Frequently Asked Questions

Results (53)

Click the question to read the answer.

-

Here are the lists of registered PROs:

Hazardous and Special Products PROs

These lists will continue to be updated as new PROs register with RPRA.

-

When paying fees to RPRA, you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI; also commonly known as ACH or EFT)

- Electronic bill payment

- Cheque

For instructions on how to submit payment by the method you chose, read one of the following FAQs:

- How do I pay my fees to RPRA by credit card?

- How do I pay my fees to RPRA by bank withdrawal (pre-authorized debit)?

- How do I pay my fees to RPRA by electronic bill?

- How do I pay my fees to RPRA by cheque?

- How do I pay my fees to RPRA by electronic data interchange (EDI)?

To note, Registry invoices are considered due on receipt. Invoices are in CAD funds and payments must be sent in CAD.

-

We recommend using Google Chrome, Mozilla Firefox, Microsoft Edge or Apple Safari when accessing the Registry. If you are experiencing an issue with the Registry, try clearing your cache or updating the browser to the latest version.

If you are using a different browser, the Registry will not function.

-

You should use the address where you carry on business. If you carry on business in more than one location in Ontario, use the main address for your business in Ontario. If you do not have an Ontario address, use the address that relates to the activities you carry out in Ontario.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

Yes. Producers and service providers can enter into contractual agreements with multiple PROs.

-

Program fees are charges that producers obligated under the Resource Recovery and Circular Economy Act, 2016, are required to pay to RPRA annually to recover its operational costs, including costs related to building and operating the registry, providing services to registrants, and compliance and enforcement activities.

All current and past fee schedules can be found here.

-

No. Producers and PROs working on their behalf must operate the collection and management systems they have established as required by the Regulation even after their minimum management requirements are met.

-

Under the Resource Recovery and Circular Economy Act, the Authority is required to provide an annual report to the Minister that includes information on aggregate producer performance, and a summary of compliance and enforcement activities. Under section 51 of the Act, the Registrar also is required to post every order issued on the Registry.

-

Resident in Ontario means a person having a permanent establishment in Ontario within the meaning of the Corporations Tax Act. A permanent establishment is usually a fixed place of business such as an office, factory, branch, warehouse, workshop, etc. In some cases, a corporation will be deemed to operate a permanent establishment in Ontario. These include cases where:

- The corporation produced, grew, mined, created, manufactured, fabricated, improved, packed, preserved or constructed anything in the province, in whole or in part;

- The corporation carries on business through an employee or agent in the province who has general authority to contract for the corporation; or

- The corporation carries on business through an employee or agent in the province who has a stock of merchandise owned by the corporation from which they regularly fill orders that they receive.

- A corporation will also have a permanent establishment in Ontario if it uses substantial machinery or equipment in the province, or if it is has a permanent establishment elsewhere in Canada and owns land in the province.

For more details about what constitutes a permanent establishment, see the definition of “permanent establishment” in the Corporations Tax Act.

-

To create a Registry account with the Authority, you will need to provide:

- CRA Business Number (BN)

- Legal Business Name

- Business address and phone number

- Address of where you work (if different from the main office)

- Contact information for your billing contact (this may also be added later)

-

For regulatory purposes, we need to know your legal name — the name you are incorporated under. We also need to know your business operating name if it is different from your legal business name to add to our published list of registrants. The list of registrants will be available on our website to allow registrants to interact with one another and to provide information to the public.

For example, if you are a registered collector and your legal name is 123456789 Ontario Ltd. and your business operating name is “Jack’s Garage,” a member of the public looking for a place to drop off used tires will need to know the name you are operating under to identify your location.

-

Brand holders and producers that supply products and packaging are required by legislation to meet individual mandatory collection and resource recovery requirements and may face compliance and enforcement consequences for failing to do so. The executive attestation ensures that executives responsible for managing the brand holder’s or producer’s business are aware of these requirements and can ensure that appropriate measures are put in place to achieve compliance with the regulations.

-

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

Producers are required to report single-use (primary) and rechargeable batteries that:

- Weigh 5 kg or less, and

- Are sold separately from products.

Examples include button cells, AA, AAA, C, D, 9V, lantern batteries, small, sealed lead acid (SLA) batteries, and replacement batteries for products such as drills, cell phones, and laptops.

