Frequently Asked Questions

Results (58)

Click the question to read the answer.

-

A producer’s management requirement is how much Blue Box material they must ensure is collected and processed into recovered resources each year. Management requirements are calculated based on what they supplied into Ontario one year prior and the resource recovery percentage as set in the regulation. A producer’s management requirement is calculated separately for each Blue Box material category (beverage container, glass, flexible plastic, rigid plastic, metal and paper).

Some producer are exempt from having a management requirement based on their supply data, for more information on exemptions see the FAQ Are there exemptions for Blue Box producers? A producer that does not have a management requirement does not have any collection, management or promotion and education obligations.

A producer with a management requirement must also provide collection and promotion and education services in Ontario. Most producers will contract the services of a producer responsibility organization (PRO) to meet their collection, management and promotion and education obligations.

To view your management requirement(s), log into your registry account, download a copy of your Blue Box Supply Report and review the section with your minimum management requirements. Management requirement for a given year are determine by supply data from two years prior. For example, 2023 management requirements were based on 2021 supply data (submitted in producers’ 2022 Supply Report).

Unsure if you are a Blue Box producer? See our FAQs Am I a producer of Blue Box product packaging? And Am I a producer of paper products and packaging-like products?

-

No, producers are not required to sign up with a PRO to meet their regulatory requirements. It is a business decision if a producer chooses to work with a PRO, and a producer can choose to meet their obligations without a PRO.

Most producers will choose to contract with a PRO to provide collection, hauling, processing, retreading and/or refurbishing services to achieve their collection and management requirements unless they carry out these activities themselves.

-

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

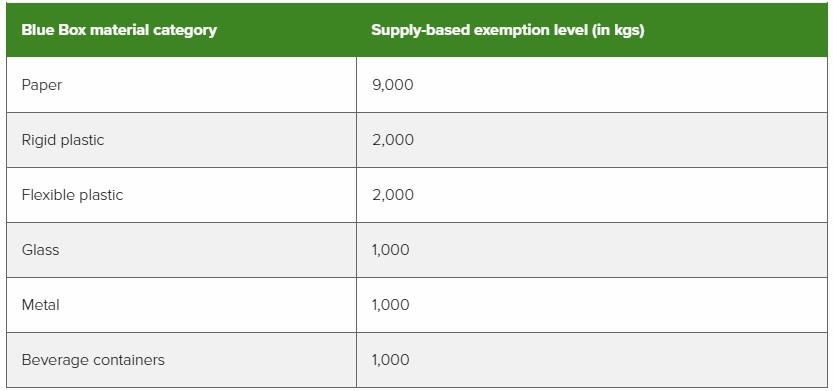

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.

-

As an obligated Blue Box producer, you are required to:

- Register with RPRA

- Report supply data to RPRA annually

- Meet mandatory and enforceable requirements for Blue Box collection systems

- Meet mandatory and enforceable requirements for managing collected Blue Box materials, including meeting a management requirement set out in the regulation

- Meet mandatory and enforceable requirements for promotion and education

- Provide third-party audits of actions taken towards meeting your collection and management requirements, and report on those actions to RPRA through annual performance reports

-

Producers are not required to collect and manage their own branded products and materials. Instead, a producer is expected to collect and manage a portion of similar materials in Ontario. The portion of material that a producer collects and manages is known as their minimum management requirement. A minimum management requirement, which is set based on calculations outlined in the applicable Regulation, is the weight of the products or packaging that the producer must ensure is collected and managed. The calculated amount is proportionate to the weight of materials that producer supplied into the province.

For example, a producer who supplied laptops into Ontario does not need to collect and manage their own branded laptops. Instead, they must ensure that they collect and manage an equivalent weight of information technology, telecommunications, and audio-visual equipment (ITT/AV) materials.

Similarly, a producer who supplied cardboard boxes into Ontario does not need to collect and manage those exact cardboard boxes. Rather, they need to ensure that an equivalent weight of paper is collected and managed.

