Frequently Asked Questions

Results (143)

Click the question to read the answer.

-

Here are the lists of registered PROs:

Hazardous and Special Products PROs

These lists will continue to be updated as new PROs register with RPRA.

-

When paying fees to RPRA, you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI; also commonly known as ACH or EFT)

- Electronic bill payment

- Cheque

For instructions on how to submit payment by the method you chose, read one of the following FAQs:

- How do I pay my fees to RPRA by credit card?

- How do I pay my fees to RPRA by bank withdrawal (pre-authorized debit)?

- How do I pay my fees to RPRA by electronic bill?

- How do I pay my fees to RPRA by cheque?

- How do I pay my fees to RPRA by electronic data interchange (EDI)?

To note, Registry invoices are considered due on receipt. Invoices are in CAD funds and payments must be sent in CAD.

-

We recommend using Google Chrome, Mozilla Firefox, Microsoft Edge or Apple Safari when accessing the Registry. If you are experiencing an issue with the Registry, try clearing your cache or updating the browser to the latest version.

If you are using a different browser, the Registry will not function.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

No, producers are not required to sign up with a PRO to meet their regulatory requirements. It is a business decision if a producer chooses to work with a PRO, and a producer can choose to meet their obligations without a PRO.

Most producers will choose to contract with a PRO to provide collection, hauling, processing, retreading and/or refurbishing services to achieve their collection and management requirements unless they carry out these activities themselves.

-

No. A PRO cannot report on behalf of service providers.

-

Yes. Producers and service providers can enter into contractual agreements with multiple PROs.

-

Program fees are charges that producers obligated under the Resource Recovery and Circular Economy Act, 2016, are required to pay to RPRA annually to recover its operational costs, including costs related to building and operating the registry, providing services to registrants, and compliance and enforcement activities.

All current and past fee schedules can be found here.

-

Under the Resource Recovery and Circular Economy Act, the Authority is required to provide an annual report to the Minister that includes information on aggregate producer performance, and a summary of compliance and enforcement activities. Under section 51 of the Act, the Registrar also is required to post every order issued on the Registry.

-

A producer responsibility organization (PRO) is a business established to contract with producers to provide collection, management, and administrative services to help producers meet their regulatory obligations under the Regulation, including:

- Arranging the establishment or operation of collection and management systems (hauling, recycling, reuse, or refurbishment services)

- Establishing or operating a collection or management system

- Preparing and submitting reports

PROs operate in a competitive market and producers can choose the PRO (or PROs) they want to work with. The terms and conditions of each contract with a PRO may vary.

-

No. The Authority does not administer contracts or provide incentives. Under the Regulations, producers will either work with a producer responsibility organization (PRO) or work directly with collection sites, haulers, refurbisher’s and/or processors to meet their collection and management requirements. Any reimbursement for services provided towards meeting a producers’ collection and management requirements will be determined through commercial contracts.

To discuss any payment, contact your service provider or a PRO. RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

To create a Registry account with the Authority, you will need to provide:

- CRA Business Number (BN)

- Legal Business Name

- Business address and phone number

- Address of where you work (if different from the main office)

- Contact information for your billing contact (this may also be added later)

-

For regulatory purposes, we need to know your legal name — the name you are incorporated under. We also need to know your business operating name if it is different from your legal business name to add to our published list of registrants. The list of registrants will be available on our website to allow registrants to interact with one another and to provide information to the public.

For example, if you are a registered collector and your legal name is 123456789 Ontario Ltd. and your business operating name is “Jack’s Garage,” a member of the public looking for a place to drop off used tires will need to know the name you are operating under to identify your location.

-

Brand holders and producers that supply products and packaging are required by legislation to meet individual mandatory collection and resource recovery requirements and may face compliance and enforcement consequences for failing to do so. The executive attestation ensures that executives responsible for managing the brand holder’s or producer’s business are aware of these requirements and can ensure that appropriate measures are put in place to achieve compliance with the regulations.

-

Individual Producer Responsibility (IPR) means that producers are responsible and accountable for collecting and managing their products and packaging after consumers have finished using them.

For programs under the Resource Recovery and Circular Economy Act, 2016 (RRCEA), producers are directly responsible and accountable for meeting mandatory collection and recycling requirements for end of life products. With IPR, producers have choice in how they meet their requirements. They can collect and recycle the products themselves, or contract with producer responsibility organizations (PROs) to help them meet their requirements.

-

The Authority is the regulator designated by law to oversee the operation and wind up of current waste diversion programs under the Waste Diversion Transition Act, 2016. The Authority provides oversight, compliance, and enforcement activities with respect to regulations made under the Resource Recovery and Circular Economy Act, 2016.

-

The Authority recognizes the commercially sensitive nature of the information that parties submit to the registry. The Authority is committed to protecting the commercially sensitive information and personal information it receives or creates in the course of conducting its regulatory functions. In recognition of this commitment, the Authority, in addition to the regulatory requirements of confidentiality set out in the Resource Recovery and Circular Economy Act 2016 (section 57), has created an Access and Privacy Code that applies to its day-to-day operations, including the regulatory functions that it carries out.

Obligated material supply, collection, and resource recovery data will only be made public in aggregate form, to protect the confidentiality of commercially sensitive information.

The Authority will publish the names and contact information of all registered businesses – producers, service providers (collectors, haulers, processors, etc.), and producer responsibility organizations. The public will also have access to a list or method to locate any obligated material collection sites, as this information becomes available.

As part of its regulatory mandate, the Registrar will provide information to the public related to compliance and enforcement activities that have been undertaken.

The information that is submitted to the Registry will be used by the Registrar to confirm compliance and to track overall collection and management system performance. It will also be used by the Authority to update its policies and procedures and by the Ministry of Environment, Conservation and Parks for policy development.

-

In accordance with the legislation (Resource Recovery Circular Economy Act 2016, section 57), the Authority is required to comply with strict confidentiality requirements. The Authority has also developed an Access and Privacy Code that applies to its day-to-day operations.

The Registry has been developed according to cybersecurity best practice principles. This includes VPN-based restrictions, staff training on all cybersecurity policies, staff access to the Registry on a strict role-requirement basis, and registry interface security features (example: two-factor authentication).

-

Businesses have the choice to recover the cost of recycling their products by incorporating those costs into the overall cost of their product (as they do with other costs, such as materials, labour, other regulatory compliance costs, etc.) or by charging it as a separate fee to consumers.

Environmental fees are not mandatory and are applied at the discretion of the business charging them, including the amount of the fee.

-

Consumer protection laws in Ontario prohibits the misrepresentation of charges, which means that producers or retailers cannot misrepresent any visible fees as a regulatory charge, tax, RPRA fee or something similar. Consumers who have questions or concerns about a specific transaction or want to report a misrepresentation can contact the Ministry of Public and Business Service Delivery at 1-800-889-9768.

As of March 2023, the promotion and education requirements related to environmental fees have been removed from the Tires, Batteries, Electrical and Electronic Equipment, and Hazardous and Special Products regulations. No changes were made to the Blue Box Regulation as it never contained promotion and education requirements related to these fees.

RPRA’s compliance bulletin Charging Tire Fees to Consumers has since been revoked and RPRA has ceased its enforcement of promotion and education requirements for visible fees across all materials.

-

There is no set environmental fee for any product, the amount of the fee charged is decided by the business.

-

No. An environmental fee is not a government tax and cannot be represented as mandatory, a regulatory charge, or a RPRA fee. It is a fee charged at the discretion of a business to recover their costs related to recycling the product.