Batteries that do not need to be reported are those that:

- Are sold with or in products (e.g., batteries included with cordless power tools, cell phones, laptops, toys, vapes, fire alarms)

- Weigh over 5 kg (e.g., car batteries, forklift batteries, stationary batteries)

Producers who wish to confirm if they are exempt because the type(s) of batteries they supply do not need to be reported should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

-

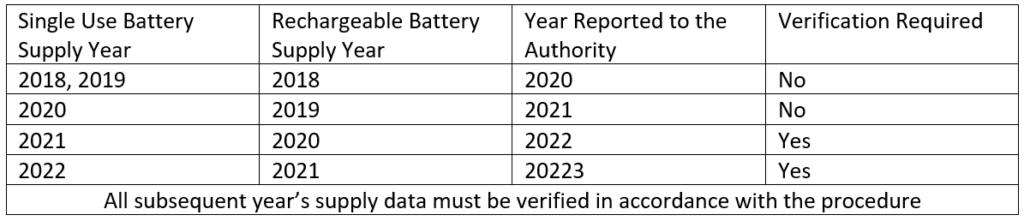

There is no audit verification requirement for the first two supply data reports submitted to the Authority. Therefore, data submitted for single-use batteries supplied in 2018, 2019, and 2020, as well as rechargeable batteries supplied in 2018 and 2019 will not have to be verified in accordance with the Registry Procedure – Verification and Audit.

As shown in the table below, under section 15 of the Battery Regulation, the first supply data report for which there are audit and verification requirements will be submitted in 2022. This supply data report is for single-use batteries supplied in 2021 and rechargeable batteries supplied in 2020.

-

Yes. You are still required to register with the Authority Registry even if you already have an existing account.

-

Producer supply data is used to calculate their individual minimum management requirements under the Batteries Regulation.

To learn how calculations are formulated, visit the FAQ How are battery producer minimum management requirements determined?

-

A producer’s individual management requirement is determined by formulas found in section 13 of the Regulation. See the table below for details:

Supply Report Year for Primary Batteries Supply Report Year for Rechargeable Batteries Formula Performance Year 2023 2022 [(2023+2022+2021)/3] + (2022+2021+2020)/3] × 45% 2025* 2024 2023 [(2024+2023+2022)/3] + (2023+2022+2021)/3] × 50% 2026 2025 2024 [(2025+2024+2023)/3] + (2024+2023+2022)/3] × 50% 2027 2026 2025 [(2026+2025+2024)/3] + (2025+2024+2023)/3] × 50% 2028 *For reports submitted in 2024, producers should use RPRA’s manual calculator.

It is important to note that producers must ensure that all collected batteries are managed, regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA.

See our FAQ ‘How do I determine if I am an exempt battery producer?’ to learn more.

-

A battery producer qualifies for an exemption if their average weight of supply for that calendar year is:

- Less than or equal to 2,500 kg of rechargeable batteries, or

- Less than or equal to 5,000 kg of primary batteries.

Average supply weight is determined using the following formula:

Average weight of rechargeable batteries = (Y3 + Y4 + Y5) / 3

- Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Average weight of primary batteries = (Y2 + Y3 + Y4) / 3

- Eg. 2025 average weight of supply = (2023 + 2022 + 2021) / 3

Battery producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA.

- Establishing a collection and management system.

- Meeting management requirements.

- Promotion and education requirements.

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of batteries (by category) supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

Also see our FAQ: ‘How are battery producers’ minimum management requirements determined?‘

-

As of July 1, 2020, producers are required to establish and operate a collection system for batteries that meets the accessibility requirements in the regulation. Producers must ensure that all batteries collected are managed regardless of their minimum management requirements.

For producers to meet their obligations, they have the choice of establishing and operating their own collection and management system or working with one or more producer responsibility organizations (PROs) that are registered with the Authority.

Please contact the Compliance Team at 833-600-0530 or registry@rpra.ca to discuss other requirements under the Batteries Regulation.

-

As the Regulator responsible for enforcing regulations under the Resource Recovery and Circular Economy Act, 2016, the Registrar uses their discretion for when it is necessary to give registrants more time to collect the information needed for registration and/or reporting.

-

Account Admins must add any new, or manage existing, Primary Contacts under the program they wish to give them access to in order for the Primary Contact to be able to submit a report (e.g., permissions to view and complete reports).

To Manage contacts on your Registry account, please see the following steps:

- Log into your account

- Once you are logged in, click on the drop-down arrow in the top right corner and select Manage Users

- Under Actions, click Manage to update preferences of existing users

- Click Add New User to add an additional contact to your account

- To give reporting access to a Primary Contact, select the program from the drop-down that you would like to grant them access to

-

In determining whether an obligated producer used best efforts to meet their management requirements, the Compliance Team will consider whether the producer, acting in good faith, took all reasonable steps to meet the requirements outlined in the applicable regulation.