Almost all producers will work with producer responsibility organizations (PROs) for the purposes of meeting their obligations to collect and manage materials. PROs establish collection and management systems across Ontario for different material types. A producer can meet their obligations to collect and manage materials by entering into a contract with a PRO to provide these services on their behalf.

-

In determining whether an obligated producer used best efforts to meet their management requirements, the Compliance Team will consider whether the producer, acting in good faith, took all reasonable steps to meet the requirements outlined in the applicable regulation.

For example, best efforts in the context of management requirements may involve a producer regularly monitoring the volume of material being collected and managed, and implementing plans for increasing those volumes if the requirements are unlikely to be met.

Producers can contact the Compliance Team to ask specific questions about fulfilling their obligations.

-

Free riders are obligated parties that:

- Have not registered or reported to RPRA

- Have not established a collection and management system (if they are so required to), or;

- Are not operating a collection and management system (if they are so required to).

See our FAQs to understand “What is RPRA’s approach to free riders?”, and “What do I do if I think a business is a free rider?”

To note:

- Some producers only have requirements to register and report. Please refer to your specific program page on our website to understand producer obligations.

- Collection and management systems may be accomplished by a producer responsibility organization (PRO) on behalf of a producer through contractual arrangements between the producer and PRO. If a PRO is managing a producer’s collection and management requirements, producers must identify that PRO to RPRA.

-

An alternative collection system is one of three types of collection and management systems for Blue Box materials. Producers can choose to establish or participate in an alternative collection system to meet their collection, management, and promotion and education requirements under the Blue Box Regulation.

An alternative collection system can be established by one or more producers or PROs. The system must demonstrate that it can meet all system regulatory requirements as well as the minimum management requirements for participating producer(s). A producer can choose to meet their obligations using an alternative collection system instead of participating in the common collection system.

Types of alternative collection systems may vary and can include depot or return-by-mail systems. Alternative collection systems must service all eligible communities south of Ontario’s Far North.

For more information on alternative collection system registration criteria, please reach out to registry@rpra.ca.

Also see: ‘What is the Blue Box common collection system?’, ‘What is a Blue Box supplemental collection system?’

-

A supplemental collection system is one of three types of collection and management systems that producers can choose to establish or participate in to contribute to their collection, management, and promotion and education requirements under the Blue Box Regulation.

Supplemental collection systems are not required to service all eligible communities south of Ontario’s Far North. Therefore, a producer participating in this type of system is still required to participate in the common collection system to meet their obligation to collect and manage Blue Box materials from all eligible communities, and to provide a promotion and education program.

One or more producers or PROs can establish a supplemental collection system. If a producer or PRO wishes to use a supplemental collection system’s collected materials towards producer minimum management requirements, that system should register with RPRA.

For more information on supplemental collection system registration criteria, please reach out to registry@rpra.ca.

Also see: ‘What is the Blue Box common collection system?’, ‘What is a Blue Box alternative collection system?’

-

No. The Authority does not administer contracts or provide incentives. Under the Regulations, producers will either work with a producer responsibility organization (PRO) or work directly with collection sites, haulers, refurbisher’s and/or processors to meet their collection and management requirements. Any reimbursement for services provided towards meeting a producers’ collection and management requirements will be determined through commercial contracts.

To discuss any payment, contact your service provider or a PRO. RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

The common collection system is the Blue Box material collection and management system established by PROs on behalf of producers. Blue Box materials that are picked up through curbside residential collection, for instance, are processed through the common collection system. The system came into effect on July 1, 2023, as outlined in the Blue Box Regulation. The common collection system services all eligible communities south of Ontario’s Far North.

It is one of three types of collection and management systems that producers can choose to use to meet their minimum management requirements. Producers who use the common collection system to meet their obligations will contract with a PRO that is participating in the common collection system.

A high-level overview of the common collection system was provided by PROs Circular Materials and Ryse Solutions Ontario in 2022 in their Initial Blue Box Report.

Also see: ‘What is a Blue Box Alternative collection system?’, ‘What is a Blue Box supplemental collection system?’

