Frequently Asked Questions

Results (410)

Click the question to read the answer.

-

Here are the lists of registered PROs:

Hazardous and Special Products PROs

These lists will continue to be updated as new PROs register with RPRA.

-

You are a tire producer if you supply new tires to consumers in Ontario and you have a permanent establishment in Canada. New tires are supplied to Ontario in two ways – sold on new vehicles or sold as loose tires. The definition for tires producers (as outlined in section 3 of the Tires Regulation) applies in both cases.

New loose tires that are marketed to consumers in Ontario

- For new tires where there is a brand holder resident in Canada: you are the producer for those new tires if you are the brand holder of the new tires (the legislation defines brand holder to mean a person who owns or licenses a brand or who otherwise has rights to market a product under the brand) and resident in Canada.

- For new tires where there is no brand holder resident in Canada: you are the producer for the new tires if you are the importer of those new tires and resident in Ontario.

- For new tires where there is no brand holder or importer resident in Ontario: you are the producer for the new tires if you are the first person to market those tires in Ontario and resident in Ontario.

- For new tires where there is no brand holder, importer or marketer resident in Ontario: you are the producer for the new tires if you are the person that marketed those new tires and non-resident in Ontario.

New vehicles with new tires that are marketed to consumers in Ontario

- For new vehicles where there is a brand holder resident in Canada: you are the producer for the new tires on those new vehicles if you are the manufacturer of the vehicles (the legislation defines vehicle to include motor vehicles, muscular-powered equipment and trailers) and resident in Canada.

- For new vehicles where there is no manufacturer resident in Canada: you are the producer for the new tires on those new vehicles if you are the importer of those new vehicles and resident in Ontario.

- For new vehicles where there is no manufacturer or importer resident in Ontario: you are the producer for the new tires on those new vehicles if you are the marketer of those new vehicles in Ontario and resident in Ontario.

- For new vehicles where there is no manufacturer, importer or marketer resident in Ontario: you are the producer for the new tires on those new vehicles if you are the marketer of those new vehicles and non-resident in Ontario.