For example, best efforts in the context of management requirements may involve a producer regularly monitoring the volume of material being collected and managed, and implementing plans for increasing those volumes if the requirements are unlikely to be met.

Producers can contact the Compliance Team to ask specific questions about fulfilling their obligations.

-

A producer can grant access to anyone they would like to authorize in their reporting (i.e. Registry) portal. Producer reporting must be done in the producer account and batch data transfers are not accepted.

-

If a producer misreports their supply data to RPRA, they must contact the Compliance Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., sales documents, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly as possible to ensure a producer’s minimum management requirement is calculated using accurate supply data.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.

-

Under the Batteries, EEE, HSP, and Tire Regulations, a consumer is any end user of a product. A consumer includes an individual who obtains the product for the individual’s own use and a business that obtains the product for the business’s own use.

See our FAQ to understand “Who is a consumer under the Blue Box Regulation?”

-

Free riders are obligated parties that:

- Have not registered or reported to RPRA

- Have not established a collection and management system (if they are so required to), or;

- Are not operating a collection and management system (if they are so required to).

See our FAQs to understand “What is RPRA’s approach to free riders?”, and “What do I do if I think a business is a free rider?”

To note:

- Some producers only have requirements to register and report. Please refer to your specific program page on our website to understand producer obligations.

- Collection and management systems may be accomplished by a producer responsibility organization (PRO) on behalf of a producer through contractual arrangements between the producer and PRO. If a PRO is managing a producer’s collection and management requirements, producers must identify that PRO to RPRA.

-

RPRA takes a risk-based and proportional approach to compliance. This approach focuses on the potential risks that arise from non-compliance and assessing those risks to guide the use of compliance tools and the deployment of resources to minimize risk and maximize compliance. Learn more about RPRA’s Risk-Based Compliance Framework.

As a provincial regulator, we have the following powers to bring non-compliant parties into compliance:

- Broad inquiry powers including authority to compel documents and data

- Inspections and investigations

- Audits

- Compliance Orders and Administrative Penalty Orders (amounts to be set in regulation once finalized)

- Prosecution

RPRA’s primary approach to compliance is through communications (C4C – Communicating for Compliance). RPRA communicates directly with obligated parties and informs them of their requirements and when and how they must be completed. A high degree of compliance is achieved with this approach.

RPRA considers free riders a high priority to the programs we administer and focuses compliance efforts on bringing free riders into compliance with the regulations.

See our FAQ to understand “What is a free rider?”, and “What do I do if I think a business is a free rider?”

-

We encourage anybody who believes an entity is a free rider to contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca with information about that entity. RPRA reviews every free rider allegation that is referred to us.

We do not share information about our inspections or progress on specific free rider cases.

See our FAQ to understand “What is a free rider?” and “What is RPRA’s approach to free riders?”

-

A brand supply list is a list of brands of obligated products that a producer supplies to consumers in Ontario. A producer must provide a brand supply list that makes up their supply data annually to RPRA. Each program has different requirements regarding how a producer must submit a brand supply list. For more information, consult the applicable programs’ walkthrough guide or contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca.

-

In the Manage PRO section in the Registry, the “Service End Date” is not a mandatory field. You can leave this field blank if there is no end date in your contract. If you decide to change PROs in the future, you can update this field to the date your agreement ended with that PRO.

-

If you select credit card as your method of payment, this method of payment is done through your Registry account.

Follow these steps to complete your payment:

- When you are in the payment method section in the Registry, select credit card as your preferred method.

- Input your credit card details.

- Click submit and payment will process automatically.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- Once your transaction has been approved, your payment will be reflected in your Registry account immediately.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select bank withdrawal as your method of payment, this authorizes the Resource Productivity and Recovery Authority to make a one-time withdrawal for the Registry invoice payment from the account you provided.

Bank Withdrawal – Important Terms:

- You have authorized RPRA to make one-time debits from your account. RPRA will obtain your authorization before any additional one-time or sporadic withdrawal is debited from your account. You have agreed that this confirmation may be provided at least three (3) calendar days before the first payment is withdrawn from your account. You have waived any and all requirements for pre-notification of the account being debited.

- Your payments are being made on behalf of a business.

