Frequently Asked Questions

Results (29)

Click the question to read the answer.

-

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

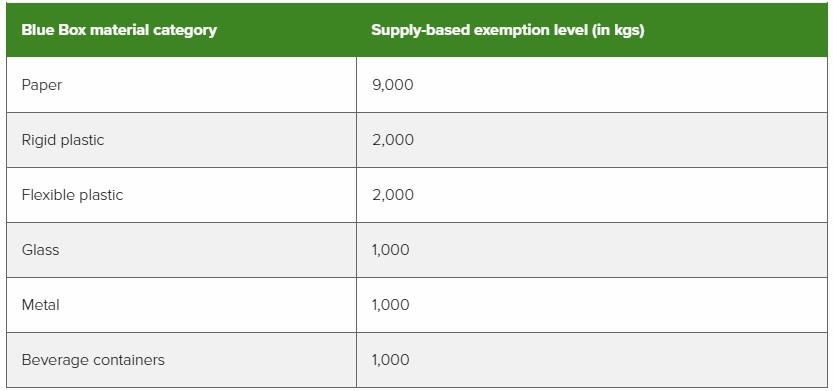

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.

-

An HSP producer qualifies for an exemption if their average weight of supply for the previous calendar year is less than or equal to the weight specified in the chart below:

Exempt (Less than <) Oil Filters 3.5 Non-refillable Pressurized Containers 3 Antifreeze 20 Oil Containers 2 Solvents 3 Paints and Coatings 10 Pesticides 1 Refillable Pressurized Containers N/A Mercury-containing Devices Fertilizers Propane Containers (refillable) See our FAQ “Am I a small, large, or exempt HSP producer?” to determine how to calculate if you are an exempt HSP producer.

HSP producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of HSP supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 1-833-600-0530 or registry@rpra.ca.

-

A lighting producer qualifies for an exemption if their average weight of supply for that calendar year is less than or equal to 700 kg.

Average supply weight is determined using the following formula:

Average weight of lighting supply = (Y3 + Y4 + Y5) / 3

Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Lighting producers that meet the exemption criteria are exempt from:

- Registering with and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Producers that are exempt must keep records of the materials they supplied, as set out in section 30 of the regulation.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

See our FAQs: “How are lighting producers’ minimum management requirements determined?” and “What do I have to do if I am an exempt lighting producer?”

-

A battery producer qualifies for an exemption if their average weight of supply for that calendar year is:

- Less than or equal to 2,500 kg of rechargeable batteries, or

- Less than or equal to 5,000 kg of primary batteries.

Average supply weight is determined using the following formula:

Average weight of rechargeable batteries = (Y3 + Y4 + Y5) / 3

- Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Average weight of primary batteries = (Y2 + Y3 + Y4) / 3

- Eg. 2025 average weight of supply = (2023 + 2022 + 2021) / 3

Battery producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA.

- Establishing a collection and management system.

- Meeting management requirements.

- Promotion and education requirements.

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of batteries (by category) supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

Also see our FAQ: ‘How are battery producers’ minimum management requirements determined?‘

-

An ITT/AV producer qualifies for an exemption if their average weight of supply for that calendar year is less than or equal to 5,000 kg.

Average supply weight is determined using the following formula:

Average weight of ITT/AV supply = (Y3 + Y4 + Y5) / 3

Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

ITT/AV producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of ITT/AV supplied into Ontario each year and provide them to the RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

-

A tire producer qualifies for an exemption if their average weight of supply for that calendar year is less than 1,175 kg.

Average supply weight is determined using the following formula:

Average weight of tire supply = (Y3+Y4+Y5) / 3

E.g. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Tire producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of tires supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

-

No, where a producer is exempt, the regulatory obligations do not become the responsibility of the organization that is next in the producer hierarchy. The exempt producer remains the “producer” for those materials; they are just exempt from certain requirements under the regulation as set out in the relevant provisions providing for the exemption. This is the case in all RRCEA regulations.

-

Producers can reference the chart below to determine if they are a small, large or exempt HSP producer.