-

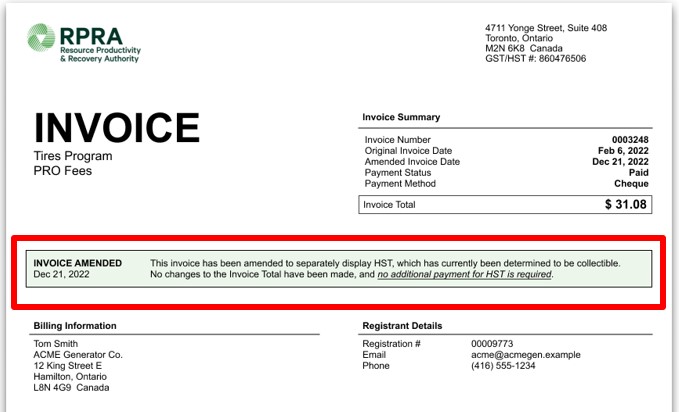

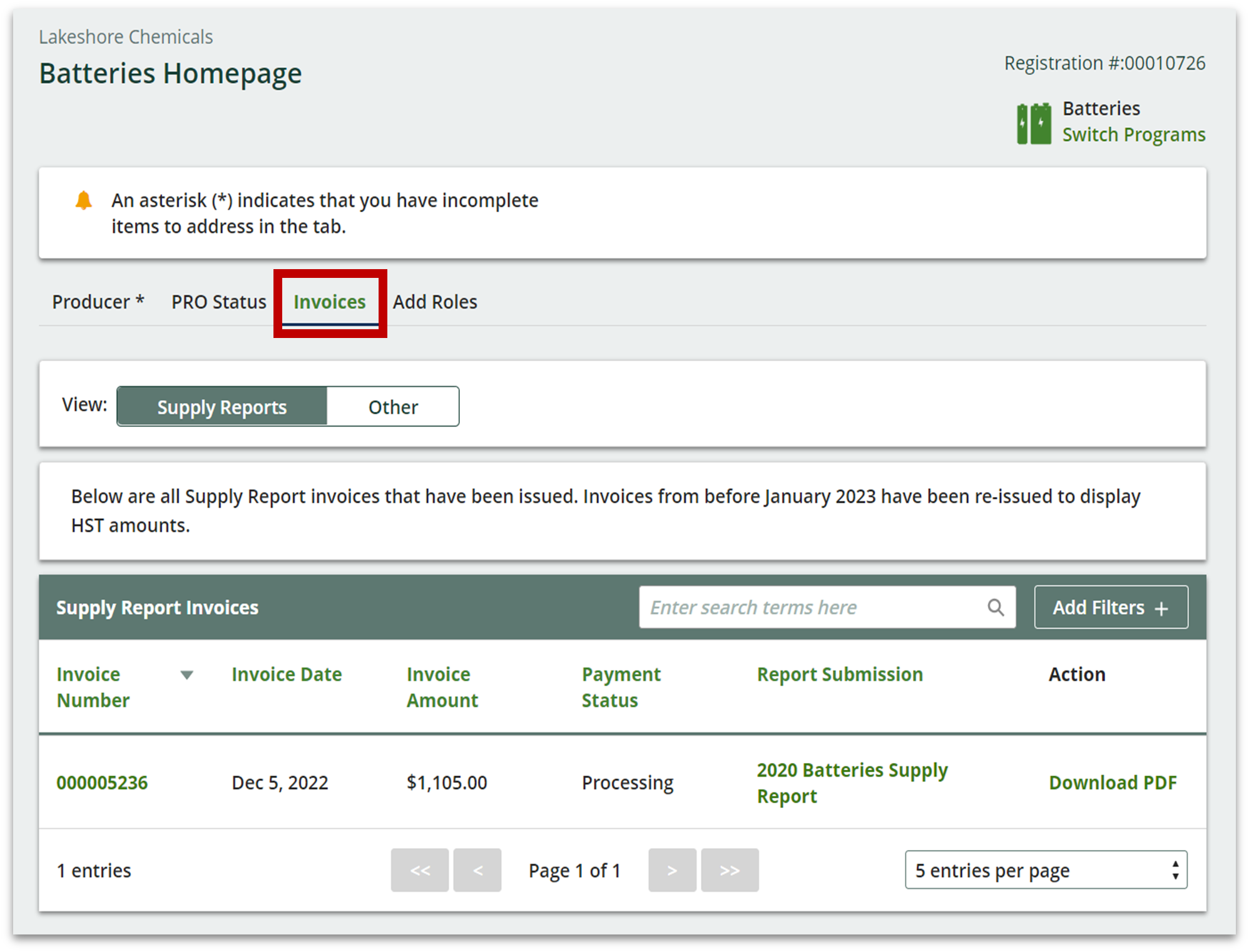

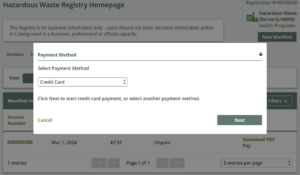

When paying fees to RPRA, you can select from one of the following payment methods:

- Bank withdrawal (pre-authorized debit)

- Credit card

- Electronic data interchange (EDI; also commonly known as ACH or EFT)

- Electronic bill payment

- Cheque

For instructions on how to submit payment by the method you chose, read one of the following FAQs:

- How do I pay my fees to RPRA by credit card?

- How do I pay my fees to RPRA by bank withdrawal (pre-authorized debit)?

- How do I pay my fees to RPRA by electronic bill?

- How do I pay my fees to RPRA by cheque?

- How do I pay my fees to RPRA by electronic data interchange (EDI)?

To note, Registry invoices are considered due on receipt. Invoices are in CAD funds and payments must be sent in CAD.

-

We recommend using Google Chrome, Mozilla Firefox, Microsoft Edge or Apple Safari when accessing the Registry. If you are experiencing an issue with the Registry, try clearing your cache or updating the browser to the latest version.

If you are using a different browser, the Registry will not function.