- Your agreement may be cancelled provided notice is received thirty (30) days before the next withdrawal. If any of the above details are incorrect, please contact us immediately at the contact information below. If the details are correct, you do not need to do anything further and your Pre-Authorized Debits (PAD) will be processed. You have certain recourse rights if any debit does not comply with these terms. For example, you have the right to receive a reimbursement for any PAD that is not authorized or is not consistent with this PAD Agreement. To obtain more information on your recourse rights, contact your financial institution or visit www.payments.ca.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for the involved banks to process your payment.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select electronic bill payment as your method of payment, this method of payment is done through your online banking account, using the bill payment functionality. It is available at major Canadian banks (e.g., TD, RBC, BMO, Scotiabank, etc.).

Follow these steps to complete your payment:

- Log in to your bank account.

- Go to the bill payment section and choose to add a payee.

- Search for and select “RPRA” as the payee.

- Once “RPRA” is selected, enter your registration number as the account number to make your payment. Your registration number can be found on your invoice.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select cheque as your method of payment, follow these steps to complete your payment:

- Make your cheque payable to “Resource Productivity and Recovery Authority”

- Enter your Invoice Number on the memo line of the cheque

- Please send your cheque to*:

-

- Resource Productivity Recovery Authority

- PO Box 46114, STN A

- Toronto, ON

- M5W 4K9

*As of January 20, 2023, the address for mailing cheques to RPRA has been revised. Please update your records and send cheques to the above address going forward.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 2-4 weeks for your payment to be reflected in your Registry account once you have mailed your cheque due to mail and cheque processing times.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select electronic data interchange (EDI) as your method of payment, this is an electronic payment through your bank, also commonly known as EFT or ACH.

Follow these steps to complete your payment:

- Submit your payment using RPRA’s banking information provided on your invoice.

- Be sure to reference your Invoice Number when you submit this payment to your bank so that we will be able to identify your payment.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

A brand is any mark, word, name, symbol, design, device or graphical element, or a combination thereof, including a registered or unregistered trademark, which identifies a product and distinguishes it from other products.

A brand holder is a person who owns or licenses a brand or otherwise has rights to market a product under the brand.

Note:

- If there are two or more brand holders, the producer most directly connected to the production of the material is the brand holder.

- If more than one material produced by different brand holders are marketed as a single package, the producer who is more directly connected to the primary product in the package is the brand holder.

-

The Manage PRO option will appear on the dashboard below your list of supply data reports when your supply data reporting is complete and if you have management requirements. If your supply data reporting is below the supply exemption threshold you will not have management requirements, and therefore not need to assign a PRO to assist with your obligations.

Also note that Account Admin are the only portal users that can manage your PRO’s responsibility, so this widget is not viewable to primary and secondary users.

-

Account admins have access to all information within a registrant’s account. They can create and assign primary and secondary users’ access to the account, edit and submit reports, and pay fees. They are the only ones who can manage PROs. Account admins can view all activities users undertake. They will also be the recipient of emails from the Registry portal.

Primary users can only assign secondary users’ access to the account, edit and submit reports and pay fees.

Secondary users can only edit and submit reports and pay fees.

-

Failure of an obligated party to meet a registration or reporting deadline may result in compliance action, including compliance orders, prosecutions or monetary penalties issued in accordance with the Administrative Penalties Guidelines.

In accordance with the Risk Based Compliance Framework, RPRA will communicate to obligated parties, via email, about their reporting requirements in advance of submission deadlines. RPRA will also send deadline reminders and notify missed deadlines to obligated parties prior to taking further compliance action.

For more guidance, read the new Late Registration or Report Submissions Compliance Bulletin.

-

No. Effective February 6, 2023, RPRA will no longer accept requests for extensions to registration or reporting deadlines. Obligated parties should make every effort to ensure they meet all submission deadlines as part of their obligations under their associated regulation.

For more guidance, read the Late Registration or Report Submissions Compliance Bulletin.

-

Yes, a producer, a PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can collect any product or material (including materials or products that are not designated under the Resource Recovery and Circular Economy Act, 2016 (RRCEA)). For example, a battery producer may choose to collect batteries that weigh over 5kg; a tire producer may choose to collect bicycle tires; or a Blue Box producer may choose to collect books.

Products or materials that are not designated under RRCEA regulations cannot be counted towards meeting a producer’s collection or management requirements under RRCEA.

