Frequently Asked Questions

Top FAQs (11)

Click the question to read the answer.

-

Failure of an obligated party to meet a registration or reporting deadline may result in compliance action, including compliance orders, prosecutions or monetary penalties issued in accordance with the Administrative Penalties Guidelines.

In accordance with the Risk Based Compliance Framework, RPRA will communicate to obligated parties, via email, about their reporting requirements in advance of submission deadlines. RPRA will also send deadline reminders and notify missed deadlines to obligated parties prior to taking further compliance action.

For more guidance, read the new Late Registration or Report Submissions Compliance Bulletin.

-

Program fees are charges that producers obligated under the Resource Recovery and Circular Economy Act, 2016, are required to pay to RPRA annually to recover its operational costs, including costs related to building and operating the registry, providing services to registrants, and compliance and enforcement activities.

All current and past fee schedules can be found here.

-

A battery producer qualifies for an exemption if their average weight of supply for that calendar year is:

- Less than or equal to 2,500 kg of rechargeable batteries, or

- Less than or equal to 5,000 kg of primary batteries.

Average supply weight is determined using the following formula:

Average weight of rechargeable batteries = (Y3 + Y4 + Y5) / 3

- Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Average weight of primary batteries = (Y2 + Y3 + Y4) / 3

- Eg. 2025 average weight of supply = (2023 + 2022 + 2021) / 3

Battery producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA.

- Establishing a collection and management system.

- Meeting management requirements.

- Promotion and education requirements.

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of batteries (by category) supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

Also see our FAQ: ‘How are battery producers’ minimum management requirements determined?‘

-

An ITT/AV producer qualifies for an exemption if their average weight of supply for that calendar year is less than or equal to 5,000 kg.

Average supply weight is determined using the following formula:

Average weight of ITT/AV supply = (Y3 + Y4 + Y5) / 3

Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

ITT/AV producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of ITT/AV supplied into Ontario each year and provide them to the RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

-

A lighting producer qualifies for an exemption if their average weight of supply for that calendar year is less than or equal to 700 kg.

Average supply weight is determined using the following formula:

Average weight of lighting supply = (Y3 + Y4 + Y5) / 3

Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Lighting producers that meet the exemption criteria are exempt from:

- Registering with and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Producers that are exempt must keep records of the materials they supplied, as set out in section 30 of the regulation.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

See our FAQs: “How are lighting producers’ minimum management requirements determined?” and “What do I have to do if I am an exempt lighting producer?”

-

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

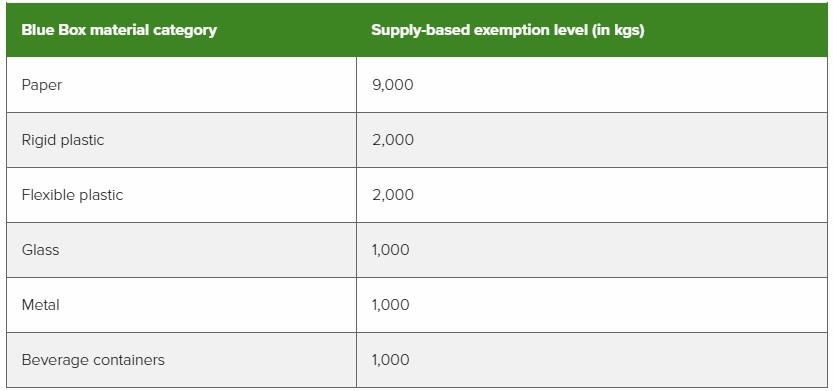

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.

-

Effective for the 2025 calendar year, and every year thereafter, producers no longer have collection targets and do not have to collect a minimum weight of used tires.

A producer’s individual management requirement is determined by formulas found in section 12 of the Regulation. See the tables below for details:

Management requirements for all tires

Performance Year Supply Report Year Formula *2025 2024 [(2020 supply + 2021 supply + 2022 supply) / 3)]×65% 2026 2025 [(2021 supply + 2022 supply + 2023 supply) / 3)]×65% 2027 2026 [(2022 supply + 2023 supply + 2024 supply) / 3)]×65% 2028 2027 [(2023 supply + 2024 supply + 2025 supply) / 3)]×65% 2029 2028 [(2024 supply + 2025 supply + 2026 supply) / 3)]×65% 2030 2029 [(2025 supply + 2026 supply + 2027 supply) / 3)]×70% Management requirements for large tires

Performance Year Supply Report Year Formula *2025 2024 [(2020 supply + 2021 supply + 2022 supply) / 3)]×60% 2026 2025 [(2021 supply + 2022 supply + 2023 supply) / 3)]×60% 2027 2026 [(2022 supply + 2023 supply + 2024 supply) / 3)]×60% 2028 2027 [(2023 supply + 2024 supply + 2025 supply) / 3)]×60% 2029 2028 [(2024 supply + 2025 supply + 2026 supply) / 3)]×60% 2030 2029 [(2025 supply + 2026 supply + 2027 supply) / 3)]×60% *For reports submitted in 2024, producers should use RPRA’s manual calculator.