-

You should use the address where you carry on business. If you carry on business in more than one location in Ontario, use the main address for your business in Ontario. If you do not have an Ontario address, use the address that relates to the activities you carry out in Ontario.

-

You are a tire collector if you operate a tire collection site where more than 1000 kgs of tires are collected in a year. A tire collection site is a location where used tires are collected, including:

- Repair shops, garages and vehicle dealerships (where used tires are collected as part of changing tires for customers)

- Auto salvage and recycling sites

- Any other site where end-of-life vehicles with tires are managed

You are not a tire collector if you operate a tire collection site where you:

- Also retread tires or process tires (you would be a tire retreader or a tire processor for those sites); or

- Only collect tires from the on-site servicing of vehicles that you own or operate (such as a site where you service your rental car fleet)

Municipalities can choose to operate collection sites, but they are exempt from registering with RPRA. For more information about municipal sites see: How does the Tires Regulation affect municipalities and First Nations?

-

You are a tire processor if you receive and process tires for resource recovery or disposal. Processing means you are transforming tires into their constituent parts, including by shredding, chipping, grinding, cutting or cryogenic crushing. You are also a tire processor if you engage in activities to chemically alter tires, such as depolymerization.

-

You are a tire retreader if you replace the tread on worn tires so that they can continue to be used as tires.

-

You are a tire hauler if you arrange for the transport of tires used in Ontario to a site for processing, reuse, retreading or disposal.

-

Yes. PROs are private enterprises and charge for their services to producers.

Each commercial contract a producer enters with a PRO will have its own set of terms and conditions. It is up to the PRO and producer to determine the terms of their contractual agreement, including fees and payment schedule.

RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

No, producers are not required to sign up with a PRO to meet their regulatory requirements. It is a business decision if a producer chooses to work with a PRO, and a producer can choose to meet their obligations without a PRO.

Most producers will choose to contract with a PRO to provide collection, hauling, processing, retreading and/or refurbishing services to achieve their collection and management requirements unless they carry out these activities themselves.

-

No. A PRO cannot report on behalf of service providers.

-

Yes. Producers and service providers can enter into contractual agreements with multiple PROs.

-

No. Section 68 subsection (3) of the Resource Recovery and Circular Economy Act states that “a person responsible for establishing and operating a collection system shall ensure that no charge is imposed at the time of the collection.”

-

Program fees are charges that producers obligated under the Resource Recovery and Circular Economy Act, 2016, are required to pay to RPRA annually to recover its operational costs, including costs related to building and operating the registry, providing services to registrants, and compliance and enforcement activities.

All current and past fee schedules can be found here.

-

You may be required to provide a verification report for the annual tire supply report. You will be required to provide verification if you meet the definition of a medium or large producer. Small producers will not be required to submit a verification report, however a percentage of small producers selected annually by the Registrar will be subject to an inspection. If exceptions are identified during the inspection, a comprehensive review may be carried out. For more information on this, read Tires Registry Procedure – Audit.

-

Effective for the 2025 calendar year, and every year thereafter, producers no longer have collection targets and do not have to collect a minimum weight of used tires.

A producer’s individual management requirement is determined by formulas found in section 12 of the Regulation. See the tables below for details:

Management requirements for all tires

Performance Year Supply Report Year Formula *2025 2024 [(2020 supply + 2021 supply + 2022 supply) / 3)]×65% 2026 2025 [(2021 supply + 2022 supply + 2023 supply) / 3)]×65% 2027 2026 [(2022 supply + 2023 supply + 2024 supply) / 3)]×65% 2028 2027 [(2023 supply + 2024 supply + 2025 supply) / 3)]×65% 2029 2028 [(2024 supply + 2025 supply + 2026 supply) / 3)]×65% 2030 2029 [(2025 supply + 2026 supply + 2027 supply) / 3)]×70% Management requirements for large tires

Performance Year Supply Report Year Formula *2025 2024 [(2020 supply + 2021 supply + 2022 supply) / 3)]×60% 2026 2025 [(2021 supply + 2022 supply + 2023 supply) / 3)]×60% 2027 2026 [(2022 supply + 2023 supply + 2024 supply) / 3)]×60% 2028 2027 [(2023 supply + 2024 supply + 2025 supply) / 3)]×60% 2029 2028 [(2024 supply + 2025 supply + 2026 supply) / 3)]×60% 2030 2029 [(2025 supply + 2026 supply + 2027 supply) / 3)]×60% *For reports submitted in 2024, producers should use RPRA’s manual calculator.