If designated materials are co-collected with materials that are not designated, a person must use a methodology or process acceptable to the Authority to account for those materials. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if bicycle tires are collected at the same time as automotive tires, they must be accounted for separately both when collected and when sent to a processor.

-

For the purposes of battery supply reporting verification:

- “Large single-use battery producer” means a battery producer with a minimum management requirement greater than or equal to 50,000 kilograms of single-use batteries in the previous calendar year.

- “Large rechargeable battery producer” means a battery producer with a minimum management requirement greater than or equal to 5,000 kilograms of rechargeable batteries in the previous calendar year.

To view your management requirements, log into your Registry account, download a copy of your previous year’s Supply Report and review the section with your minimum management requirements for your reporting year.

Beginning in 2023, only large producers are required to submit a Supply Data Verification Report. Small producers will no longer be required to submit a verification report but will be subject to inspections. Review the Registry Procedure – Verification and Audit for more information.

-

No, where a producer is exempt, the regulatory obligations do not become the responsibility of the organization that is next in the producer hierarchy. The exempt producer remains the “producer” for those materials; they are just exempt from certain requirements under the regulation as set out in the relevant provisions providing for the exemption. This is the case in all RRCEA regulations.

-

A Verifier can be an individual, either an employee of the business or a hired third-party (including a PRO), who has one of the following designations and is not the same person who prepared the supply report:

- CPA (Chartered Professional Accountants) in Canada or CPA (Certified Public Accountant) in the US

- ACCA (Association of Chartered Certified Accounts) Qualification

- CIA (Certified Internal Auditor)

- CPB (Certified Professional Bookkeeper) in Canada

- RPA (Registered Professional Accountant) in Canada

-

Producers of batteries need to provide the following information when registering in RPRA’s Registry:

- Business information (e.g. business name, contact information)

- The year you began marketing or selling batteries into Ontario

- Any PROs you are contracted with

- Your annual Supply Report

-

Producers are obligated parties under the Resource Recovery and Circular Economy Act and are ultimately responsible for their data submitted through RPRA’s Registry. Producers can choose to contract with an external consultant to support their data submission, but third parties have limited permissions in the Registry as they are not regulated parties.

A producer can choose to assign a primary or secondary user profile in their Registry account to an external consultant. An external consultant may submit supply data reports and/or pay registry fees on the producer’s behalf.

External consultants cannot submit and/or sign registration, executive attestations, account admin changes or supply data adjustment documentation on behalf of a producer. External consultants cannot be account admins, nor can they manage a PRO within the Registry on behalf of a producer.

-

Producers are not required to collect and manage their own branded products and materials. Instead, a producer is expected to collect and manage a portion of similar materials in Ontario. The portion of material that a producer collects and manages is known as their minimum management requirement. A minimum management requirement, which is set based on calculations outlined in the applicable Regulation, is the weight of the products or packaging that the producer must ensure is collected and managed. The calculated amount is proportionate to the weight of materials that producer supplied into the province.

For example, a producer who supplied laptops into Ontario does not need to collect and manage their own branded laptops. Instead, they must ensure that they collect and manage an equivalent weight of information technology, telecommunications, and audio-visual equipment (ITT/AV) materials.

Similarly, a producer who supplied cardboard boxes into Ontario does not need to collect and manage those exact cardboard boxes. Rather, they need to ensure that an equivalent weight of paper is collected and managed.

Almost all producers will work with producer responsibility organizations (PROs) for the purposes of meeting their obligations to collect and manage materials. PROs establish collection and management systems across Ontario for different material types. A producer can meet their obligations to collect and manage materials by entering into a contract with a PRO to provide these services on their behalf.

-

RPRA’s Where to Recycle map displays locations across Ontario where the public can drop off used materials to be recycled, such as batteries, electronics, household hazardous waste (e.g., paint, antifreeze, pesticides), lighting and tires, for free. Materials collected at these locations are reused, refurbished, recycled, or properly disposed of to help keep them out of landfill, recover valuable resources and protect our environment. Learn more here.

-

The recycling locations that appear on the map are reported to RPRA by businesses that run the recycling systems in Ontario.

-

The recycling locations that appear on the map are reported to RPRA by PROs (or producers managing their own collection networks) as the administrators of the collection systems. The public collection activities that PROs report in their registry account are uploaded to the map in near real-time.

-

If a producer or service provider needs to adjust the performance data reported to RPRA, they must contact the Compliance Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., tonnage purchase or sale contract, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly as possible to ensure that it has accurate performance data from all registrants.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.