Producer categories use the average weight of material (in tonnes) supplied in Ontario in the previous calendar year.

Type of HSP Exempt (Less than <) Small Producer Large Producer (Equal to or greater than >) Oil Filters 3.5 ⟷ 100 Non-refillable Pressurized Containers 3 ⟷ 100 Antifreeze 20 ⟷ 300 Oil Containers 2 ⟷ 55 Solvents 3 ⟷ 70 Paints and Coatings 10 ⟷ 1,000 Pesticides 1 ⟷ 9 Refillable Pressurized Containers N/A Mercury-containing Devices Fertilizers Propane Containers (refillable) Note that ‘⟷’ indicates a value greater than ‘Exempt’ but less than ‘Large Producer’ threshold.

Average supply weight is determined using the following formula:

Average weight of HSP supply = (Y1 + Y2 + Y3) / 3

E.g. 2025 average weight of supply = (2024 + 2023 + 2022) / 3

-

An exempt producer is not required to:

- Register and report to RPRA

- Establish a collection and management system

- Meet a management requirement

- Meet promotion and education requirements

Exempt producers must retain records related to the weight of lighting supplied into Ontario each year and provide them to RPRA upon request.

See our FAQ: ‘How do I determine if I am an exempt lighting producer?’

-

There is an exemption in the Blue Box regulation for producers whose gross annual revenue generated from products and services in Ontario less than $2 million. The revenue that counts towards the exemption is revenue from products and services. Charitable donations are not revenue from products and services and therefore does not count towards the exemption. Revenue other than charitable donations that are recorded from registered charities will be considered revenue from products and services.

-

Yes. The new Subject Waste Program Regulation under the Resource Recovery and Circular Economy Act, 2016, preserves and clarifies existing Hazardous Waste Program fee exemptions, which RPRA must follow when recovering the cost to operate the HWP Registry.

Existing exemptions include:

- Municipal hazardous or special waste

- Contaminated sites

- Emergencies (spills)

- Tonnage-fee exempt recycling facilities

-

There is an exemption in the Blue Box Regulation for producers whose gross annual revenue generated from products and services in Ontario is less than $2 million. The following sources are excluded for the purpose of determining revenue:

- Government tax revenue

- Property taxes

- General assistance funding received under the Ontario Municipal Partnership Fund

- Payments in lieu of taxes

- Canadian or Ontarian government grants available to municipalities with the intent of investing in public infrastructure

-

A producer’s management requirement is how much Blue Box material they must ensure is collected and processed into recovered resources each year. Management requirements are calculated based on what they supplied into Ontario one year prior and the resource recovery percentage as set in the regulation. A producer’s management requirement is calculated separately for each Blue Box material category (beverage container, glass, flexible plastic, rigid plastic, metal and paper).

Some producer are exempt from having a management requirement based on their supply data, for more information on exemptions see the FAQ Are there exemptions for Blue Box producers? A producer that does not have a management requirement does not have any collection, management or promotion and education obligations.

A producer with a management requirement must also provide collection and promotion and education services in Ontario. Most producers will contract the services of a producer responsibility organization (PRO) to meet their collection, management and promotion and education obligations.

To view your management requirement(s), log into your registry account, download a copy of your Blue Box Supply Report and review the section with your minimum management requirements. Management requirement for a given year are determine by supply data from two years prior. For example, 2023 management requirements were based on 2021 supply data (submitted in producers’ 2022 Supply Report).

Unsure if you are a Blue Box producer? See our FAQs Am I a producer of Blue Box product packaging? And Am I a producer of paper products and packaging-like products?

-

A newspaper producer is a person who supplies newspapers to consumers in Ontario. For the purpose of the Blue Box Regulation, newspapers include broadsheet, tabloid or free newspaper. For further information, see the FAQ: What is a newspaper?

Note that a producer of supplemental advertisements or flyers that are supplied with a newspaper would not be considered a newspaper producer as they do not supply the actual broadsheet, tabloid, or free newspaper. This producer cannot use the newspaper exemption percentage to be exempt from Blue Box collection and management requirements. See the FAQ: Are there exemptions for Blue Box producers?

