Frequently Asked Questions

Results (46)

Click the question to read the answer.

-

A producer’s individual management requirement is determined by formulas found in section 13 of the Regulation. See the table below for details:

Supply Report Year for Primary Batteries Supply Report Year for Rechargeable Batteries Formula Performance Year 2023 2022 [(2023+2022+2021)/3] + (2022+2021+2020)/3] × 45% 2025* 2024 2023 [(2024+2023+2022)/3] + (2023+2022+2021)/3] × 50% 2026 2025 2024 [(2025+2024+2023)/3] + (2024+2023+2022)/3] × 50% 2027 2026 2025 [(2026+2025+2024)/3] + (2025+2024+2023)/3] × 50% 2028 *For reports submitted in 2024, producers should use RPRA’s manual calculator.

It is important to note that producers must ensure that all collected batteries are managed, regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA.

See our FAQ ‘How do I determine if I am an exempt battery producer?’ to learn more.

-

A battery producer qualifies for an exemption if their average weight of supply for that calendar year is:

- Less than or equal to 2,500 kg of rechargeable batteries, or

- Less than or equal to 5,000 kg of primary batteries.

Average supply weight is determined using the following formula:

Average weight of rechargeable batteries = (Y3 + Y4 + Y5) / 3

- Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Average weight of primary batteries = (Y2 + Y3 + Y4) / 3

- Eg. 2025 average weight of supply = (2023 + 2022 + 2021) / 3

Battery producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA.

- Establishing a collection and management system.

- Meeting management requirements.

- Promotion and education requirements.

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of batteries (by category) supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

Also see our FAQ: ‘How are battery producers’ minimum management requirements determined?‘

-

For the purposes of battery supply reporting verification:

- “Large single-use battery producer” means a battery producer with a minimum management requirement greater than or equal to 50,000 kilograms of single-use batteries in the previous calendar year.

- “Large rechargeable battery producer” means a battery producer with a minimum management requirement greater than or equal to 5,000 kilograms of rechargeable batteries in the previous calendar year.

To view your management requirements, log into your Registry account, download a copy of your previous year’s Supply Report and review the section with your minimum management requirements for your reporting year.

Beginning in 2023, only large producers are required to submit a Supply Data Verification Report. Small producers will no longer be required to submit a verification report but will be subject to inspections. Review the Registry Procedure – Verification and Audit for more information.

-

Producer supply data is used to calculate their individual minimum management requirements under the Batteries Regulation.

To learn how calculations are formulated, visit the FAQ How are battery producer minimum management requirements determined?

-

Producers are not required to collect and manage their own branded products and materials. Instead, a producer is expected to collect and manage a portion of similar materials in Ontario. The portion of material that a producer collects and manages is known as their minimum management requirement. A minimum management requirement, which is set based on calculations outlined in the applicable Regulation, is the weight of the products or packaging that the producer must ensure is collected and managed. The calculated amount is proportionate to the weight of materials that producer supplied into the province.

For example, a producer who supplied laptops into Ontario does not need to collect and manage their own branded laptops. Instead, they must ensure that they collect and manage an equivalent weight of information technology, telecommunications, and audio-visual equipment (ITT/AV) materials.

Similarly, a producer who supplied cardboard boxes into Ontario does not need to collect and manage those exact cardboard boxes. Rather, they need to ensure that an equivalent weight of paper is collected and managed.

Almost all producers will work with producer responsibility organizations (PROs) for the purposes of meeting their obligations to collect and manage materials. PROs establish collection and management systems across Ontario for different material types. A producer can meet their obligations to collect and manage materials by entering into a contract with a PRO to provide these services on their behalf.

-

Yes, a producer, a PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can collect any product or material (including materials or products that are not designated under the Resource Recovery and Circular Economy Act, 2016 (RRCEA)). For example, a battery producer may choose to collect batteries that weigh over 5kg; a tire producer may choose to collect bicycle tires; or a Blue Box producer may choose to collect books.

Products or materials that are not designated under RRCEA regulations cannot be counted towards meeting a producer’s collection or management requirements under RRCEA.

If designated materials are co-collected with materials that are not designated, a person must use a methodology or process acceptable to the Authority to account for those materials. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if bicycle tires are collected at the same time as automotive tires, they must be accounted for separately both when collected and when sent to a processor.