It is important to note that producers must ensure that all collected tires are managed, regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA.

See our FAQ ‘How do I determine if I am an exempt tire producer?’ to learn more.

-

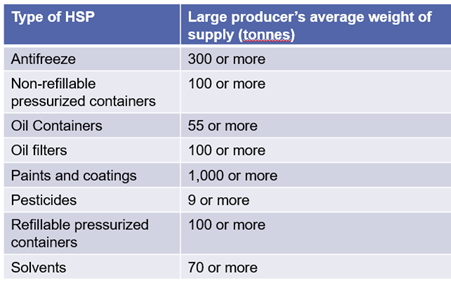

Large producers for supply data verification

Producers whose average supply meets the large producer threshold in the below chart must submit a verification report for that reporting year.

Example: Producers of oil filters that have an average weight of supply in their 2023 supply report that exceeds 100 tonnes are considered a large producer and must submit a verification report for oil filters in 2024.

Small producers for supply data verification

Producers who are below the threshold are considered small producers. Small producers are only required to submit a verification report but will be subject to inspections.

-

Each registry account has one account administrator, who is responsible for enrolling the company in programs (e.g., HWP, batteries, etc.) and adding/removing additional account users.

There is one primary user for each program enrolment. In HWP, the primary user can add/remove users to the HWP program, add program roles (such as generator, carrier or receiver) and is the point of contact to receive email notifications (such as when a new invoice is available).

Secondary users in the HWP can create and edit generator facilities and waste information (generator/AGD roles only); add ECA information and edit contact information (carrier/receiver roles only); create, edit and sign manifests.

Driver users are specific to the carrier role in the HWP program. Drivers can create, edit and sign manifests but cannot add ECA information.

Manifest-only users, like the driver user role, have a reduced level of access limited to viewing, creating, editing and signing manifests. They cannot view, edit, or manage facilities, or view information related to fees.

Account admins can manage password resets for all active users in the account. Primary users are also able to manage password resets, but only for active users within the programs they are the primary user for. If secondary users, drivers or manifest-only users require a password reset, they can reach out to the account admin or primary user to do so.

User Management

Functionalities Admin Primary Secondary Driver* Manifest-only Add/remove users across programs ⚫ Reset passwords for all users across programs ⚫ Add / remove users to same program ⚫ ⚫ Reset passwords for active users within the same program ⚫ ⚫ Receive invoice notifications ⚫ ⚫ Create / manage facilities ⚫ ⚫ ⚫ Create / manage wastes ⚫ ⚫ ⚫ View / create / edit and sign manifests ⚫ ⚫ ⚫ ⚫ ⚫ *Available only to accounts where the carrier role is selected. Drivers will only be able to view and action manifests where the company is listed as the carrier -

Fees are tied to the activities that generators report on or that are reported on their behalf by authorized generator delegates (AGDs) (e.g., manifests and on-site storage, processing and disposal). Fees will be invoiced on the first day of each month and will include all manifests completed in the previous month.

RPRA consulted industry stakeholders on the 2025 HWP Registry Fees from September 27 to November 12, 2024 and, based on the feedback received, the HWP Registry Fees have been set on the following basis:

- fees is charged to generators only, aligning with the current Hazardous Waste Program fee structure

- the manifest fee has been set at $6, the same rate as today, and will be charged per manifest

- the tonnage fee has been set at $27.50, instead of the past $30 fee, and will only apply to shipped hazardous waste and hazardous waste that is disposed on site which remains the same as today’s framework

- there is no annual registration fee

- all existing fee exemptions are maintained, as per Ontario Regulation 323/22: Subject Waste Program

View the 2025 HWP Registry Fees Schedule

See FAQ: Will I pay my fees using a prepaid account like HWIN?

-

The account admin or primary user navigates to the program homepage of which the user requiring a password reset is enrolled in. The account admin or primary user then clicks their username at the top right of the page to show the drop-down list and selects Manage Users.

In the Active Users table, the account admin or primary user clicks Reset Password on the row for the user they want to reset the password for and clicks Confirm.

The user’s password has now been reset. They will receive an email with a password reset link.

Note: the password reset link will expire within 24 hours. If the link expires before the user creates a new password, the account admin or primary must click “Reset Password” again to restart the process.

See the FAQ: Who can reset passwords in the registry?