It is important to note that producers must ensure that all collected tires are managed, regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA.

See our FAQ ‘How do I determine if I am an exempt tire producer?’ to learn more.

-

To register as a PRO, contact the Compliance and Registry Team at registry@rpra.ca or call 647-496-0530 or toll-free 1-833-600-0530.

-

The Tires Regulation states that at least one collection site or event per year is required in a territorial district with a population of 1,000 or more. Read Compliance Bulletin – Tire Collection Systems for more information.

-

Yes. However, the collection site may only allow up to 10 tires from a person in a single day to be dropped off. If the site is willing to accept more than 10 tires at a time, the site operator is required to record the municipality’s name, contact information, and the number of tires being dropped off. If a municipality chooses not to operate any tire collection sites, residents can be directed to a registered collector.

Contact RPRA’s Compliance Team at registry@rpra.ca, 647-496-0530 or toll free at 1-833-600-0530 if you or your residents have any issues dropping off less than 10 tires to a registered collector’s site.

-

As a retailer, you may also be a producer and/or a collector, based on the definitions in the Tires Regulation.

Businesses will continue to have discretion over whether they charge a fee to recover the cost of recycling their products. If a business chooses to charge a fee, they are no longer required to provide information about who is charging the visible fee and what it will be used for.

-

Contact the Ministry of Environment, Conservation and Parks for any information about Environmental Compliance Approvals.

-

If you collect used tires at your site as a result of onsite servicing of your vehicles, you are not a tire collector for the purposes of the Tires Regulation and you are exempt from registering as a collector with RPRA.

-

Operators of tire collection sites will have to independently enter into commercial agreements with producers or producer responsibility organizations (PROs) to secure tire collection services. As long as a collection site is part of a producer’s tire collection system, the producer, or their PRO, is obligated to ensure tires are picked up from that site.

Since producers have legal obligations under the Tires Regulation, producers, or their PROs, will need tires to meet their management requirements. While tire collectors (i.e., operator of collection sits) are no longer required to register with RPRA, the collection site must be part of a producer’s collection system for the tires to count toward a producer’s management requirements

A list of registered PROs and producers is available on RPRA’s website on the Find a registrant page.

-

The Tires Regulation requires producers to submit to the Registry the identity of each tire collector and tire collection site that is a part of that producer’s tire collection system. It is up to each producer, or a producer responsibility organization (PRO) on the producer’s behalf, to identify the tire collection sites that will be used in their tire collection systems.

Tire collectors are required to register and identify their collection sites (i.e., the address for every individual site where tires are collected). The collection site data will be used to populate a list of collection sites that will be available to producers and PROs. Producers, or their PROs, will be required to identify their tire collection systems.

Please read Compliance Bulletin -Tire Collection Systems for compliance guidance to producers who are required to establish and operate tire collection systems under the Tires Regulation.

-

No. If a municipality has a private company operating a site on their behalf, the company is not required to register the municipally-owned sites as long as the tires are picked up by a registered hauler and delivered to a registered processor or retreader.

If the private company owns or operates collection sites that are not owned by a municipality, it is required to register and report its non-municipally-owned sites.

To ensure tires continue to be picked up from your sites, you will need to make sure those sites are included in the collection systems established by tire producers or producer responsibility organizations (PROs). Since most producers will work with PROs to establish their collection systems, municipalities should contact a registered PRO.

Visit our webpage about PROs for more information.

-

No. Producers and PROs working on their behalf must operate the collection and management systems they have established as required by the Regulation even after their minimum management requirements are met.