-

Effective for the 2025 calendar year, and every year thereafter, producers no longer have collection targets and do not have to collect a minimum weight of used tires.

A producer’s individual management requirement is determined by formulas found in section 12 of the Regulation. See the tables below for details:

Management requirements for all tires

Performance Year Supply Report Year Formula *2025 2024 [(2020 supply + 2021 supply + 2022 supply) / 3)]×65% 2026 2025 [(2021 supply + 2022 supply + 2023 supply) / 3)]×65% 2027 2026 [(2022 supply + 2023 supply + 2024 supply) / 3)]×65% 2028 2027 [(2023 supply + 2024 supply + 2025 supply) / 3)]×65% 2029 2028 [(2024 supply + 2025 supply + 2026 supply) / 3)]×65% 2030 2029 [(2025 supply + 2026 supply + 2027 supply) / 3)]×70% Management requirements for large tires

Performance Year Supply Report Year Formula *2025 2024 [(2020 supply + 2021 supply + 2022 supply) / 3)]×60% 2026 2025 [(2021 supply + 2022 supply + 2023 supply) / 3)]×60% 2027 2026 [(2022 supply + 2023 supply + 2024 supply) / 3)]×60% 2028 2027 [(2023 supply + 2024 supply + 2025 supply) / 3)]×60% 2029 2028 [(2024 supply + 2025 supply + 2026 supply) / 3)]×60% 2030 2029 [(2025 supply + 2026 supply + 2027 supply) / 3)]×60% *For reports submitted in 2024, producers should use RPRA’s manual calculator.

It is important to note that producers must ensure that all collected tires are managed, regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA.

See our FAQ ‘How do I determine if I am an exempt tire producer?’ to learn more.

-

A producer’s individual management requirement is determined by formulas found in section 13 of the Regulation. See the table below for details:

Supply Report Year for Primary Batteries Supply Report Year for Rechargeable Batteries Formula Performance Year 2023 2022 [(2023+2022+2021)/3] + (2022+2021+2020)/3] × 45% 2025* 2024 2023 [(2024+2023+2022)/3] + (2023+2022+2021)/3] × 50% 2026 2025 2024 [(2025+2024+2023)/3] + (2024+2023+2022)/3] × 50% 2027 2026 2025 [(2026+2025+2024)/3] + (2025+2024+2023)/3] × 50% 2028 *For reports submitted in 2024, producers should use RPRA’s manual calculator.

It is important to note that producers must ensure that all collected batteries are managed, regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA.

See our FAQ ‘How do I determine if I am an exempt battery producer?’ to learn more.

-

A producer’s individual management requirements are determined by formulas found in section 14 of the Regulation, summarized in the table below:

Performance Year Supply Report Year Formula 2025 2024 (2020 supply + 2021 supply + 2022 supply) / 3×65%* 2026 2025 (2021 supply + 2022 supply + 2023 supply) / 3×65% 2027 2026 (2022 supply + 2023 supply + 2024 supply) / 3×65% 2028 2027 (2023 supply + 2024 supply + 2025 supply) / 3×65% 2029 2028 (2024 supply + 2025 supply + 2026 supply) / 3×65% 2030 2029 (2025 supply + 2026 supply + 2027 supply) / 3×70% *For reports submitted in 2024, producers should use RPRA’s manual calculator

It is important to note that producers must ensure that all ITT/AV collected is managed regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA. See our FAQ ‘How do I determine if I am an exempt ITT/AV producer?’ to learn more.