-

If you are concerned about the fee you were charged, you should contact the business that charged you the fee to request a more detailed explanation of how the fee was determined.

-

Under the Blue Box Regulation, blue box product packaging includes:

- Primary packaging is for the containment, protection, handling, delivery and presentation of a product at the point of sale, including all packaging components, but does not include convenience packaging or transport packaging (e.g., film and cardboard used to package a 24-pack of water bottles and the label on the water bottle).

- Transportation packaging which is provided in addition to primary packaging to facilitate the handling or transportation of one or more products such as a pallet, bale wrap or box, but does not include a shipping container designed for transporting things by road, ship, rail or air.

- Convenience packaging includes service packaging and is used in addition to primary packaging to facilitate end users’ handling or transportation of one or more products. It also includes packaging that is supplied at the point of sale by food-service or other service providers to facilitate the delivery of goods and includes items such as bags and boxes that are supplied to end users at check out, whether or not there is a separate fee for these items.

- Service accessories are products supplied with a food or beverage product and facilitate the consumption of that food or beverage product and are ordinarily disposed of after a single use, whether or not they could be reused (e.g., a straw, cutlery or plate).

- Ancillary elements are integrated into packaging (directly hung or attached to packaging) and are intended to be consumed or disposed of with the primary packaging. Ancillary elements help the consumer use the product. Examples of ancillary packaging include a mascara brush forming part of a container closure, a toy on the top of candy acting as part of the closure, devices for measuring dosage that form part of a detergent container cap, or the pouring spout on a juice or milk carton.

-

Under the Blue Box Regulation, paper products include printed and unprinted paper, such as a newspaper, magazine, greeting cards, calendars (promotional or purchased), notebooks and daily planners, promotional material, directory, catalogue or paper used for copying, writing or any other general use.

Hard or soft cover books and hardcover periodicals are not considered paper products.

-

Under the Blue Box Regulation, a packaging-like product is:

- ordinarily used for the containment, protection, handling, delivery, presentation or transportation of things

- ordinarily disposed of after a single use

- not used as packaging when it is supplied to the consumer

Packaging-like products include aluminum foil, a metal tray, plastic film, plastic wrap, wrapping paper, a paper bag, beverage cup, plastic bag, cardboard box or envelope, but does not include a product made from flexible plastic that is ordinarily used for the containment, protection, or handling of food, such as cling wrap, sandwich bags, or freezer bags.

If a producer is unsure whether or not their product is a packaging-like product, they can ask themselves the following questions to help determine whether the product is obligated to be reported under the Blue Box Regulation:

- Is the product actually packaging around a separate product?

- If yes, the product is not a packaging-like product. Instead, the product is considered blue box packaging and must be reported as blue box material. If no, continue to the next question.

- Is the product used for the containment, protection, handling, delivery, presentation or transportation of a thing(s)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product typically disposed of after a single use (regardless if some may wash and reuse it)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product made from flexible plastic that is for the containment, protection or handling of food?

- If yes, the product is not a packaging-like product. If no, the product is a packaging-like product and must be reported as blue box material.

If a producer is still unsure whether or not their product is a packaging-like product, they should contact the Compliance and Registry Team at 833-600-0530 or registry@rpra.ca.

-

As the Regulator responsible for enforcing regulations under the Resource Recovery and Circular Economy Act, 2016, the Registrar uses their discretion for when it is necessary to give registrants more time to collect the information needed for registration and/or reporting.

-

See our FAQ to understand “What is blue box product packaging?”.

Product packaging added to a product can be added at any stage of the production, distribution and supply of the product. A person adds packaging to a product if they:

- make the packaging available for another person to add the packaging to the product

- cause another person to add the packaging to a product

- combine the product and the packaging

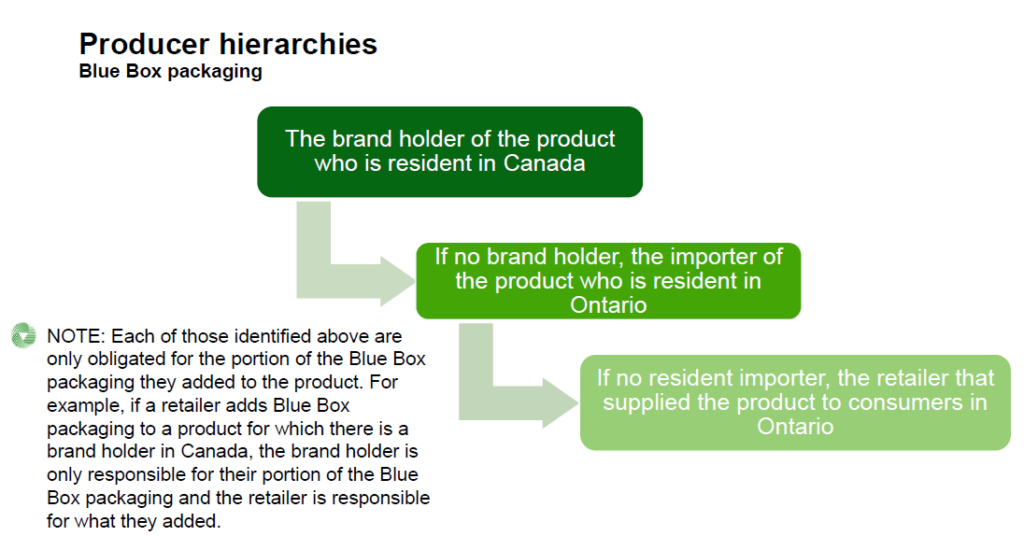

For the portion of the product packaging that a brand holder added to the product, a person is considered a producer:

- if they are the brand holder of the product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For the portion of the product packaging that an importer of the product into Ontario added to the product, a person is considered a producer:

- if they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For any portion of the packaging that is not described above, the producer is the retailer who supplied the product to consumers in Ontario.

-

See our FAQs to understand “What are paper products?” and “What are packaging-like products?”.

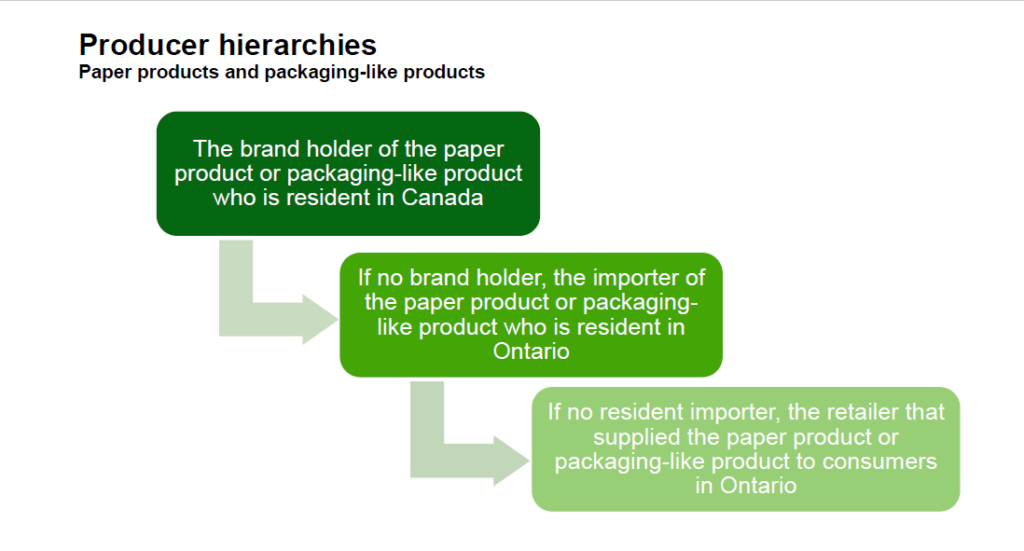

For paper products and packaging-like products, a person is considered a producer:

- if they are the brand holder of the paper product or packaging-like product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the paper product or packaging-like product from outside of Ontario

- if no resident importer, they are the retailer that supplied the paper product or packaging-like product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

-

No, transport packaging is only obligated when supplied to a consumer in Ontario. Any transport packaging removed by a retailer or other entity before the product is supplied to a consumer is not obligated under this regulation.

