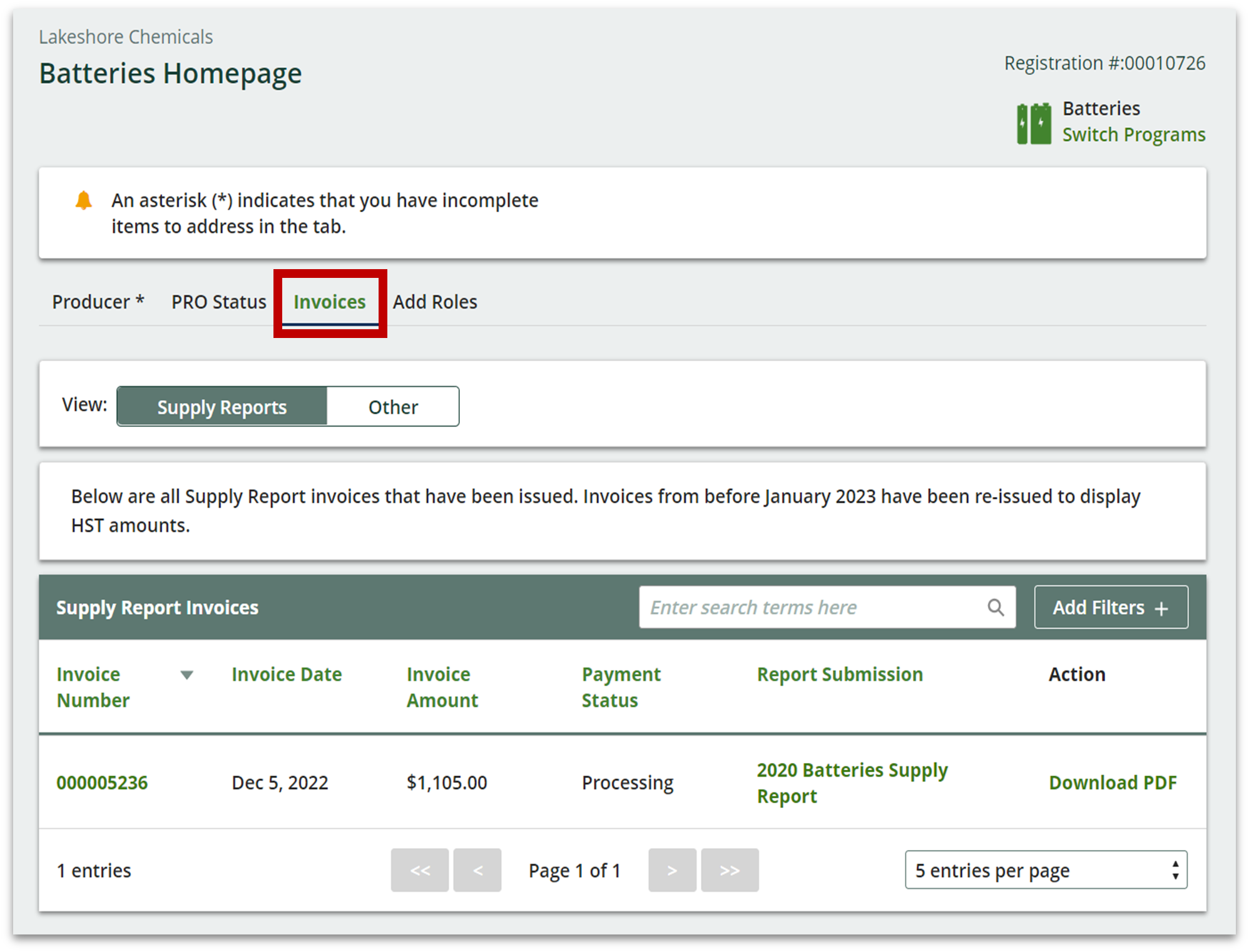

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. A banner will be displayed that highlights whether an invoice has been amended to include HST as well as the date the amended invoice was reissued. This will show on all invoices with an invoice date before December 21, 2022. See sample screenshot below.