-

Yes, there are some key changes to the data reported to Stewardship Ontario and what needs to be reported under the new regulation, which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- There are fewer reporting categories than under the Stewardship Ontario program

- Certified compostable packaging and products now must be reported separately, but this category does not have management requirements

- There are only two deductions permitted under the Blue Box Regulation, and producers must report total supply and then report any weight to be deducted separately

- Exemptions are based on tonnage supply under each material category instead of a total supply weight threshold of less than 15 tonnes as in Stewardship Ontario’s program

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”; “Are there exemptions for Blue Box producers?“; “Are there any differences in Blue Box producer hierarchies between the current Stewardship Ontario program and the new Blue Box Regulation?”; and “Are there are any differences in obligated Blue Box materials between the current Stewardship Ontario program and the new Blue Box Regulation?”

-

A producer’s individual minimum management requirement is determined by the following formulas, found in section 14 of the Electrical and Electronic Equipment (EEE) Regulation, summarized in the following chart:

Performance Year Supply Report Year Formula 2025 2024 (2020 supply + 2021 supply + 2022 supply) / 3×30% 2026 2025 (2021 supply + 2022 supply + 2023 supply) / 3×30% 2027 2026 (2022 supply + 2023 supply + 2024 supply) / 3×30% 2028 2027 (2023 supply + 2024 supply + 2025 supply) / 3×30% 2029 2028 (2024 supply + 2025 supply + 2026 supply)/ 3×30% 2030 2029 (2025 supply + 2026 supply + 2027 supply)/ 3×30% 2031 2030 (2026 supply + 2027 supply + 2028 supply)/ 3×35% It is important to note that producers must ensure that all lighting that is collected is managed, regardless of their minimum management requirement.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA. See our FAQ ‘How do I determine if I am an exempt lighting producer?’ to learn more.

-

You are a tire collector if you operate a tire collection site where more than 1000 kgs of tires are collected in a year. A tire collection site is a location where used tires are collected, including:

- Repair shops, garages and vehicle dealerships (where used tires are collected as part of changing tires for customers)

- Auto salvage and recycling sites

- Any other site where end-of-life vehicles with tires are managed

You are not a tire collector if you operate a tire collection site where you:

- Also retread tires or process tires (you would be a tire retreader or a tire processor for those sites); or

- Only collect tires from the on-site servicing of vehicles that you own or operate (such as a site where you service your rental car fleet)

Municipalities can choose to operate collection sites, but they are exempt from registering with RPRA. For more information about municipal sites see: How does the Tires Regulation affect municipalities and First Nations?

-

If you collect used tires at your site as a result of onsite servicing of your vehicles, you are not a tire collector for the purposes of the Tires Regulation and you are exempt from registering as a collector with RPRA.

-

Producers are required to report single-use (primary) and rechargeable batteries that:

- Weigh 5 kg or less, and

- Are sold separately from products.

Examples include button cells, AA, AAA, C, D, 9V, lantern batteries, small, sealed lead acid (SLA) batteries, and replacement batteries for products such as drills, cell phones, and laptops.

Batteries that do not need to be reported are those that:

- Are sold with or in products (e.g., batteries included with cordless power tools, cell phones, laptops, toys, vapes, fire alarms)

- Weigh over 5 kg (e.g., car batteries, forklift batteries, stationary batteries)

Producers who wish to confirm if they are exempt because the type(s) of batteries they supply do not need to be reported should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

-

The regulation requires notices to be filed for three types of activities:

1. Notice filings for excess soil from Project Areas that can be made by a Project Leader or Authorized Person and may require retaining a Qualified Person. These notices will be required starting January 1st, 2022, before soil that will become excess soil is removed from the Project Area. There will be two fillings for each notice:

- An initial filing before the soil is removed, which will require the following information to be provided:

-

- a description of the project and Project Area including the location of each property within the project area

- the contact information of the Project Leader, Operator or Authorized Person and the person responsible for transportation, and if applicable, the qualified person

- an estimated amount of the soil that will be generated broken down by quality standard

- a list of substances/materials that were added to the soil

- the location of temporary or final sites that the soil will be transported to

- details of the Reuse Site(s) where the soil will be moved to

- information on any peer review or certification processes if applicable

- and a declaration by the Project Leader.