-

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

No, where a producer is exempt, the regulatory obligations do not become the responsibility of the organization that is next in the producer hierarchy. The exempt producer remains the “producer” for those materials; they are just exempt from certain requirements under the regulation as set out in the relevant provisions providing for the exemption. This is the case in all RRCEA regulations.

-

Free riders are obligated parties that:

- Have not registered or reported to RPRA

- Have not established a collection and management system (if they are so required to), or;

- Are not operating a collection and management system (if they are so required to).

See our FAQs to understand “What is RPRA’s approach to free riders?”, and “What do I do if I think a business is a free rider?”

To note:

- Some producers only have requirements to register and report. Please refer to your specific program page on our website to understand producer obligations.

- Collection and management systems may be accomplished by a producer responsibility organization (PRO) on behalf of a producer through contractual arrangements between the producer and PRO. If a PRO is managing a producer’s collection and management requirements, producers must identify that PRO to RPRA.

-

Producers are obligated parties under the Resource Recovery and Circular Economy Act and are ultimately responsible for their data submitted through RPRA’s Registry. Producers can choose to contract with an external consultant to support their data submission, but third parties have limited permissions in the Registry as they are not regulated parties.

A producer can choose to assign a primary or secondary user profile in their Registry account to an external consultant. An external consultant may submit supply data reports and/or pay registry fees on the producer’s behalf.

External consultants cannot submit and/or sign registration, executive attestations, account admin changes or supply data adjustment documentation on behalf of a producer. External consultants cannot be account admins, nor can they manage a PRO within the Registry on behalf of a producer.

-

As of July 1, 2020, producers are required to establish and operate a collection system for batteries that meets the accessibility requirements in the regulation. Producers must ensure that all batteries collected are managed regardless of their minimum management requirements.

For producers to meet their obligations, they have the choice of establishing and operating their own collection and management system or working with one or more producer responsibility organizations (PROs) that are registered with the Authority.

Please contact the Compliance Team at 833-600-0530 or registry@rpra.ca to discuss other requirements under the Batteries Regulation.

-

A volunteer organization is a person who:

- Is a brand holder who owns a brand that is used in respect of batteries or EEE;

- Is not a resident in Canada;

- Has registered with the Authority; and

- Has entered into a written agreement with a producer for the purpose of carrying out one or more producer responsibilities.

A volunteer organization is not a producer but can take on the registration and reporting responsibilities for producers in relation to its brand. Under the Regulation, producers remain responsible for meeting their management requirements and cannot pass off their obligations through voluntary remitter agreements or any other commercial agreement.

Any brand holder or producer who is interested in making any agreement as indicated (or described) above, should contact the Compliance Team at registry@rpra.ca, 647-496-0530 or toll-free at 1-833-600-0530.

-

Individual Producer Responsibility (IPR) means that producers are responsible and accountable for collecting and managing their products and packaging after consumers have finished using them.

For programs under the Resource Recovery and Circular Economy Act, 2016 (RRCEA), producers are directly responsible and accountable for meeting mandatory collection and recycling requirements for end of life products. With IPR, producers have choice in how they meet their requirements. They can collect and recycle the products themselves, or contract with producer responsibility organizations (PROs) to help them meet their requirements.

-

In determining whether an obligated producer used best efforts to meet their management requirements, the Compliance Team will consider whether the producer, acting in good faith, took all reasonable steps to meet the requirements outlined in the applicable regulation.

For example, best efforts in the context of management requirements may involve a producer regularly monitoring the volume of material being collected and managed, and implementing plans for increasing those volumes if the requirements are unlikely to be met.

Producers can contact the Compliance Team to ask specific questions about fulfilling their obligations.

-

No, only producers are required to pay RPRA program fees. The decision to make producers pay fees and cover the Authority’s costs was made to reflect the fact that the Resource Recovery and Circular Economy Act, 2016 (RRCEA) is based on a producer responsibility framework. Although producers may hire service providers to help meet their obligations, the responsibility remains with the producer.