-

A producer responsibility organization (PRO) is not necessarily required to include each and every collection site in Ontario in their collection system. However, producers and PROs acting on their behalf are required to establish and operate a collection system that meets the requirements of the Tires Regulation.

If a collection site operator is unable to be included in a collection system, the operator should contact RPRA’s Compliance Team at registry@rpra.ca, 647-496-0530 or toll free at 1-833-600-0530 for assistance.

Read Compliance Bulletin – Tire Collection Systems for more information. The contact information for all registered PROs is available on the producer responsibility organization webpage.

-

Under the Resource Recovery and Circular Economy Act, the Authority is required to provide an annual report to the Minister that includes information on aggregate producer performance, and a summary of compliance and enforcement activities. Under section 51 of the Act, the Registrar also is required to post every order issued on the Registry.

-

A producer responsibility organization (PRO) is a business established to contract with producers to provide collection, management, and administrative services to help producers meet their regulatory obligations under the Regulation, including:

- Arranging the establishment or operation of collection and management systems (hauling, recycling, reuse, or refurbishment services)

- Establishing or operating a collection or management system

- Preparing and submitting reports

PROs operate in a competitive market and producers can choose the PRO (or PROs) they want to work with. The terms and conditions of each contract with a PRO may vary.

-

Collection sites are required to accept used tires that are of similar rim size and weight as the new tires (or tires on new vehicles) that they sell. Use the Authority’s Find a Collection Site map to find a drop-off location and call ahead to confirm that the collection site will accept your tires.

-

No. The Authority does not administer contracts or provide incentives. Under the Regulations, producers will either work with a producer responsibility organization (PRO) or work directly with collection sites, haulers, refurbisher’s and/or processors to meet their collection and management requirements. Any reimbursement for services provided towards meeting a producers’ collection and management requirements will be determined through commercial contracts.

To discuss any payment, contact your service provider or a PRO. RPRA does not set the terms of the contractual arrangements between PROs and producers.

-

Resident in Ontario means a person having a permanent establishment in Ontario within the meaning of the Corporations Tax Act. A permanent establishment is usually a fixed place of business such as an office, factory, branch, warehouse, workshop, etc. In some cases, a corporation will be deemed to operate a permanent establishment in Ontario. These include cases where:

- The corporation produced, grew, mined, created, manufactured, fabricated, improved, packed, preserved or constructed anything in the province, in whole or in part;

- The corporation carries on business through an employee or agent in the province who has general authority to contract for the corporation; or

- The corporation carries on business through an employee or agent in the province who has a stock of merchandise owned by the corporation from which they regularly fill orders that they receive.

- A corporation will also have a permanent establishment in Ontario if it uses substantial machinery or equipment in the province, or if it is has a permanent establishment elsewhere in Canada and owns land in the province.

For more details about what constitutes a permanent establishment, see the definition of “permanent establishment” in the Corporations Tax Act.

-

You will have to meet the registration requirements for every category that applies to you.

-

To create a Registry account with the Authority, you will need to provide:

- CRA Business Number (BN)

- Legal Business Name

- Business address and phone number

- Address of where you work (if different from the main office)

- Contact information for your billing contact (this may also be added later)

-

For regulatory purposes, we need to know your legal name — the name you are incorporated under. We also need to know your business operating name if it is different from your legal business name to add to our published list of registrants. The list of registrants will be available on our website to allow registrants to interact with one another and to provide information to the public.

For example, if you are a registered collector and your legal name is 123456789 Ontario Ltd. and your business operating name is “Jack’s Garage,” a member of the public looking for a place to drop off used tires will need to know the name you are operating under to identify your location.

-

Brand holders and producers that supply products and packaging are required by legislation to meet individual mandatory collection and resource recovery requirements and may face compliance and enforcement consequences for failing to do so. The executive attestation ensures that executives responsible for managing the brand holder’s or producer’s business are aware of these requirements and can ensure that appropriate measures are put in place to achieve compliance with the regulations.