Exceptions

The Project Leader, Operator or Authorized Person may file a notice after soil that will become excess soil has been removed from the project area if:

- conducting the required sampling and analysis at the project area is impractical

- the soil is removed from the project area and delivered to a temporary site to conduct the required sampling, and

- the Project Leader, Operator or Authorized Person makes sure the required sampling is conducted as soon as the soil is delivered to the temporary site

If soil is removed before a notice is filed in the Registry, the Project Leader, Operator, or Authorized Person is required to ensure that the notice is filed in the Registry before the soil that has become excess soil is transported from the temporary site to the final site.

More information about when this type of notice filing is not required can be found under Schedule 2 of the regulation.

The Project Leader or Authorized Person is required to update notice filings that are no longer complete or accurate within 30 days after the day the person becomes aware that the information is no longer complete or accurate.

2. A final notice within 30 days after excess soil has been removed from the Project Area or temporary site which will require the following information:

- the amount of excess soil removed from the Project Area that was deposited at: a class 1 soil management site, a class 2 soil management site, a reuse site, a local waste transfer facility, and a landfilling site or dump

- the date on which the last load of excess soil was removed from the project area or temporary site

- a declaration by the Project Leader

2. Notice filings for Residential Development Soil Depots can be made by an Owner, Operator, or Authorized Person. This notice will be required before excess soil is deposited on a residential development soil depot site if the depot commences operation on or after January 1, 2022, or if the depot was already in operation when the requirement to file a notice comes into effect, the notice should be filed ahead of January 1, 2022.

The Owner or Operator of the Residential Development Soil Depot must ensure that the quality of the excess soil accepted and managed at the depot meets the applicable Excess Soil Quality Standards set out in the regulation. There will be two filings for each notice:

- An initial filing before the soil is received, which will require the following information to be provided:

- the site location

- the contact information of the Site Owner and Operator

- the project commencement date

- the estimated amount of soil (including inventory on-site)

- the site instrument identification

- and a declaration by the Site Owner or Operator.

- A final filling within 90 days of the depot closing indicating the date when the depot ceased operations, and a declaration by the Site Owner or Operator.

3. Notice filings for Reuse Sites can be made by a Site Owner, Operator, or an Authorized Person. These will be required starting January 1st, 2022, and apply to a Reuse Site that expects at least 10,000 m3 of excess soil to be deposited after January 1st, 2022 (including Reuse Sites that were in operation before that date). There will be two filings for each notice:

- An initial filing before the excess soil is deposited, which will require the following information to be provided:

- the site location/property type

- the contact information of the Site Owner and Operator

- a description of the undertaking

- the applicable excess soil quality standards for the site

- the estimated amount of soil by quality standard

- the estimated dates when the first and last soil load will be deposited

- the site instrument identification

- and a declaration by the Site Owner or Operator.

- A final notice filing within 30 days after the final load of excess soil has been deposited at the Reuse Site which will require the following information:

- confirmation that all excess soil that will be reused for a beneficial purpose has been deposited at the reuse site

- the total amount of excess soil that was deposited

- the date the final load of excess soil was deposited

- and a declaration by the owner or operator.

The Site Owner or Operator is required to update notice filings that are no longer complete or accurate within 30 days after the day the person becomes aware that the information is no longer complete or accurate.

Exemptions:

Reuse Sites that are part of infrastructure projects are not required to file notices.

-

As of October 1, 2021, producers are required to establish and operate a collection system that meets the accessibility requirements in the regulation. Producers must ensure that all HSP collected is managed regardless of what their minimum management requirements are.

Producers have the choice of establishing and operating their own collection and management systems or working with one or more producer responsibility organizations (PROs) registered with RPRA to meet their obligations.

Large producers have an additional requirement to provide call-in collection services. Learn more.

Please contact the Compliance Team at 1-833-600-0530 or registry@rpra.ca to discuss other requirements under the HSP Regulation.

See our FAQ to understand “Am I a small, large or exempt HSP producer?“. For more guidance, read the Hazardous and Special Products Collection Systems Compliance Bulletin.

-

Yes, in October 2022, RPRA has migrated the facility and waste stream data identified below to the new registry to minimize the volume of data users would otherwise have to enter from scratch.