-

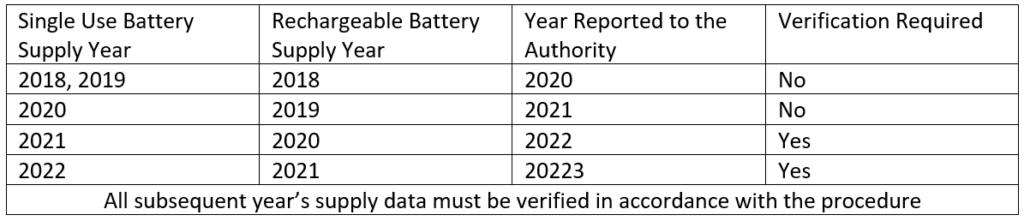

There is no audit verification requirement for the first two supply data reports submitted to the Authority. Therefore, data submitted for single-use batteries supplied in 2018, 2019, and 2020, as well as rechargeable batteries supplied in 2018 and 2019 will not have to be verified in accordance with the Registry Procedure – Verification and Audit.

As shown in the table below, under section 15 of the Battery Regulation, the first supply data report for which there are audit and verification requirements will be submitted in 2022. This supply data report is for single-use batteries supplied in 2021 and rechargeable batteries supplied in 2020.

-

A producer can grant access to anyone they would like to authorize in their reporting (i.e. Registry) portal. Producer reporting must be done in the producer account and batch data transfers are not accepted.

-

A producer responsibility organization (PRO) is a business established to contract with producers to provide collection, management, and administrative services to help producers meet their regulatory obligations under the Regulation, including:

- Arranging the establishment or operation of collection and management systems (hauling, recycling, reuse, or refurbishment services)

- Establishing or operating a collection or management system

- Preparing and submitting reports

PROs operate in a competitive market and producers can choose the PRO (or PROs) they want to work with. The terms and conditions of each contract with a PRO may vary.

-

No. The Authority does not administer contracts or provide incentives. Under the Regulations, producers will either work with a producer responsibility organization (PRO) or work directly with collection sites, haulers, refurbisher’s and/or processors to meet their collection and management requirements. Any reimbursement for services provided towards meeting a producers’ collection and management requirements will be determined through commercial contracts.

To discuss any payment, contact your service provider or a PRO. RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

A brand supply list is a list of brands of obligated products that a producer supplies to consumers in Ontario. A producer must provide a brand supply list that makes up their supply data annually to RPRA. Each program has different requirements regarding how a producer must submit a brand supply list. For more information, consult the applicable programs’ walkthrough guide or contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca.

-

No. Producers and PROs working on their behalf must operate the collection and management systems they have established as required by the Regulation even after their minimum management requirements are met.

-

If a producer misreports their supply data to RPRA, they must contact the Compliance Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., sales documents, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly as possible to ensure a producer’s minimum management requirement is calculated using accurate supply data.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.

-

Under the Resource Recovery and Circular Economy Act, the Authority is required to provide an annual report to the Minister that includes information on aggregate producer performance, and a summary of compliance and enforcement activities. Under section 51 of the Act, the Registrar also is required to post every order issued on the Registry.

-

Producers are required to report single-use (primary) and rechargeable batteries that:

- Weigh 5 kg or less, and

- Are sold separately from products.

Examples include button cells, AA, AAA, C, D, 9V, lantern batteries, small, sealed lead acid (SLA) batteries, and replacement batteries for products such as drills, cell phones, and laptops.

Batteries that do not need to be reported are those that:

- Are sold with or in products (e.g., batteries included with cordless power tools, cell phones, laptops, toys, vapes, fire alarms)

- Weigh over 5 kg (e.g., car batteries, forklift batteries, stationary batteries)

Producers who wish to confirm if they are exempt because the type(s) of batteries they supply do not need to be reported should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

-

RPRA does not vet PROs before listing them on the website. Any business that registers as a PRO will be listed. Producers should do their own due diligence when determining which PRO to work with.

-

A brand is any mark, word, name, symbol, design, device or graphical element, or a combination thereof, including a registered or unregistered trademark, which identifies a product and distinguishes it from other products.

A brand holder is a person who owns or licenses a brand or otherwise has rights to market a product under the brand.

Note:

- If there are two or more brand holders, the producer most directly connected to the production of the material is the brand holder.