-

No, products or packaging designated as Hazardous and Special Products (HSP) are not obligated under the Blue Box Regulation. For example, primary packaging for paints and coatings are HSP and therefore not obligated as Blue Box materials.

Some packaging for HSP products may still be obligated. For example, the packaging that contains an oil filter is obligated as Blue Box materials.

Consult the HSP Regulation or the Compliance and Registry Team for further information.

-

The brand holder is the obligated producer.

A marketplace facilitator only becomes obligated for products supplied through its marketplace where the producer would have been a retailer. If the producer is a brand holder or an importer, they remain the obligated producer even when products are distributed by a marketplace facilitator.

A retailer is a business that supplies products to consumers, whether online or at a physical location.

-

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).

-

RPRA does not vet PROs before listing them on the website. Any business that registers as a PRO will be listed. Producers should do their own due diligence when determining which PRO to work with.

-

Sections 54 and 55 of the Blue Box Regulation require municipalities and First Nations to submit the information in the Initial Report and Transition Report to the Authority.

Under the Blue Box Regulation, producers will be fully responsible for the collection and management of Blue Box materials that are supplied into Ontario. To ensure that all communities continue to receive Blue Box collection services, communities will be allocated to producers, or PROs on their behalf, who are obligated to provide collection services. The information that is submitted in the Initial and Transition Reports will be used by PROs to plan for collection in each eligible community.

The Authority will also use the information provided by municipalities and First Nations to ensure that producers are complying with their collection obligations under the Blue Box Regulation.

It is important that municipalities and First Nations complete these reports accurately so that all eligible sources (residences, facilities, and public spaces) in their communities continue to receive Blue Box collection after their community transitions to full producer responsibility.

-

There are three reports for eligible communities under the Blue Box Regulation: an Initial Report, a Transition Report and Change Reports.

- The Initial Report will be submitted by all communities in 2021. It will provide an overview of the communities and of the WDTA Blue Box program that operates in that community.

- The Transition Report will be submitted by communities 2 years prior to their transition year. It provides more detailed information about the WDTA Blue Box program that operates in the community.

- Local municipalities and local services boards are not required to submit Change Reports to update information provided in their Initial or Transition Reports. Any changes should be addressed with Circular Materials in their role as the Administrator of the common collection system. Contact operations@circularmaterials.ca for more information.

These reports need to be completed by all eligible communities under the Blue Box Regulation.

An eligible community is a local municipality or local services board area that is not located in the Far North, or a reserve that is registered by a First Nation with the Authority and not located in the Far North.

- The Far North has the same meaning as in the Far North Act, 2010. To determine whether a community is in the Far North, use this link.

- A local municipality means a single-tier municipality or a lower-tier municipality. A local services board has the same meaning as “Board” in the Northern Services Boards Act.

- A First Nation means a council of the Band as referred to in subsection 2(1) of the Indian Act (Canada).

If you are an upper-tier municipality or waste association, these reports must be submitted separately for each eligible community in your program.

Visit the Municipal and First Nation webpages for more information.

-

Yes, all eligible communities must submit these reports to the Authority. The Datacall is the source of data for determining the net Blue Box system cost and for allocating funding under the Blue Box Program Plan. The Initial and Transition reports are for a separate and distinct program than Datacall and are required under the new Blue Box Regulation, which requires eligible communities to submit these reports.

While some of the required information in these reports was reported to Datacall, much of the information was not. Where there is overlap between what was reported to Datacall and the information that is required in these reports, please see the guidance below on where to find this information in your Datacall report.

-

First Nation communities interested in receiving producer-run Blue Box services must register with the Authority. To register, communities must submit contact information of the person responsible for waste management in the community using the First Nation community registration form. Once completed, the registration form should be submitted by email to registry@rpra.ca.

Visit our First Nation webpage for more information.

-

Under the Blue Box Regulation, consumers are individuals who use a product and its packaging for personal, family or household purposes, or persons who use a beverage and its container for personal, family, household, or business purposes.

-

A marketplace facilitator is a person who contracts with a marketplace seller to facilitate the supply of the marketplace seller’s products by:

- Owning or operating an online consumer-facing marketplace or forum in which the marketplace seller’s products are listed or advertised for supply and where offer and acceptance are communicated between a marketplace seller and a buyer (e.g., a website), and

- Providing for the physical distribution of a marketplace seller’s products to the consumer (e.g., storage, preparation, shipping of products).

Under the Blue Box Regulation, if a retailer (online or at a physical location) is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer. A marketplace seller is a person who contracts with a marketplace facilitator to supply its products.

-

As an obligated Blue Box producer, you are required to:

- Register with RPRA

- Report supply data to RPRA annually

- Meet mandatory and enforceable requirements for Blue Box collection systems

- Meet mandatory and enforceable requirements for managing collected Blue Box materials, including meeting a management requirement set out in the regulation

- Meet mandatory and enforceable requirements for promotion and education

- Provide third-party audits of actions taken towards meeting your collection and management requirements, and report on those actions to RPRA through annual performance reports

-

Yes, there have been some key changes to the producer hierarchies which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- If a retailer is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer.

- Brand holders that are resident in Canada are obligated, which varies from the Stewardship Ontario program where brand holders that are resident in Ontario are obligated.

See our FAQ to understand “Who is a marketplace facilitator?”.

-

There is an exemption in the Blue Box Regulation for producers whose gross annual revenue generated from products and services in Ontario is less than $2 million. The following sources are excluded for the purpose of determining revenue:

- Government tax revenue

- Property taxes

- General assistance funding received under the Ontario Municipal Partnership Fund

- Payments in lieu of taxes

- Canadian or Ontarian government grants available to municipalities with the intent of investing in public infrastructure

-

There is an exemption in the Blue Box regulation for producers whose gross annual revenue generated from products and services in Ontario less than $2 million. The revenue that counts towards the exemption is revenue from products and services. Charitable donations are not revenue from products and services and therefore does not count towards the exemption. Revenue other than charitable donations that are recorded from registered charities will be considered revenue from products and services.

-

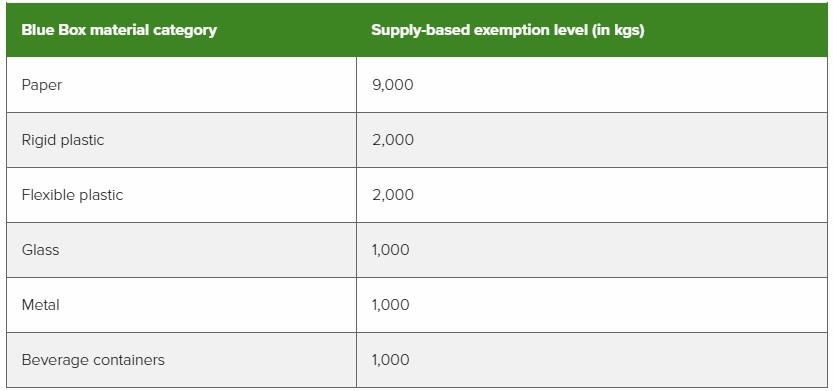

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.