-

Tire collection sites are established to facilitate the responsible recycling and management of used tires. The types of tires accepted at these sites include, but are not limited to:

Examples of Accepted Tires:

- Automobile tires (cars, SUVs, light-duty trucks)

- Motorcycle tires

- Motor assisted bicycle tires (e.g., mopeds, non-kick scooters)

- Tractor tires

- Tires on industrial and agricultural vehicles and equipment

- Transport truck tires

- Trailer tires (e.g., boat trailers, RVs)

- All-terrain vehicle (ATV) tires

- Riding lawn mower tires

- Aircraft tires (if not supplied on an aircraft)

- Snow blower tires

- Small tires (1 kg to <5 kg), such as:

- Wheelbarrow tires

- Dolly tires

Examples of Tires That Are Not Accepted:

- Bicycle tires (muscle-powered)

- Stroller and kick scooter tires (non-motorized)

- Power-assisted bicycle tires (e.g., electric bicycles)

- Personal mobility device tires (e.g., wheelchairs, medical scooters)

Tires can be dropped off on or off the rim. Collection sites must accept tires on rims.

-

Individual Producer Responsibility (IPR) means that producers are responsible and accountable for collecting and managing their products and packaging after consumers have finished using them.

For programs under the Resource Recovery and Circular Economy Act, 2016 (RRCEA), producers are directly responsible and accountable for meeting mandatory collection and recycling requirements for end of life products. With IPR, producers have choice in how they meet their requirements. They can collect and recycle the products themselves, or contract with producer responsibility organizations (PROs) to help them meet their requirements.

-

No. While RPRA is responsible for the oversight, compliance and enforcement of the regulatory requirements for tires under Ontario’s individual producer responsibility framework, RPRA’s activities do not replicate those of OTS.

-

The Authority is the regulator designated by law to oversee the operation and wind up of current waste diversion programs under the Waste Diversion Transition Act, 2016. The Authority provides oversight, compliance, and enforcement activities with respect to regulations made under the Resource Recovery and Circular Economy Act, 2016.

-

The Authority recognizes the commercially sensitive nature of the information that parties submit to the registry. The Authority is committed to protecting the commercially sensitive information and personal information it receives or creates in the course of conducting its regulatory functions. In recognition of this commitment, the Authority, in addition to the regulatory requirements of confidentiality set out in the Resource Recovery and Circular Economy Act 2016 (section 57), has created an Access and Privacy Code that applies to its day-to-day operations, including the regulatory functions that it carries out.

Obligated material supply, collection, and resource recovery data will only be made public in aggregate form, to protect the confidentiality of commercially sensitive information.

The Authority will publish the names and contact information of all registered businesses – producers, service providers (collectors, haulers, processors, etc.), and producer responsibility organizations. The public will also have access to a list or method to locate any obligated material collection sites, as this information becomes available.

As part of its regulatory mandate, the Registrar will provide information to the public related to compliance and enforcement activities that have been undertaken.

The information that is submitted to the Registry will be used by the Registrar to confirm compliance and to track overall collection and management system performance. It will also be used by the Authority to update its policies and procedures and by the Ministry of Environment, Conservation and Parks for policy development.

-

In accordance with the legislation (Resource Recovery Circular Economy Act 2016, section 57), the Authority is required to comply with strict confidentiality requirements. The Authority has also developed an Access and Privacy Code that applies to its day-to-day operations.

The Registry has been developed according to cybersecurity best practice principles. This includes VPN-based restrictions, staff training on all cybersecurity policies, staff access to the Registry on a strict role-requirement basis, and registry interface security features (example: two-factor authentication).

-

1. You will need the following information to create a Registry account:

- CRA Business Number (BN)

- Legal Business Name

- Business address and phone number

- Address of where you work (if different from the main office)

- Contact information for your additional users

2. You will need to provide the address and phone number for each site where you retread and/or process tires.

3. You will need to identify which of the following tire categories are applicable to your business:

- Large tires (over 700 kg)

- Other tires (700 kg or less)

4. If you are a processor, you will also need to identify which of the following materials are applicable to your process:

- Crumb rubber

- Tire derived mulch

- Tire derived aggregate

- Tire derived rubber strips and chunks

- Fluff/fibre

- Tire derived steel/metal

- Other

If your business performs multiple roles (e.g., hauler and processor), you only need to create one registry account and identify the additional roles. If you are a producer, use your producer account to add roles.