- If more than one material produced by different brand holders are marketed as a single package, the producer who is more directly connected to the primary product in the package is the brand holder.

-

Producers of batteries need to provide the following information when registering in RPRA’s Registry:

- Business information (e.g. business name, contact information)

- The year you began marketing or selling batteries into Ontario

- Any PROs you are contracted with

- Your annual Supply Report

-

Brand holders and producers that supply products and packaging are required by legislation to meet individual mandatory collection and resource recovery requirements and may face compliance and enforcement consequences for failing to do so. The executive attestation ensures that executives responsible for managing the brand holder’s or producer’s business are aware of these requirements and can ensure that appropriate measures are put in place to achieve compliance with the regulations.

-

The Authority recognizes the commercially sensitive nature of the information that parties submit to the registry. The Authority is committed to protecting the commercially sensitive information and personal information it receives or creates in the course of conducting its regulatory functions. In recognition of this commitment, the Authority, in addition to the regulatory requirements of confidentiality set out in the Resource Recovery and Circular Economy Act 2016 (section 57), has created an Access and Privacy Code that applies to its day-to-day operations, including the regulatory functions that it carries out.

Obligated material supply, collection, and resource recovery data will only be made public in aggregate form, to protect the confidentiality of commercially sensitive information.

The Authority will publish the names and contact information of all registered businesses – producers, service providers (collectors, haulers, processors, etc.), and producer responsibility organizations. The public will also have access to a list or method to locate any obligated material collection sites, as this information becomes available.

As part of its regulatory mandate, the Registrar will provide information to the public related to compliance and enforcement activities that have been undertaken.

The information that is submitted to the Registry will be used by the Registrar to confirm compliance and to track overall collection and management system performance. It will also be used by the Authority to update its policies and procedures and by the Ministry of Environment, Conservation and Parks for policy development.

-

Here are the lists of registered PROs:

Hazardous and Special Products PROs

These lists will continue to be updated as new PROs register with RPRA.

-

Battery, electronics, lighting and tire collection sites must be operated during regular business hours throughout the calendar year.

Household hazardous waste collection sites may open seasonally. The Where to Recycle map should reflect the time of the year when the collection site operates.

-

If a producer or service provider needs to adjust the performance data reported to RPRA, they must contact the Compliance Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., tonnage purchase or sale contract, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly as possible to ensure that it has accurate performance data from all registrants.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.

-

The recycling locations that appear on the map are reported to RPRA by PROs (or producers managing their own collection networks) as the administrators of the collection systems. The public collection activities that PROs report in their registry account are uploaded to the map in near real-time.

-

Program fees are charges that producers obligated under the Resource Recovery and Circular Economy Act, 2016, are required to pay to RPRA annually to recover its operational costs, including costs related to building and operating the registry, providing services to registrants, and compliance and enforcement activities.

All current and past fee schedules can be found here.

-

Yes. Producers and service providers can enter into contractual agreements with multiple PROs.

-

Consumer protection laws in Ontario prohibits the misrepresentation of charges, which means that producers or retailers cannot misrepresent any visible fees as a regulatory charge, tax, RPRA fee or something similar. Consumers who have questions or concerns about a specific transaction or want to report a misrepresentation can contact the Ministry of Public and Business Service Delivery at 1-800-889-9768.

As of March 2023, the promotion and education requirements related to environmental fees have been removed from the Tires, Batteries, Electrical and Electronic Equipment, and Hazardous and Special Products regulations. No changes were made to the Blue Box Regulation as it never contained promotion and education requirements related to these fees.

RPRA’s compliance bulletin Charging Tire Fees to Consumers has since been revoked and RPRA has ceased its enforcement of promotion and education requirements for visible fees across all materials.

-

Starting January 1, 2023, RPRA will collect 13% HST on all fees at the time of fee payment.

This decision is based on a ruling RPRA received from the CRA in which HST must be charged on its fees under the Resource Recovery and Circular Economy Act, 2016 (RRCEA). RPRA has determined that this ruling applies to all RRCEA producer responsibility programs and the Excess Soil and Hazardous Waste programs.

On December 22, 2022, RPRA will reissue invoices that were issued prior to January 1, 2023, amended to indicate that 13% HST was paid. From December 22 onwards, registrants will be able to access the amended invoices in their Registry accounts under a new tab labelled “Invoices”. The amended invoice will show an HST amount as well as the date the amended invoice was reissued.