-

The Manage PRO option will appear on the dashboard below your list of supply data reports when your supply data reporting is complete and if you have management requirements. If your supply data reporting is below the supply exemption threshold you will not have management requirements, and therefore not need to assign a PRO to assist with your obligations.

Also note that Account Admin are the only portal users that can manage your PRO’s responsibility, so this widget is not viewable to primary and secondary users.

-

There are only two allowable deductions for Blue Box materials. There are for materials that are:

- collected from an eligible source at the time a related product was installed or delivered (e.g., packaging that is removed from the house by a technician installing a new appliance). This is the “installation deduction”.

- deposited into a receptacle at a location that is collected from a business or institution where Blue Box collection services are not provided under the regulation. This is the “ineligible source deduction” that was expanded by the regulation amendment in July 2023.

Ineligible source deductions:

Blue Box Producers may deduct materials that are collected from a business or institution where producers are not required to provide Blue Box collection services. Examples include offices, stores and shopping malls, restaurants, community centres, recreation facilities, sports and entertainment venues, universities and colleges, and manufacturing facilities.

Producers cannot deduct the following materials collected through the collection systems established under the Blue Box Regulation:

- Material that is generated at a facility (including multi-residential buildings, retirement homes, long-term care homes and schools).

- Material that is collected from a residence through a curbside or depot collection service.

- Material that is collected from a public space (including an outdoor area in a park, playground or sidewalk, or a public transit station).

- Material collected under an alternative or supplemental collection system.

- Beverage containers cannot be deducted.

Materials that are deducted cannot count toward a producer’s management requirement.

Please see the Reporting Guidance Ineligible Source Deductions for the 2024 Blue Box Supply Report for more information on how to determine and use these deductions.

-

Yes, there are some key changes to the data reported to Stewardship Ontario and what needs to be reported under the new regulation, which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- There are fewer reporting categories than under the Stewardship Ontario program

- Certified compostable packaging and products now must be reported separately, but this category does not have management requirements

- There are only two deductions permitted under the Blue Box Regulation, and producers must report total supply and then report any weight to be deducted separately

- Exemptions are based on tonnage supply under each material category instead of a total supply weight threshold of less than 15 tonnes as in Stewardship Ontario’s program

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”; “Are there exemptions for Blue Box producers?“; “Are there any differences in Blue Box producer hierarchies between the current Stewardship Ontario program and the new Blue Box Regulation?”; and “Are there are any differences in obligated Blue Box materials between the current Stewardship Ontario program and the new Blue Box Regulation?”

-

If a producer misreports their supply data to RPRA, they must contact the Compliance Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., sales documents, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly as possible to ensure a producer’s minimum management requirement is calculated using accurate supply data.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.

-

Yes, a producer, a PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can collect any product or material (including materials or products that are not designated under the Resource Recovery and Circular Economy Act, 2016 (RRCEA)). For example, a battery producer may choose to collect batteries that weigh over 5kg; a tire producer may choose to collect bicycle tires; or a Blue Box producer may choose to collect books.

Products or materials that are not designated under RRCEA regulations cannot be counted towards meeting a producer’s collection or management requirements under RRCEA.

If designated materials are co-collected with materials that are not designated, a person must use a methodology or process acceptable to the Authority to account for those materials. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if bicycle tires are collected at the same time as automotive tires, they must be accounted for separately both when collected and when sent to a processor.

-

Yes, a Blue Box producer, or PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can choose to offer collection services to any location. Blue Box producers are required to provide collection services to all eligible sources, as well as public spaces.

Blue Box materials collected from locations that are not eligible sources cannot count towards meeting a producer’s management requirement unless they were supplied to a consumer in Ontario. See this FAQ: Who is a consumer under the Blue Box Regulation?

If a person is co-collecting from locations that are eligible sources and not eligible sources, a person must use a methodology or process acceptable to the Authority to account for materials collected from each type of source. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if materials are collected from an eligible source and a location that is not an eligible source along the same collection route, they must be accounted for separately. When those materials are then sent to a processor, they must also be accounted for separately.