-

The following are the types of Blue Box Materials obligated under the Blue Box Regulation:

- Blue box packaging (primary, transport, convenience, service accessories, ancillary elements)

- Paper products

- Packaging-like products

-

Producers are required to register with RPRA by October 1, 2021, as outlined in the Blue Box Regulation.

After this date, new businesses are required to register within 30 days of becoming a producer.

-

Producers are required to provide the following information when registering with RPRA:

- Contact information

- PRO information (if a PRO has been retained at time of reporting), including what services they have retained a PRO for

- Their 2020 supply data in each of the seven material categories– beverage container, glass material, flexible plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

Please note that this information must be submitted to RPRA directly.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

Starting in 2022, producers are required to report their supply data annually to RPRA.

Each year, producers will need to provide the previous years’ supply data in each of the seven material categories – beverage container, glass material, flexible plastic, rigid plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

RPRA’s Registry fees cover the costs related to compliance and enforcement and other activities required to administer the regulations under the RRCEA, and building and operating the Registry.

The Registry fees cover expenses in a given year (e.g., 2021 fees cover 2021 expenses). 2021 fees for Blue Box cover the Authority’s costs to undertake activities to implement the regulation in 2021, which include:

- helping obligated parties understand their requirements

- ensuring producers register and report their supply data by the deadline in the regulation

- compliance, enforcement, and communication activities

-

There are only two allowable deductions for Blue Box materials. There are for materials that are:

- collected from an eligible source at the time a related product was installed or delivered (e.g., packaging that is removed from the house by a technician installing a new appliance). This is the “installation deduction”.

- deposited into a receptacle at a location that is collected from a business or institution where Blue Box collection services are not provided under the regulation. This is the “ineligible source deduction” that was expanded by the regulation amendment in July 2023.

Ineligible source deductions:

Blue Box Producers may deduct materials that are collected from a business or institution where producers are not required to provide Blue Box collection services. Examples include offices, stores and shopping malls, restaurants, community centres, recreation facilities, sports and entertainment venues, universities and colleges, and manufacturing facilities.

Producers cannot deduct the following materials collected through the collection systems established under the Blue Box Regulation:

- Material that is generated at a facility (including multi-residential buildings, retirement homes, long-term care homes and schools).

- Material that is collected from a residence through a curbside or depot collection service.

- Material that is collected from a public space (including an outdoor area in a park, playground or sidewalk, or a public transit station).

- Material collected under an alternative or supplemental collection system.

- Beverage containers cannot be deducted.

Materials that are deducted cannot count toward a producer’s management requirement.

Please see the Reporting Guidance Ineligible Source Deductions for the 2024 Blue Box Supply Report for more information on how to determine and use these deductions.

-

Yes, there are some key changes to the data reported to Stewardship Ontario and what needs to be reported under the new regulation, which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- There are fewer reporting categories than under the Stewardship Ontario program

- Certified compostable packaging and products now must be reported separately, but this category does not have management requirements

- There are only two deductions permitted under the Blue Box Regulation, and producers must report total supply and then report any weight to be deducted separately

- Exemptions are based on tonnage supply under each material category instead of a total supply weight threshold of less than 15 tonnes as in Stewardship Ontario’s program

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”; “Are there exemptions for Blue Box producers?“; “Are there any differences in Blue Box producer hierarchies between the current Stewardship Ontario program and the new Blue Box Regulation?”; and “Are there are any differences in obligated Blue Box materials between the current Stewardship Ontario program and the new Blue Box Regulation?”

-

The rule and allocation table creation process has been removed from the Blue Box Regulation and is therefore no longer required to create and maintain the system for collecting Blue Box materials across the province, as per regulatory amendments made by the government on April 14, 2022. As such, rule creators are no longer applicable under the regulation. Learn more about the amendments.

To replace these tools, the amended regulation now requires PROs to submit a report that outlines how they will operate the Blue Box collection system on behalf of producers, ensuring that materials are collected from all eligible communities (i.e., communities outside of the Far North) across the province. Learn more about what PROs need to include in the report.

-

Yes, a producer can change PROs at any time. Producers must notify RPRA of any change in PROs within 30 days of the change.

-

Account Admins must add any new, or manage existing, Primary Contacts under the program they wish to give them access to in order for the Primary Contact to be able to submit a report (e.g., permissions to view and complete reports).

To Manage contacts on your Registry account, please see the following steps:

- Log into your account

- Once you are logged in, click on the drop-down arrow in the top right corner and select Manage Users

- Under Actions, click Manage to update preferences of existing users

- Click Add New User to add an additional contact to your account

- To give reporting access to a Primary Contact, select the program from the drop-down that you would like to grant them access to

-

In determining whether an obligated producer used best efforts to meet their management requirements, the Compliance Team will consider whether the producer, acting in good faith, took all reasonable steps to meet the requirements outlined in the applicable regulation.

For example, best efforts in the context of management requirements may involve a producer regularly monitoring the volume of material being collected and managed, and implementing plans for increasing those volumes if the requirements are unlikely to be met.

Producers can contact the Compliance Team to ask specific questions about fulfilling their obligations.

-

Under the Blue Box Regulation, allowable deductions for producers include Blue Box materials that are deposited into a receptacle at a location that is not an eligible source and where the product related to the Blue Box material was supplied and used or consumed.

This applies to food court restaurants located in a mall or in the base of an office tower. Blue Box materials that were disposed of in the buildings’ recycling receptacles and were supplied and used or consumed within that physical building are an allowable deduction. Blue Box materials that were disposed of in the buildings’ recycling receptacles but were not supplied and used or consumed within that physical building are not deductible.

This does not reduce the obligation of a producer to provide complete and accurate supply data or limit the ability of an Authority inspector to review the data and related records for the purpose of determining compliance.

-

A producer can grant access to anyone they would like to authorize in their reporting (i.e. Registry) portal. Producer reporting must be done in the producer account and batch data transfers are not accepted.

-

If a producer misreports their supply data to RPRA, they must contact the Compliance Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., sales documents, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly as possible to ensure a producer’s minimum management requirement is calculated using accurate supply data.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.

-

You are a Blue Box processor if you process Blue Box material that was supplied to a consumer in Ontario for the purposes of resource recovery.

For the purpose of resource recovery, processing includes, and is not limited to:

- Sorting

- Baling

- Paper and cardboard shredding

- Plastic reprocessing, which includes grinding, washing, pelletizing, compounding, etc.

- Crushed glass reprocessing

- Aluminum and steel reprocessing

See our FAQs to understand “Who is a consumer under the Blue Box Regulation”.

-

No, only producers are required to pay RPRA program fees. The decision to make producers pay fees and cover the Authority’s costs was made to reflect the fact that the Resource Recovery and Circular Economy Act, 2016 (RRCEA) is based on a producer responsibility framework. Although producers may hire service providers to help meet their obligations, the responsibility remains with the producer.