Important notes:

- On the amended invoices there have been no changes to the Invoice Total and registrants will not be required to pay any additional monies to RPRA for past invoices.

- Registrants may be able to claim input tax credits for the HST collected on RPRA fees, for both the amended invoices and new invoices issued January 1, 2023, onwards. However, RPRA is not in a position to provide tax advice and suggests you consult your internal or external accountants to seek their counsel.

- All new invoices issued effective January 1, 2023, will contain appropriate information identifying the amount of the HST and other relevant details. These invoices will also be displayed under the “Invoices” tab in a registrants’ Registry account.

-

Collection sites for batteries, electronics, household hazardous waste, lighting, and tires that are reported by producers, or PROs on their behalf, appear on the map.

Collection sites that are considered private (e.g. a recycling bin inside a business that is not accessible to the public) do not appear on the map.

-

If your collection site isn’t part of a PRO’s collection network, it won’t appear on the map. The map populates collection sites with data entered by producers or PROs on their behalf.

If you are working with a PRO and your site is not listed on the map, contact your PRO.

If you aren’t already working with a PRO and want to add your collection site to the map, you can find a list of PROs and their contact information on the applicable program page of RPRA’s website.

-

A Verifier can be an individual, either an employee of the business or a hired third-party (including a PRO), who has one of the following designations and is not the same person who prepared the supply report:

- CPA (Chartered Professional Accountants) in Canada or CPA (Certified Public Accountant) in the US

- ACCA (Association of Chartered Certified Accounts) Qualification

- CIA (Certified Internal Auditor)

- CPB (Certified Professional Bookkeeper) in Canada

- RPA (Registered Professional Accountant) in Canada

-

RPRA’s Where to Recycle map displays locations across Ontario where the public can drop off used materials to be recycled, such as batteries, electronics, household hazardous waste (e.g., paint, antifreeze, pesticides), lighting and tires, for free. Materials collected at these locations are reused, refurbished, recycled, or properly disposed of to help keep them out of landfill, recover valuable resources and protect our environment. Learn more here.

-

The recycling locations that appear on the map are reported to RPRA by businesses that run the recycling systems in Ontario.

-

We encourage anybody who believes an entity is a free rider to contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca with information about that entity. RPRA reviews every free rider allegation that is referred to us.

We do not share information about our inspections or progress on specific free rider cases.

See our FAQ to understand “What is a free rider?” and “What is RPRA’s approach to free riders?”

-

A public collection site must be readily accessible to the public and accept designated used materials during regular business hours. Publicly accessible collection sites and events appear on the Where to Recycle map.

A private collection site (e.g. office or school that collects designated materials) does not need to be publicly accessible. Private collection sites do not appear on the map.

Read this related FAQ: What does it mean for a collection site to be readily accessible to the public?

-

Readily accessible to the public means a site can be accessed by any consumer who wants to drop off used materials for free to be recycled, reused or refurbished.

A public collection site cannot restrict the type of products accepted. For example, an electronics collection site cannot refuse to accept printers or large televisions. Retail stores are only required to accept materials of a similar size and function to the products supplied at that location. For example, a mobile phone kiosk may choose to accept only mobile phones.

Collection sites can request reasonable requirements when consumers drop off an item to ensure health and safety. For example, sites may require that used oil filters are dropped off in sealed containers, light tubes are taped together, etc.

Publicly accessible collection sites and events will appear on the Where to Recycle map.

Restrictions

If a collection site has restrictions, for example due to an Environmental Compliance Approval (ECA), municipal by-law, or fire code provision, the restrictions may be applied, and the collection site will still be considered readily accessible to the public. For example, a municipal depot that has an ECA to accept materials only from residents of the community can apply this restriction and still be considered readily accessible to the public. Similarly, a collection site with an ECA that prohibits collection from the industrial, commercial and institutional sectors may apply these restrictions and still be considered readily accessible to the public. And a collection site that has restrictions on how it can be accessed (such as drive-in only) may enforce these restrictions and still be considered readily accessible to the public.

Read this related FAQ: What is the difference between a public and private collection site?