-

Yes, a Blue Box producer or PRO (producer responsibility organization) on behalf of a producer, or a service provider on behalf of either party, can voluntarily choose to collect Blue Box materials that are not marketed to consumers.

Blue Box materials not marketed to consumers cannot be counted towards meeting a producer’s collection or management requirements under the Blue Box Regulation.

If Blue Box materials that are marketed to consumers are co-collected with Blue Box materials not marketed to consumers, a person must use a methodology or process acceptable to the Authority to account for materials supplied to a consumer or not. Anyone considering this can contact the Compliance Team to discuss at registry@rpra.ca or 833-600-0530.

For example, if Blue Box materials supplied to a consumer in Ontario are collected along the same collection route as Blue Box materials that were not supplied to a consumer, they must be accounted for separately. When those materials are then sent to a processor, they must also be accounted for separately.

See the FAQ: Who is a consumer under the Blue Box Regulation?

-

A newspaper producer is a person who supplies newspapers to consumers in Ontario. For the purpose of the Blue Box Regulation, newspapers include broadsheet, tabloid or free newspaper. For further information, see the FAQ: What is a newspaper?

Note that a producer of supplemental advertisements or flyers that are supplied with a newspaper would not be considered a newspaper producer as they do not supply the actual broadsheet, tabloid, or free newspaper. This producer cannot use the newspaper exemption percentage to be exempt from Blue Box collection and management requirements. See the FAQ: Are there exemptions for Blue Box producers?

-

A producer responsibility organization (PRO) is a business established to contract with producers to provide collection, management, and administrative services to help producers meet their regulatory obligations under the Regulation, including:

- Arranging the establishment or operation of collection and management systems (hauling, recycling, reuse, or refurbishment services)

- Establishing or operating a collection or management system

- Preparing and submitting reports

PROs operate in a competitive market and producers can choose the PRO (or PROs) they want to work with. The terms and conditions of each contract with a PRO may vary.

-

For most producers and for all municipalities, little has changed:

- Rule creators and the rule creation process, including the allocation table, have been removed. Instead, each producer is responsible for providing Blue Box collection to every eligible source in Ontario and creating a province-wide system for collection.

- Producer Responsibility Organizations (PROs) are now required to submit a report to RPRA on how they will operate the Blue Box system on behalf of producers.

- Newspaper producers whose newspaper supply accounts for more than 70% of their total Blue Box supply to consumers in Ontario are exempt from collection, management, and promotion and education requirements.

The amendments do not change or impact:

- Producer registration or 2020 supply data reporting to RPRA

- Most producers’ 2021 supply data reporting to RPRA

- The materials collected in the Blue Box system

- The communities that receive collection or the collection requirements

- The transition schedule and its timelines

-

Yes, producers are legally required to register and report to RPRA. There are some differences between which materials were reported to Stewardship Ontario as a steward and what must now be reported to RPRA as a producer. Differences include:

- newly obligated materials

- brand holder in Canada now obligated (rather than Ontario)

- producer must report total supply, and then report any weight to be deducted separately.

During transition years, stewards must meet their requirements (e.g., paying fees to Stewardship Ontario) under the Blue Box Program Plan and the WDTA. Producers also have requirements under the new Blue Box Regulation and the RRCEA, which includes registering, reporting, paying their program fee to RPRA and establishing collection, management and promotion and education systems for Blue Box materials.

-

Individual Producer Responsibility (IPR) means that producers are responsible and accountable for collecting and managing their products and packaging after consumers have finished using them.

For programs under the Resource Recovery and Circular Economy Act, 2016 (RRCEA), producers are directly responsible and accountable for meeting mandatory collection and recycling requirements for end of life products. With IPR, producers have choice in how they meet their requirements. They can collect and recycle the products themselves, or contract with producer responsibility organizations (PROs) to help them meet their requirements.