-

Processors need to provide the following information when registering with the Authority:

- Business information (e.g., business name, contact information)

- Processing site location, contact information and Blue Box materials received and processed at each location

- Any producers or PROs the processor has contracted with

Visit our Blue Box Processors webpage for more information.

-

No. If your business does not conduct resource recovery activities as its primary purpose, there is no requirement to register as a processor with the Authority.

-

A “Public space” means an outdoor area in a park, playground or beside/on a sidewalk, a public transit station or stop under municipal or provincial jurisdiction, including a track-level stop, to which the public is normally provided access.

During transition, producers are required to collect Blue Box material from public space receptacles in eligible communities that were provided collection service under the WDTA program.

The definition of a “public space” in the Blue Box Regulation is broader than the definition used in the Datacall for WDTA municipal funding purposes. For the purpose of collection services during transition, producers must collect from eligible communities’ public space receptacles collected as part of a communities’ Blue Box servicing that was funded under the WDTA Blue Box program (i.e., those along residential routes).

-

RPRA considers an aerosol container to be a non-refillable receptacle that contains a product and a propellant under pressure, and that is fitted with a release device allowing the contents to be ejected as solid or liquid particles in suspension in a gas, or as a foam, paste, powder, liquid, or gas.

-

Free riders are obligated parties that:

- Have not registered or reported to RPRA

- Have not established a collection and management system (if they are so required to), or;

- Are not operating a collection and management system (if they are so required to).

See our FAQs to understand “What is RPRA’s approach to free riders?”, and “What do I do if I think a business is a free rider?”

To note:

- Some producers only have requirements to register and report. Please refer to your specific program page on our website to understand producer obligations.

- Collection and management systems may be accomplished by a producer responsibility organization (PRO) on behalf of a producer through contractual arrangements between the producer and PRO. If a PRO is managing a producer’s collection and management requirements, producers must identify that PRO to RPRA.

-

RPRA takes a risk-based and proportional approach to compliance. This approach focuses on the potential risks that arise from non-compliance and assessing those risks to guide the use of compliance tools and the deployment of resources to minimize risk and maximize compliance. Learn more about RPRA’s Risk-Based Compliance Framework.

As a provincial regulator, we have the following powers to bring non-compliant parties into compliance:

- Broad inquiry powers including authority to compel documents and data

- Inspections and investigations

- Audits

- Compliance Orders and Administrative Penalty Orders (amounts to be set in regulation once finalized)

- Prosecution

RPRA’s primary approach to compliance is through communications (C4C – Communicating for Compliance). RPRA communicates directly with obligated parties and informs them of their requirements and when and how they must be completed. A high degree of compliance is achieved with this approach.

RPRA considers free riders a high priority to the programs we administer and focuses compliance efforts on bringing free riders into compliance with the regulations.

See our FAQ to understand “What is a free rider?”, and “What do I do if I think a business is a free rider?”

-

We encourage anybody who believes an entity is a free rider to contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca with information about that entity. RPRA reviews every free rider allegation that is referred to us.

We do not share information about our inspections or progress on specific free rider cases.

See our FAQ to understand “What is a free rider?” and “What is RPRA’s approach to free riders?”

-

A newspaper is a regularly (usually daily or weekly) printed document consisting of large, folded, stapled or unstapled, sheets of paper containing news reports, articles, photographs, and advertisements. Newspapers include broadsheet, tabloid, and free newspaper categories.

Newspapers have traditionally been published in print on low-grade paper known as newsprint. However, not all documents printed on newsprint are considered newspapers. For example, flyers printed on newsprint quality paper supplied separately from newspapers are not newspapers for the purpose of supply data reporting under the Blue Box Regulation.

For the purpose of supply reporting, newspapers include any supplemental advertisements and inserts that are provided with/inserted in them (e.g., a flyer or circular that is placed within the folds of a newspaper). Inserts may be composed of any material including, but not limited to, paper. See the FAQ: How do newspaper producers report their supply of newspapers?

Note that magazines are not considered newspapers; a magazine is a periodical publication containing articles and illustrations, typically covering a particular subject or area of interest, and printed on high-quality paper.

-

With the removal of the rule creation process and allocation table as the tools to create and maintain the Blue Box collection system, the amended regulation now requires producer responsibility organizations (PROs) to submit a report that outlines how they will operate the Blue Box collection system on behalf of producers, ensuring that materials are collected from all eligible communities (i.e., communities outside of the Far North) across the province.

Circular Materials Ontario and Ryse Solutions Ontario PROs submitted a Blue Box PRO initial report to RPRA on July 1, 2022, that provides the following information:

- A description of how they will comply with the collection requirements of the regulation, including any agreements between themselves and any other PRO

- A detailed description of how they will make collected Blue Box materials available for processing, how materials will be processed, and the expected location of receiving facilities in Ontario

- A description of how they will comply with the promotion and education requirements of the regulation

You can read the news release and the initial report here.

-

For most producers and for all municipalities, little has changed:

- Rule creators and the rule creation process, including the allocation table, have been removed. Instead, each producer is responsible for providing Blue Box collection to every eligible source in Ontario and creating a province-wide system for collection.

- Producer Responsibility Organizations (PROs) are now required to submit a report to RPRA on how they will operate the Blue Box system on behalf of producers.

- Newspaper producers whose newspaper supply accounts for more than 70% of their total Blue Box supply to consumers in Ontario are exempt from collection, management, and promotion and education requirements.

The amendments do not change or impact:

- Producer registration or 2020 supply data reporting to RPRA

- Most producers’ 2021 supply data reporting to RPRA

- The materials collected in the Blue Box system

- The communities that receive collection or the collection requirements

- The transition schedule and its timelines

-

For the purpose of reporting annual supply data under the Blue Box Regulation, the weight of newspaper must be reported in the appropriate material categories. For example, newsprint must be reported in the ‘paper’ category, while any protective plastic wrapping must be reported as ‘flexible plastic’.

Then, producers will be asked to indicate what percentage of their total Blue Box material supply was newspaper, including any protective wrapping and supplemental advertisements and inserts, in that calendar year.

See our FAQs: “What is a newspaper?” and “Who is a newspaper producer?”

-

In the Blue Box Regulation, certified compostable products and packaging is defined as material that:

- is only capable of being processed by composting, anaerobic digestion or other processes that result in decomposition by bacteria or other living organisms, and

- is certified compostable by an international, national, or industry standard that is listed in this procedure.

All certified compostable products and packaging reported by producers must be certified under one of the following standards:

- CAN/BNQ 0017-088: Specifications for Compostable Plastics

- ISO 17088: Specifications for compostable plastics

- ASTM D6400: Standard Specification for Labeling of Plastics Designed to be Aerobically Composted in Municipal or Industrial Facilities

- ASTM D6868: Standard Specification for Labeling of End Items that Incorporate Plastics and Polymers as Coatings or Additives with Paper and Other Substrates Designed to be Aerobically Composted in Municipal or Industrial Facilities

- EN 13432: Requirements for packaging recoverable through composting and biodegradation – Test scheme and evaluation criteria for the final acceptance of packaging

-

Yes, producers are obligated to provide collection services to new single-family residences that come into existence during the transition period.

-

Producers are obligated to provide collection services to new facilities that come into existence during the transition period only if that facility would have qualified for collection services under the WDTA Blue Box Program.

For further certainty, the WDTA Blue Box Program includes collection services for multi-family households (including rental, cooperative or condominium residential), senior citizen residences, long-term care facilities and public and private elementary and secondary schools.