-

A volunteer organization is a person who:

- Is a brand holder who owns a brand that is used in respect of batteries or EEE;

- Is not a resident in Canada;

- Has registered with the Authority; and

- Has entered into a written agreement with a producer for the purpose of carrying out one or more producer responsibilities.

A volunteer organization is not a producer but can take on the registration and reporting responsibilities for producers in relation to its brand. Under the Regulation, producers remain responsible for meeting their management requirements and cannot pass off their obligations through voluntary remitter agreements or any other commercial agreement.

Any brand holder or producer who is interested in making any agreement as indicated (or described) above, should contact the Compliance Team at registry@rpra.ca, 647-496-0530 or toll-free at 1-833-600-0530.

-

You are considered a battery producer under the Batteries Regulation if you market batteries into Ontario and meet the following requirements:

- Are the brand holder of the battery and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import batteries from outside of Ontario;

- If there is no resident importer, have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, does not have residency in Ontario and markets directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Batteries Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

Producers are required to report single-use (primary) and rechargeable batteries that:

- Weigh 5 kg or less, and

- Are sold separately from products.

Examples include button cells, AA, AAA, C, D, 9V, lantern batteries, small, sealed lead acid (SLA) batteries, and replacement batteries for products such as drills, cell phones, and laptops.

Batteries that do not need to be reported are those that:

- Are sold with or in products (e.g., batteries included with cordless power tools, cell phones, laptops, toys, vapes, fire alarms)

- Weigh over 5 kg (e.g., car batteries, forklift batteries, stationary batteries)

Producers who wish to confirm if they are exempt because the type(s) of batteries they supply do not need to be reported should contact the Compliance Team at registry@rpra.ca or 833-600-0530.

-

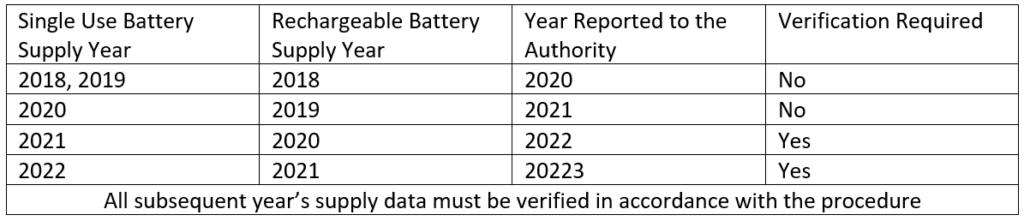

There is no audit verification requirement for the first two supply data reports submitted to the Authority. Therefore, data submitted for single-use batteries supplied in 2018, 2019, and 2020, as well as rechargeable batteries supplied in 2018 and 2019 will not have to be verified in accordance with the Registry Procedure – Verification and Audit.

As shown in the table below, under section 15 of the Battery Regulation, the first supply data report for which there are audit and verification requirements will be submitted in 2022. This supply data report is for single-use batteries supplied in 2021 and rechargeable batteries supplied in 2020.

-

Yes. You are still required to register with the Authority Registry even if you already have an existing account.

-

Producer supply data is used to calculate their individual minimum management requirements under the Batteries Regulation.

To learn how calculations are formulated, visit the FAQ How are battery producer minimum management requirements determined?

-

A producer’s individual management requirement is determined by formulas found in section 13 of the Regulation. See the table below for details:

Supply Report Year for Primary Batteries Supply Report Year for Rechargeable Batteries Formula Performance Year 2023 2022 [(2023+2022+2021)/3] + (2022+2021+2020)/3] × 45% 2025* 2024 2023 [(2024+2023+2022)/3] + (2023+2022+2021)/3] × 50% 2026 2025 2024 [(2025+2024+2023)/3] + (2024+2023+2022)/3] × 50% 2027 2026 2025 [(2026+2025+2024)/3] + (2025+2024+2023)/3] × 50% 2028 *For reports submitted in 2024, producers should use RPRA’s manual calculator.