-

Consumer protection laws in Ontario prohibits the misrepresentation of charges, which means that producers or retailers cannot misrepresent any visible fees as a regulatory charge, tax, RPRA fee or something similar. Consumers who have questions or concerns about a specific transaction or want to report a misrepresentation can contact the Ministry of Public and Business Service Delivery at 1-800-889-9768.

As of March 2023, the promotion and education requirements related to environmental fees have been removed from the Tires, Batteries, Electrical and Electronic Equipment, and Hazardous and Special Products regulations. No changes were made to the Blue Box Regulation as it never contained promotion and education requirements related to these fees.

RPRA’s compliance bulletin Charging Tire Fees to Consumers has since been revoked and RPRA has ceased its enforcement of promotion and education requirements for visible fees across all materials.

-

Brand holders and producers that supply products and packaging are required by legislation to meet individual mandatory collection and resource recovery requirements and may face compliance and enforcement consequences for failing to do so. The executive attestation ensures that executives responsible for managing the brand holder’s or producer’s business are aware of these requirements and can ensure that appropriate measures are put in place to achieve compliance with the regulations.

-

With the removal of the rule creation process and allocation table as the tools to create and maintain the Blue Box collection system, the amended regulation now requires producer responsibility organizations (PROs) to submit a report that outlines how they will operate the Blue Box collection system on behalf of producers, ensuring that materials are collected from all eligible communities (i.e., communities outside of the Far North) across the province.

Circular Materials Ontario and Ryse Solutions Ontario PROs submitted a Blue Box PRO initial report to RPRA on July 1, 2022, that provides the following information:

- A description of how they will comply with the collection requirements of the regulation, including any agreements between themselves and any other PRO

- A detailed description of how they will make collected Blue Box materials available for processing, how materials will be processed, and the expected location of receiving facilities in Ontario

- A description of how they will comply with the promotion and education requirements of the regulation

You can read the news release and the initial report here.

-

The Authority recognizes the commercially sensitive nature of the information that parties submit to the registry. The Authority is committed to protecting the commercially sensitive information and personal information it receives or creates in the course of conducting its regulatory functions. In recognition of this commitment, the Authority, in addition to the regulatory requirements of confidentiality set out in the Resource Recovery and Circular Economy Act 2016 (section 57), has created an Access and Privacy Code that applies to its day-to-day operations, including the regulatory functions that it carries out.

Obligated material supply, collection, and resource recovery data will only be made public in aggregate form, to protect the confidentiality of commercially sensitive information.

The Authority will publish the names and contact information of all registered businesses – producers, service providers (collectors, haulers, processors, etc.), and producer responsibility organizations. The public will also have access to a list or method to locate any obligated material collection sites, as this information becomes available.

As part of its regulatory mandate, the Registrar will provide information to the public related to compliance and enforcement activities that have been undertaken.

The information that is submitted to the Registry will be used by the Registrar to confirm compliance and to track overall collection and management system performance. It will also be used by the Authority to update its policies and procedures and by the Ministry of Environment, Conservation and Parks for policy development.

-

Where an entire community is receiving recycling curbside collection and has access to recycling depots, the requirement is that during transition, that same level of service is still provided. After transition, there is no requirement to maintain depots within these communities.

-

RPRA has developed a library of resources to support Registry users navigate the online system and meet their regulatory requirements. RPRA consistently adds to this pool of resources based on upcoming requirements, emerging needs, and questions we receive from stakeholders.

View Registry resources for each program:

-

While the Blue Box Regulation states the requirement for Blue Box producers or PROs to deliver printed promotion and education materials in English and French to eligible sources by mail at least once a year, many Ontario municipalities have stopped providing printed promotion and education materials to their residents in favour of electronic formats.

As long as Blue Box producers or Blue Box PROs continue to provide the same format of promotion and education materials as the Ontario municipality provided prior to the date the municipality transitioned under the Blue Box Regulation (i.e., print or electronic or both), RPRA will consider this as having satisfied the requirement in section 72(1) paragraph 2. The materials must be provided in both English and French.

-

In accordance with the legislation (Resource Recovery Circular Economy Act 2016, section 57), the Authority is required to comply with strict confidentiality requirements. The Authority has also developed an Access and Privacy Code that applies to its day-to-day operations.