-

A brand supply list is a list of brands of obligated products that a producer supplies to consumers in Ontario. A producer must provide a brand supply list that makes up their supply data annually to RPRA. Each program has different requirements regarding how a producer must submit a brand supply list. For more information, consult the applicable programs’ walkthrough guide or contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca.

-

RPRA will accept a report that substantiates the total Blue Box material weight deductions based on the customer’s recorded response to “Will you eat in or take out?” for all locations. Reports must be retained either in electronic or paper format for five years and be provided upon request for verification by RPRA.

-

For the purposes of the Blue Box Regulation, a beverage container is a container that:

- Contains a ready-to-drink beverage product,

- “Ready-to-drink” means a beverage packaged by the manufacturer for immediate consumption that does not require any preparation. A ready-to-drink beverage is intended to be consumed as purchased and does not require a dispensing device to be consumed.

- “Beverage” means a consumable liquid for enjoyment or hydration. It does not include an “alcoholic beverage”, or “non-alcoholic beer, wine or spirits” as defined in O. Reg. 391/21.

- Is made from metal, glass, paper or rigid plastic, or any combination of these materials, and

- If a beverage container is made only of flexible plastic, it would be obligated as a Blue Box material but would be reported under the material category “Flexible Plastic” rather than the “Beverage Container” material category. The Blue Box Regulation defines flexible plastic as unmoulded plastic. For more information on reporting of packaging and beverage containers that consist of multiple materials, please see the “Component Threshold Rule” in the Blue Box Verification and Audit Procedure Registry Procedure.

- Is sealed by its manufacturer.

- A cup provided to a consumer in a restaurant filled with fountain pop is not sealed by the manufacturer and is therefore not considered a beverage container. However, the cup (including the lid and straw) would still be obligated as a Blue Box material in the paper and/or plastic material categories.

For greater clarity, the Registrar does not consider the packaging from the following product types to be a beverage container:

- Infant formula

- Meal replacements, nutritional supplements or dietary supplements

- Regulated health products

- Concentrated beverages intended to be mixed or diluted before consumption, such as frozen juices, cocktail mixers, extracts and flavour enhancers

- Liquids that are not intended to be consumed as purchased such as soup, syrups, cream and other beverage additives, whipping cream, buttermilk, broth

- Beverage containers made of flexible plastics such as milk bags (these are still to be reported as flexible plastics)

Milk products and substitutes (e.g., soy beverage, almond beverage, a rigid plastic container of milk, drinkable yogurt) are beverage containers provided they are packaged in a container as defined above.

- Contains a ready-to-drink beverage product,

-

In the Manage PRO section in the Registry, the “Service End Date” is not a mandatory field. You can leave this field blank if there is no end date in your contract. If you decide to change PROs in the future, you can update this field to the date your agreement ended with that PRO.

-

If you select credit card as your method of payment, this method of payment is done through your Registry account.

Follow these steps to complete your payment:

- When you are in the payment method section in the Registry, select credit card as your preferred method.

- Input your credit card details.

- Click submit and payment will process automatically.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- Once your transaction has been approved, your payment will be reflected in your Registry account immediately.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select bank withdrawal as your method of payment, this authorizes the Resource Productivity and Recovery Authority to make a one-time withdrawal for the Registry invoice payment from the account you provided.

Bank Withdrawal – Important Terms:

- You have authorized RPRA to make one-time debits from your account. RPRA will obtain your authorization before any additional one-time or sporadic withdrawal is debited from your account. You have agreed that this confirmation may be provided at least three (3) calendar days before the first payment is withdrawn from your account. You have waived any and all requirements for pre-notification of the account being debited.

- Your payments are being made on behalf of a business.

- Your agreement may be cancelled provided notice is received thirty (30) days before the next withdrawal. If any of the above details are incorrect, please contact us immediately at the contact information below. If the details are correct, you do not need to do anything further and your Pre-Authorized Debits (PAD) will be processed. You have certain recourse rights if any debit does not comply with these terms. For example, you have the right to receive a reimbursement for any PAD that is not authorized or is not consistent with this PAD Agreement. To obtain more information on your recourse rights, contact your financial institution or visit www.payments.ca.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for the involved banks to process your payment.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select electronic bill payment as your method of payment, this method of payment is done through your online banking account, using the bill payment functionality. It is available at major Canadian banks (e.g., TD, RBC, BMO, Scotiabank, etc.).

Follow these steps to complete your payment:

- Log in to your bank account.

- Go to the bill payment section and choose to add a payee.

- Search for and select “RPRA” as the payee.

- Once “RPRA” is selected, enter your registration number as the account number to make your payment. Your registration number can be found on your invoice.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select cheque as your method of payment, follow these steps to complete your payment:

- Make your cheque payable to “Resource Productivity and Recovery Authority”

- Enter your Invoice Number on the memo line of the cheque

- Please send your cheque to*:

-

- Resource Productivity Recovery Authority

- PO Box 46114, STN A

- Toronto, ON

- M5W 4K9

*As of January 20, 2023, the address for mailing cheques to RPRA has been revised. Please update your records and send cheques to the above address going forward.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 2-4 weeks for your payment to be reflected in your Registry account once you have mailed your cheque due to mail and cheque processing times.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

If you select electronic data interchange (EDI) as your method of payment, this is an electronic payment through your bank, also commonly known as EFT or ACH.

Follow these steps to complete your payment:

- Submit your payment using RPRA’s banking information provided on your invoice.

- Be sure to reference your Invoice Number when you submit this payment to your bank so that we will be able to identify your payment.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for your payment to be reflected in your Registry account once you have completed it.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

Where an entire community is receiving recycling curbside collection and has access to recycling depots, the requirement is that during transition, that same level of service is still provided. After transition, there is no requirement to maintain depots within these communities.

-

No, beverage containers are not eligible for this deduction.

The allowable deduction is permitted for Blue Box materials that are deposited into a “non-eligible source,” meaning a place where consumers dispose of Blue Box materials that are not included in the producer-run collection system.

Under the Blue Box Regulation, beverage containers that are supplied to Ontario consumers for personal, family, household or business purposes are obligated Blue Box materials. The inclusion of “business purposes” is unique to the beverage container material category.

Because supplying a beverage container can mean either supplying for “personal, family and/or household purposes” that will likely be consumed and disposed of in a residential context (e.g., a home, apartment, long-term care facility, etc.) or supplying for “business purposes” that will likely be consumed and disposed of in a commercial or institutional context (e.g., a restaurant, college or gym), there are no “non-eligible sources” for beverage containers. All beverage containers must be reported and collected from all sources, whether they are residential, business, commercial or institutional.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

A brand is any mark, word, name, symbol, design, device or graphical element, or a combination thereof, including a registered or unregistered trademark, which identifies a product and distinguishes it from other products.

A brand holder is a person who owns or licenses a brand or otherwise has rights to market a product under the brand.

Note:

- If there are two or more brand holders, the producer most directly connected to the production of the material is the brand holder.

- If more than one material produced by different brand holders are marketed as a single package, the producer who is more directly connected to the primary product in the package is the brand holder.

-

The Manage PRO option will appear on the dashboard below your list of supply data reports when your supply data reporting is complete and if you have management requirements. If your supply data reporting is below the supply exemption threshold you will not have management requirements, and therefore not need to assign a PRO to assist with your obligations.

Also note that Account Admin are the only portal users that can manage your PRO’s responsibility, so this widget is not viewable to primary and secondary users.