Data that has been migrated into the Registry from HWIN includes:

- Active generators accounts:

- Generator ID

- Company details

- Site location

- Company official / alternate HWIN Administrator details

- Site Details

- Waste Identification (for active wastes):

- Waste Class

- Waste Stream

- Land Disposal Restrictions (LDR) Notification Form

- Fee exemptions

- Carrier and Receiver Environmental Compliance Approval (ECA) information:

- ECA number

- Company Name

- Site location

- Company admin / official information

- Waste codes

*The following data has not been migrated:

- Generator accounts where the generator number or ID begins with ONR or ONF

- Inactive waste streams and facilities

- Manifests

- On-site processing, storage and disposal information

- LDR questionnaires (only LDR notification forms will be migrated)

- Financial information (including account balances, payment information)

- Document attachments (such as copies of Environmental Compliance Approvals)

Note: while some recently expired generator accounts might have been migrated to the registry, users should have ensured that their data in the HWIN system is accurate and up to date ahead of the migration in October to ensure their data is accessible in the registry. This may have included reactivating inactive waste streams and facilities in HWIN in order for them to be migrated to the registry.

-

Fees are tied to the activities that generators report on or that are reported on their behalf by authorized generator delegates (AGDs) (e.g., manifests and on-site storage, processing and disposal). Fees will be invoiced on the first day of each month and will include all manifests completed in the previous month.

RPRA consulted industry stakeholders on the 2025 HWP Registry Fees from September 27 to November 12, 2024 and, based on the feedback received, the HWP Registry Fees have been set on the following basis:

- fees is charged to generators only, aligning with the current Hazardous Waste Program fee structure

- the manifest fee has been set at $6, the same rate as today, and will be charged per manifest

- the tonnage fee has been set at $27.50, instead of the past $30 fee, and will only apply to shipped hazardous waste and hazardous waste that is disposed on site which remains the same as today’s framework

- there is no annual registration fee

- all existing fee exemptions are maintained, as per Ontario Regulation 323/22: Subject Waste Program

View the 2025 HWP Registry Fees Schedule

See FAQ: Will I pay my fees using a prepaid account like HWIN?

-

RPRA consulted industry stakeholders on the 2025 HWP Registry Fees from September 27 to November 12, 2024 and, based on the feedback received, the HWP Registry Fees have been set on the following basis:

- fees will be charged to generators only, aligning with the current Hazardous Waste Program fee structure

- the manifest fee will be set at $6, the same rate as today, and will be charged per manifest

- the tonnage fee has been set at $27.50, instead of the current $30 fee, and will only apply to shipped hazardous waste and hazardous waste that is disposed on site which remains the same as today’s framework

- there will be no annual registration fee

- all existing fee exemptions will be maintained, as per Ontario Regulation 323/22: Subject Waste Program

-

For most producers and for all municipalities, little has changed:

- Rule creators and the rule creation process, including the allocation table, have been removed. Instead, each producer is responsible for providing Blue Box collection to every eligible source in Ontario and creating a province-wide system for collection.

- Producer Responsibility Organizations (PROs) are now required to submit a report to RPRA on how they will operate the Blue Box system on behalf of producers.

- Newspaper producers whose newspaper supply accounts for more than 70% of their total Blue Box supply to consumers in Ontario are exempt from collection, management, and promotion and education requirements.

The amendments do not change or impact:

- Producer registration or 2020 supply data reporting to RPRA

- Most producers’ 2021 supply data reporting to RPRA

- The materials collected in the Blue Box system

- The communities that receive collection or the collection requirements

- The transition schedule and its timelines

-

The Manage PRO option will appear on the dashboard below your list of supply data reports when your supply data reporting is complete and if you have management requirements. If your supply data reporting is below the supply exemption threshold you will not have management requirements, and therefore not need to assign a PRO to assist with your obligations.

Also note that Account Admin are the only portal users that can manage your PRO’s responsibility, so this widget is not viewable to primary and secondary users.