The Registry has been developed according to cybersecurity best practice principles. This includes VPN-based restrictions, staff training on all cybersecurity policies, staff access to the Registry on a strict role-requirement basis, and registry interface security features (example: two-factor authentication).

-

RPRA’s Registry fees cover the costs related to compliance and enforcement and other activities required to administer the regulations under the RRCEA, and building and operating the Registry.

The Registry fees cover expenses in a given year (e.g., 2021 fees cover 2021 expenses). 2021 fees for Blue Box cover the Authority’s costs to undertake activities to implement the regulation in 2021, which include:

- helping obligated parties understand their requirements

- ensuring producers register and report their supply data by the deadline in the regulation

- compliance, enforcement, and communication activities

-

Sections 54 and 55 of the Blue Box Regulation require municipalities and First Nations to submit the information in the Initial Report and Transition Report to the Authority.

Under the Blue Box Regulation, producers will be fully responsible for the collection and management of Blue Box materials that are supplied into Ontario. To ensure that all communities continue to receive Blue Box collection services, communities will be allocated to producers, or PROs on their behalf, who are obligated to provide collection services. The information that is submitted in the Initial and Transition Reports will be used by PROs to plan for collection in each eligible community.

The Authority will also use the information provided by municipalities and First Nations to ensure that producers are complying with their collection obligations under the Blue Box Regulation.

It is important that municipalities and First Nations complete these reports accurately so that all eligible sources (residences, facilities, and public spaces) in their communities continue to receive Blue Box collection after their community transitions to full producer responsibility.

-

First Nation communities interested in receiving producer-run Blue Box services must register with the Authority. To register, communities must submit contact information of the person responsible for waste management in the community using the First Nation community registration form. Once completed, the registration form should be submitted by email to registry@rpra.ca.

Visit our First Nation webpage for more information.

-

RPRA does not vet PROs before listing them on the website. Any business that registers as a PRO will be listed. Producers should do their own due diligence when determining which PRO to work with.

-

No. If your business does not conduct resource recovery activities as its primary purpose, there is no requirement to register as a processor with the Authority.

-

RPRA takes a risk-based and proportional approach to compliance. This approach focuses on the potential risks that arise from non-compliance and assessing those risks to guide the use of compliance tools and the deployment of resources to minimize risk and maximize compliance. Learn more about RPRA’s Risk-Based Compliance Framework.

As a provincial regulator, we have the following powers to bring non-compliant parties into compliance:

- Broad inquiry powers including authority to compel documents and data

- Inspections and investigations

- Audits

- Compliance Orders and Administrative Penalty Orders (amounts to be set in regulation once finalized)

- Prosecution

RPRA’s primary approach to compliance is through communications (C4C – Communicating for Compliance). RPRA communicates directly with obligated parties and informs them of their requirements and when and how they must be completed. A high degree of compliance is achieved with this approach.

RPRA considers free riders a high priority to the programs we administer and focuses compliance efforts on bringing free riders into compliance with the regulations.

See our FAQ to understand “What is a free rider?”, and “What do I do if I think a business is a free rider?”

-

In the Blue Box Regulation, certified compostable products and packaging is defined as material that:

- is only capable of being processed by composting, anaerobic digestion or other processes that result in decomposition by bacteria or other living organisms, and

- is certified compostable by an international, national, or industry standard that is listed in this procedure.

All certified compostable products and packaging reported by producers must be certified under one of the following standards:

- CAN/BNQ 0017-088: Specifications for Compostable Plastics

- ISO 17088: Specifications for compostable plastics

- ASTM D6400: Standard Specification for Labeling of Plastics Designed to be Aerobically Composted in Municipal or Industrial Facilities

- ASTM D6868: Standard Specification for Labeling of End Items that Incorporate Plastics and Polymers as Coatings or Additives with Paper and Other Substrates Designed to be Aerobically Composted in Municipal or Industrial Facilities

- EN 13432: Requirements for packaging recoverable through composting and biodegradation – Test scheme and evaluation criteria for the final acceptance of packaging

-

A brand supply list is a list of brands of obligated products that a producer supplies to consumers in Ontario. A producer must provide a brand supply list that makes up their supply data annually to RPRA. Each program has different requirements regarding how a producer must submit a brand supply list. For more information, consult the applicable programs’ walkthrough guide or contact RPRA’s Compliance and Registry Team at 1-833-600-0530 or by emailing registry@rpra.ca.