-

Yes, cheques are an obligated material and should be reported under the paper material category. If you have questions regarding how to determine whether you are the brand holder and are obligated to report the supply of cheques, please reach out to the Compliance & Registry team at registry@rpra.ca.

-

Account admins have access to all information within a registrant’s account. They can create and assign primary and secondary users’ access to the account, edit and submit reports, and pay fees. They are the only ones who can manage PROs. Account admins can view all activities users undertake. They will also be the recipient of emails from the Registry portal.

Primary users can only assign secondary users’ access to the account, edit and submit reports and pay fees.

Secondary users can only edit and submit reports and pay fees.

-

Paints, pesticides, solvents fertilizers obligated under the HSP Regulation along with their primary packaging must be accepted at collection sites collecting the corresponding material. For instance, empty paint cans and pesticide aerosols obligated under the HSP Regulation must be accepted at collection sites collecting paint and pesticides.

See our FAQ to understand “Under the HSP Regulation, is the packaging of antifreeze, pesticides, solvents, paints and coatings obligated?” and “Are containers that are obligated under the HSP Regulation obligated as Blue Box materials?“

-

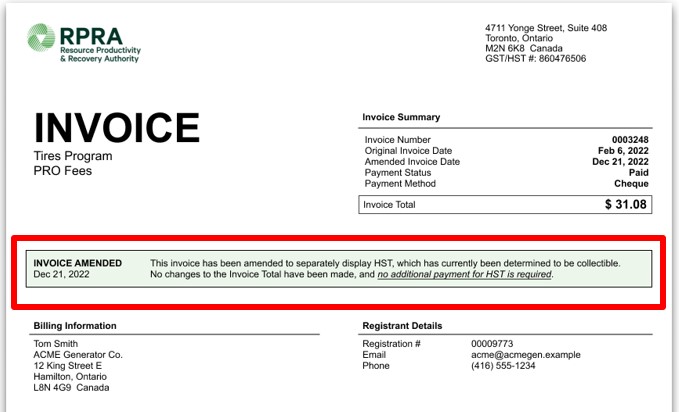

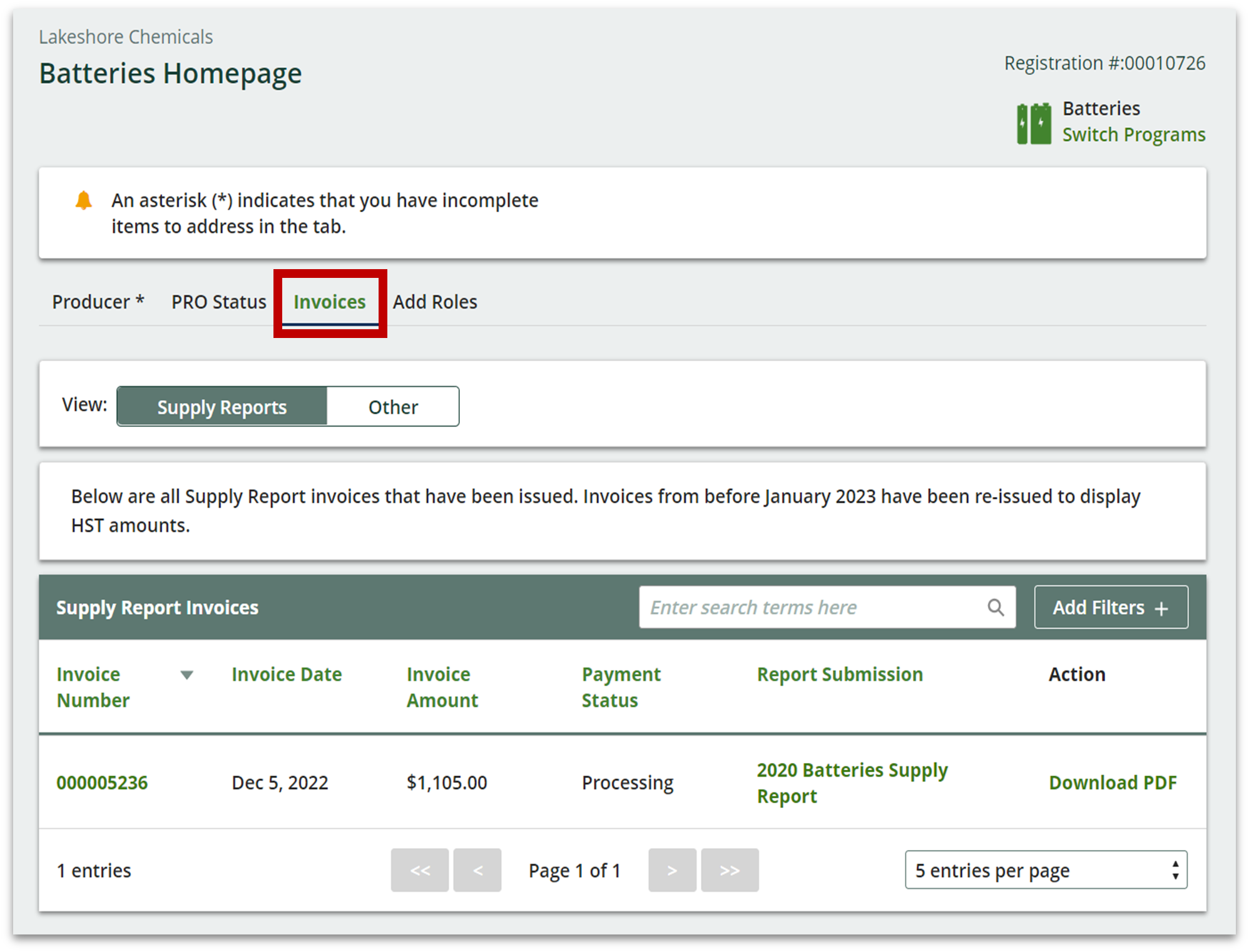

Starting January 1, 2023, RPRA will collect 13% HST on all fees at the time of fee payment.

This decision is based on a ruling RPRA received from the CRA in which HST must be charged on its fees under the Resource Recovery and Circular Economy Act, 2016 (RRCEA). RPRA has determined that this ruling applies to all RRCEA producer responsibility programs and the Excess Soil and Hazardous Waste programs.

On December 22, 2022, RPRA will reissue invoices that were issued prior to January 1, 2023, amended to indicate that 13% HST was paid. From December 22 onwards, registrants will be able to access the amended invoices in their Registry accounts under a new tab labelled “Invoices”. The amended invoice will show an HST amount as well as the date the amended invoice was reissued.

Important notes:

- On the amended invoices there have been no changes to the Invoice Total and registrants will not be required to pay any additional monies to RPRA for past invoices.

- Registrants may be able to claim input tax credits for the HST collected on RPRA fees, for both the amended invoices and new invoices issued January 1, 2023, onwards. However, RPRA is not in a position to provide tax advice and suggests you consult your internal or external accountants to seek their counsel.

- All new invoices issued effective January 1, 2023, will contain appropriate information identifying the amount of the HST and other relevant details. These invoices will also be displayed under the “Invoices” tab in a registrants’ Registry account.

-

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. A banner will be displayed that highlights whether an invoice has been amended to include HST as well as the date the amended invoice was reissued. This will show on all invoices with an invoice date before December 21, 2022. See sample screenshot below.

-

Registrants can access past invoices in their Registry account under a new tab labelled “Invoices”. See sample screenshot below.