-

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. See sample screenshot below.

-

In December 2022, the Government of Ontario finalized amendments to O. Reg. 406/19: On-Site and Excess Soil Regulation (Excess Soil Regulation) and the Rules for Soil Management and Excess Soil Quality Standards (Soil Rules), which came into effect January 1, 2023.

If a project triggers the filing requirements under the Excess Soil Regulation, the process for filing notices has not changed.

However, the amended regulation may affect the types of projects for which a notice is required to be filed through the Excess Soil Registry.The two key amendments made to the regulation mean:

- Reuse planning requirements are not triggered for projects defined as “low-risk project areas”, being a property at which the current or last property use was agricultural or other, residential, parkland or institutional (as defined under O. Reg. 153/04), that would otherwise have been triggered to complete reuse planning requirements as a result of being located within an area of settlement and removing at least 2,000m3 of excess soil. Other triggers for reuse planning may still apply.

- The limit on the maximum size of soil storage piles (previously 2,500 m3) has been removed. Other soil storage rules would continue to apply, including the requirement to prevent any adverse effects.

If you have questions about the Excess Soil Regulation or the amendments, contact the ministry at MECP.LandPolicy@ontario.ca.

See our FAQ to see “Who needs to file notices?”

-

On April 21, 2022, the Ontario Government announced a temporary suspension of the registration and reporting requirements under the Excess Soil Regulation. The requirements were suspended until January 1, 2023. The Excess Soil Registry remained open for users during the pause.

As of January 1, construction and development Project Leaders and Operators/Owners of soil Reuse Sites and Residential Development Soil Depot sites are required to register and file notices about how they reuse and dispose of excess soil in Ontario through RPRA’s Excess Soil Registry.

-

RPRA has developed a library of resources to support Registry users navigate the online system and meet their regulatory requirements. RPRA consistently adds to this pool of resources based on upcoming requirements, emerging needs, and questions we receive from stakeholders.

View Registry resources for each program:

-

RPRA has developed an Excess Soil Registry Resources webpage to help users navigate the online system and complete common activities such as account creation, filing and searching for notices. Resources include step-by-instructions and walk-through videos.

-

Account admins can manage password resets for all active users in the account. Primary users are also able to manage password resets, but only for active users within the programs they are the primary user for. If secondary users require a password reset, they can reach out to the account admin or primary user to do so.

-

The account admin or primary user navigates to the program homepage of which the user requiring a password reset is enrolled in. The account admin or primary user then clicks their username at the top right of the page to show the drop-down list and selects Manage Users.

In the Active Users table, the account admin or primary user clicks Reset Password on the row for the user they want to reset the password for and clicks Confirm.

The user’s password has now been reset. They will receive an email with a password reset link.

Note: the password reset link will expire within 24 hours. If the link expires before the user creates a new password, the account admin or primary must click “Reset Password” again to restart the process.

See the FAQ: Who can reset passwords in the registry?

-

If you need to change an email address in your registry account, please contact the Compliance Team at registry@rpra.ca. Registry users cannot update email addresses themselves; this can only be completed by RPRA.

-

“In April 2024, the Government of Ontario finalized amendments to Reg. 406/19: On-Site and Excess Soil Regulation (Excess Soil Regulation) and the Rules for Soil Management and Excess Soil Quality Standards (Soil Rules), which came into effect April 23, 2024. A key amendment made to the regulation means: Enhanced usability of project leader-owned or controlled storage sites (Class 2 soil management sites and local waste transfer facilities) and soil depots to allow for larger volumes of soil being managed without requiring a waste approval, now up to 25,000 m3 (previously 10,000 m3) with additional flexibility for public bodies and having greater alignment of rules across sites.

If you have questions about the Excess Soil Regulation or the amendments, contact the ministry at MECP.LandPolicy@ontario.ca. See our FAQ to see “Who needs to file notices?”