-

If you select bank withdrawal as your method of payment, this authorizes the Resource Productivity and Recovery Authority to make a one-time withdrawal for the Registry invoice payment from the account you provided.

Bank Withdrawal – Important Terms:

- You have authorized RPRA to make one-time debits from your account. RPRA will obtain your authorization before any additional one-time or sporadic withdrawal is debited from your account. You have agreed that this confirmation may be provided at least three (3) calendar days before the first payment is withdrawn from your account. You have waived any and all requirements for pre-notification of the account being debited.

- Your payments are being made on behalf of a business.

- Your agreement may be cancelled provided notice is received thirty (30) days before the next withdrawal. If any of the above details are incorrect, please contact us immediately at the contact information below. If the details are correct, you do not need to do anything further and your Pre-Authorized Debits (PAD) will be processed. You have certain recourse rights if any debit does not comply with these terms. For example, you have the right to receive a reimbursement for any PAD that is not authorized or is not consistent with this PAD Agreement. To obtain more information on your recourse rights, contact your financial institution or visit www.payments.ca.

Please note:

- Registry invoices are considered due on receipt.

- Invoices are in CAD funds and payments must be sent in CAD.

- It may take 1-2 weeks for the involved banks to process your payment.

If you have questions relating to fee payment, contact our Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free at 1-833-600-0530.

-

Failure of an obligated party to meet a registration or reporting deadline may result in compliance action, including compliance orders, prosecutions or monetary penalties issued in accordance with the Administrative Penalties Guidelines.

In accordance with the Risk Based Compliance Framework, RPRA will communicate to obligated parties, via email, about their reporting requirements in advance of submission deadlines. RPRA will also send deadline reminders and notify missed deadlines to obligated parties prior to taking further compliance action.

For more guidance, read the new Late Registration or Report Submissions Compliance Bulletin.

-

No, where a producer is exempt, the regulatory obligations do not become the responsibility of the organization that is next in the producer hierarchy. The exempt producer remains the “producer” for those materials; they are just exempt from certain requirements under the regulation as set out in the relevant provisions providing for the exemption. This is the case in all RRCEA regulations.

-

There is no requirement for a First Nation community to formally change its transition date. If a community is not ready to report and/or participate in the offer process with the PROs by the initial transition date or the date outlined in the Transition Schedule, the community can indicate that to RPRA and we will work with you and the PROs to track when your community is ready to move forward in the process.

-

Eligible Ontario institutions are obligated to manage their waste under several regulations, each of which imposes different obligations and requirements.

Under the Ontario Environmental Protection Act, Industrial, Commercial and Institutional (IC&I) sector organizations have obligations to establish and operate an internal collection system that separates the waste generated on-site into different material categories (i.e., a source-separation program).

The Blue Box Regulation, under the Resource Recovery and Circular Economy Act, obligates producers of Blue Box material to collect, manage, and report on the materials that they supply to consumers both on-site and off-site.

-

Here are the lists of registered PROs:

Hazardous and Special Products PROs

These lists will continue to be updated as new PROs register with RPRA.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

Yes. Producers and service providers can enter into contractual agreements with multiple PROs.

-

Under the Resource Recovery and Circular Economy Act, the Authority is required to provide an annual report to the Minister that includes information on aggregate producer performance, and a summary of compliance and enforcement activities. Under section 51 of the Act, the Registrar also is required to post every order issued on the Registry.

-

No, products or packaging designated as Hazardous and Special Products (HSP) are not obligated under the Blue Box Regulation. For example, primary packaging for paints and coatings are HSP and therefore not obligated as Blue Box materials.