-

A producer’s management requirement is how much Blue Box material they must ensure is collected and processed into recovered resources each year. Management requirements are calculated based on what they supplied into Ontario one year prior and the resource recovery percentage as set in the regulation. A producer’s management requirement is calculated separately for each Blue Box material category (beverage container, glass, flexible plastic, rigid plastic, metal and paper).

Some producer are exempt from having a management requirement based on their supply data, for more information on exemptions see the FAQ Are there exemptions for Blue Box producers? A producer that does not have a management requirement does not have any collection, management or promotion and education obligations.

A producer with a management requirement must also provide collection and promotion and education services in Ontario. Most producers will contract the services of a producer responsibility organization (PRO) to meet their collection, management and promotion and education obligations.

To view your management requirement(s), log into your registry account, download a copy of your Blue Box Supply Report and review the section with your minimum management requirements. Management requirement for a given year are determine by supply data from two years prior. For example, 2023 management requirements were based on 2021 supply data (submitted in producers’ 2022 Supply Report).

Unsure if you are a Blue Box producer? See our FAQs Am I a producer of Blue Box product packaging? And Am I a producer of paper products and packaging-like products?

-

Failure of an obligated party to meet a registration or reporting deadline may result in compliance action, including compliance orders, prosecutions or monetary penalties issued in accordance with the Administrative Penalties Guidelines.

In accordance with the Risk Based Compliance Framework, RPRA will communicate to obligated parties, via email, about their reporting requirements in advance of submission deadlines. RPRA will also send deadline reminders and notify missed deadlines to obligated parties prior to taking further compliance action.

For more guidance, read the new Late Registration or Report Submissions Compliance Bulletin.

-

RPRA has developed a library of resources to support Registry users navigate the online system and meet their regulatory requirements. RPRA consistently adds to this pool of resources based on upcoming requirements, emerging needs, and questions we receive from stakeholders.

View Registry resources for each program:

-

Registry Resources such as Registry Procedures, Compliance Bulletins, and Reporting Guides can be found on our Blue Box Registry Resources webpage.

-

No. Effective February 6, 2023, RPRA will no longer accept requests for extensions to registration or reporting deadlines. Obligated parties should make every effort to ensure they meet all submission deadlines as part of their obligations under their associated regulation.

For more guidance, read the Late Registration or Report Submissions Compliance Bulletin.

-

Yes, a producer, a PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can collect any product or material (including materials or products that are not designated under the Resource Recovery and Circular Economy Act, 2016 (RRCEA)). For example, a battery producer may choose to collect batteries that weigh over 5kg; a tire producer may choose to collect bicycle tires; or a Blue Box producer may choose to collect books.

Products or materials that are not designated under RRCEA regulations cannot be counted towards meeting a producer’s collection or management requirements under RRCEA.

If designated materials are co-collected with materials that are not designated, a person must use a methodology or process acceptable to the Authority to account for those materials. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if bicycle tires are collected at the same time as automotive tires, they must be accounted for separately both when collected and when sent to a processor.

-

Yes, a Blue Box producer, or PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can choose to offer collection services to any location. Blue Box producers are required to provide collection services to all eligible sources, as well as public spaces.

Blue Box materials collected from locations that are not eligible sources cannot count towards meeting a producer’s management requirement unless they were supplied to a consumer in Ontario. See this FAQ: Who is a consumer under the Blue Box Regulation?

If a person is co-collecting from locations that are eligible sources and not eligible sources, a person must use a methodology or process acceptable to the Authority to account for materials collected from each type of source. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if materials are collected from an eligible source and a location that is not an eligible source along the same collection route, they must be accounted for separately. When those materials are then sent to a processor, they must also be accounted for separately.

-

Yes, a Blue Box producer or PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can voluntarily choose to collect Blue Box materials that are not marketed to consumers.

Blue Box materials not marketed to consumers cannot be counted towards meeting a producer’s collection or management requirements under the Blue Box Regulation.

If Blue Box materials that are marketed to consumers are co-collected with Blue Box materials not marketed to consumers, a person must use a methodology or process acceptable to the Authority to account for materials supplied to a consumer or not. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if Blue Box materials supplied to a consumer in Ontario are collected along the same collection route as Blue Box materials that were not supplied to a consumer, they must be accounted for separately. When those materials are then sent to a processor, they must also be accounted for separately.

See the FAQ: Who is a consumer under the Blue Box Regulation?

-

For the purpose of reporting supply data under the Blue Box Regulation, the weight of newspaper, including any protective wrapping and supplemental advertisements and inserts, must be reported in the appropriate material categories. For example, newsprint must be reported in the ‘paper’ category, while any protective plastic wrapping must be reported as ‘flexible plastic’.

Then, producers will be asked to indicate what percentage of their total Blue Box material supply was newspaper, including any protective wrapping and supplemental advertisements and inserts, in that calendar year.

When reporting either their total supply or the percentage of their total supply that is newspaper, a producer should only include the weight of Blue Box materials for which they are the producer. For example, if flyers for which there is a different brand holder resident in Canada are supplied along with a newspaper and those flyers have a different brand holder resident in Canada, their weight should not be reported by the newspaper producer. Instead, it is the brand holder of those flyers who would be required to include the weight of those flyers in their own supply report.

See our FAQ: “What is a newspaper?”

-

No, where a producer is exempt, the regulatory obligations do not become the responsibility of the organization that is next in the producer hierarchy. The exempt producer remains the “producer” for those materials; they are just exempt from certain requirements under the regulation as set out in the relevant provisions providing for the exemption. This is the case in all RRCEA regulations.

-

Producers are obligated parties under the Resource Recovery and Circular Economy Act and are ultimately responsible for their data submitted through RPRA’s Registry. Producers can choose to contract with an external consultant to support their data submission, but third parties have limited permissions in the Registry as they are not regulated parties.

A producer can choose to assign a primary or secondary user profile in their Registry account to an external consultant. An external consultant may submit supply data reports and/or pay registry fees on the producer’s behalf.

External consultants cannot submit and/or sign registration, executive attestations, account admin changes or supply data adjustment documentation on behalf of a producer. External consultants cannot be account admins, nor can they manage a PRO within the Registry on behalf of a producer.

-

A First Nation’s transition date represents the earliest date that producers are required to provide the community with either Blue Box service or funding within the Blue Box program. Transition dates cannot be moved or changed.

A First Nation’s community name, reserve name(s) and transition date appearing on the transition schedule means it is an eligible community to receive Blue Box collection service or funding between July 1, 2023, and December 31, 2025. The transition schedule was amended for the last time on February 23, 2024. There will be no more additions to the transition schedule.

Related FAQs:

-

There is no requirement for a First Nation community to formally change its transition date. If a community is not ready to report and/or participate in the offer process with the PROs by the initial transition date or the date outlined in the Transition Schedule, the community can indicate that to RPRA and we will work with you and the PROs to track when your community is ready to move forward in the process.

-

If your community is south of the Far North boundary, you can complete the registration form and email it to registry@rpra.ca to express your community’s interest in participating in the producer-run Blue Box program. A Compliance Officer will reach out to you to discuss the reporting and offer process, confirm the information provided in the registration form, and answer any questions you may have.

Communities in this situation are eligible to receive recycling collection services starting January 1, 2026.

-

No, First Nations are not required to participate. First Nations can choose if the producer-run Blue Box system is the best option for their community. One of RPRA’s roles in overseeing the Blue Box program is to provide as much information as possible to support a community’s informed decision.