Some packaging for HSP products may still be obligated. For example, the packaging that contains an oil filter is obligated as Blue Box materials.

Consult the HSP Regulation or the Compliance and Registry Team for further information.

-

The brand holder is the obligated producer.

A marketplace facilitator only becomes obligated for products supplied through its marketplace where the producer would have been a retailer. If the producer is a brand holder or an importer, they remain the obligated producer even when products are distributed by a marketplace facilitator.

A retailer is a business that supplies products to consumers, whether online or at a physical location.

-

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).

-

The rule and allocation table creation process has been removed from the Blue Box Regulation and is therefore no longer required to create and maintain the system for collecting Blue Box materials across the province, as per regulatory amendments made by the government on April 14, 2022. As such, rule creators are no longer applicable under the regulation. Learn more about the amendments.

To replace these tools, the amended regulation now requires PROs to submit a report that outlines how they will operate the Blue Box collection system on behalf of producers, ensuring that materials are collected from all eligible communities (i.e., communities outside of the Far North) across the province. Learn more about what PROs need to include in the report.

-

Yes, a producer can change PROs at any time. Producers must notify RPRA of any change in PROs within 30 days of the change.

-

Under the Blue Box Regulation, allowable deductions for producers include Blue Box materials that are deposited into a receptacle at a location that is not an eligible source and where the product related to the Blue Box material was supplied and used or consumed.

This applies to food court restaurants located in a mall or in the base of an office tower. Blue Box materials that were disposed of in the buildings’ recycling receptacles and were supplied and used or consumed within that physical building are an allowable deduction. Blue Box materials that were disposed of in the buildings’ recycling receptacles but were not supplied and used or consumed within that physical building are not deductible.

This does not reduce the obligation of a producer to provide complete and accurate supply data or limit the ability of an Authority inspector to review the data and related records for the purpose of determining compliance.

-

Yes, producers are obligated to provide collection services to new single-family residences that come into existence during the transition period.

-

Producers are obligated to provide collection services to new facilities that come into existence during the transition period only if that facility would have qualified for collection services under the WDTA Blue Box Program.

For further certainty, the WDTA Blue Box Program includes collection services for multi-family households (including rental, cooperative or condominium residential), senior citizen residences, long-term care facilities and public and private elementary and secondary schools.

-

Yes, reusable bags made from Blue Box materials ( e.g. plastic, paper) and used as convenience packaging are obligated under the Blue Box Regulation and must be reported annually by producers in their supply report.

Convenience packaging refers to material that is provided with a product for consumers to handle or transport that product, in addition to the product’s primary packaging. This includes items such as bags and boxes that are supplied to consumers at check out.

For additional clarity:

- Reusable bags made primarily from plastic, paper, or any other Blue Box material, or a combination of these materials, are obligated. Reusable bags made from textile fibres such as cotton, hemp, bamboo, etc., are not obligated.

- Recycled content of the material has no impact on whether a reusable bag is obligated. For example, reusable bags containing post-consumer recycled plastic content are obligated.

- A reusable bag is obligated regardless of whether it is supplied to the consumer for free or at a cost. Examples include bags supplied at checkout to consumers at retail locations.

If you haven’t been reporting reusable bags as part of your annual supply data, please contact the Compliance Team immediately at registry@rpra.ca.

Also see our FAQ: ‘What do I do if I misreported my supply data?’

-

If a producer or service provider needs to adjust the performance data reported to RPRA, they must contact the Compliance Team immediately by emailing registry@rpra.ca. Please include the following information in the email:

- The rationale for the change in the data

- Any data that supports the need for a correction (e.g., tonnage purchase or sale contract, audit)

- Any other information to support the change

While it is an offence to submit false or misleading information under the RRCEA, RPRA wants this corrected as quickly as possible to ensure that it has accurate performance data from all registrants.

RPRA can only receive these requests from the primary contact on the company’s Registry account. Your request for an adjustment will be reviewed by a Compliance and Registry Officer.