It is important to note that producers must ensure that all collected batteries are managed, regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA.

See our FAQ ‘How do I determine if I am an exempt battery producer?’ to learn more.

-

A battery producer qualifies for an exemption if their average weight of supply for that calendar year is:

- Less than or equal to 2,500 kg of rechargeable batteries, or

- Less than or equal to 5,000 kg of primary batteries.

Average supply weight is determined using the following formula:

Average weight of rechargeable batteries = (Y3 + Y4 + Y5) / 3

- Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

Average weight of primary batteries = (Y2 + Y3 + Y4) / 3

- Eg. 2025 average weight of supply = (2023 + 2022 + 2021) / 3

Battery producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA.

- Establishing a collection and management system.

- Meeting management requirements.

- Promotion and education requirements.

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of batteries (by category) supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

Also see our FAQ: ‘How are battery producers’ minimum management requirements determined?‘

-

As of July 1, 2020, producers are required to establish and operate a collection system for batteries that meets the accessibility requirements in the regulation. Producers must ensure that all batteries collected are managed regardless of their minimum management requirements.

For producers to meet their obligations, they have the choice of establishing and operating their own collection and management system or working with one or more producer responsibility organizations (PROs) that are registered with the Authority.

Please contact the Compliance Team at 833-600-0530 or registry@rpra.ca to discuss other requirements under the Batteries Regulation.

-

You are an information technology, telecommunications, audio-visual (ITT/AV) producer if you market ITT/AV into Ontario and:

- Are the brand holder of the EEE and have residency in Canada;

- If there is no resident brand holder, have residency in Ontario and import EEE from outside of Ontario;

- If there is no resident importer, have residency in Ontario and market directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, do not have residency in Ontario and market directly to consumers in Ontario (e.g., online sales).

Even if you do not meet the above definition, there may be circumstances where you qualify as a producer. Read the Electrical and Electronic Equipment Regulation for more detail or contact the Compliance and Registry Team for guidance at registry@rpra.ca or (647) 496-0530 or toll-free at (833) 600-0530.

-

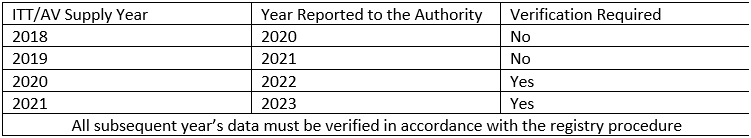

As shown in the table below, verification of the ITT/AV supply data reported in 2020 and 2021 is not required. Verification of supply data for ITT/AV will be required starting in 2022 for products supplied in 2020. All subsequent years of supply data are required to be verified when the data is reported.

For more information on the required verification and audit of data, view the Registry Procedure: EEE Verification and Audit.

-

Yes. If you are a producer with retailers or distributors supplying your obligated EEE into Ontario, you can email us at registry@rpra.ca to discuss options on how to report your supply data. There are several options available, including an easy-to-use sales formula and weight conversion factors. See the EEE Verification and Audit procedure for more information.

One option is to have your supply data reported by each of your retailers or distributors on a piecemeal basis. The piecemeal option requires that extra steps be undertaken by you and the Authority. You must contact the Authority in advance if you wish to pursue this option.

Note that even if you have a retailer or distributor providing data on your behalf, it remains the producer’s obligation to ensure that all the required data gets reported and that it is reported accurately to the Authority in accordance with the EEE Regulation. The entry of inaccurate information by someone on your behalf is not a defense to non-compliance.

-

Yes. You are still required to register with the Authority Registry even if you already have an existing account.

-

Producer supply data is used to calculate their individual minimum management requirements under the EEE Regulation.

To learn how calculations are formulated, visit the FAQ How are ITT/AV producer minimum management requirements determined?

-

A producer’s individual management requirements are determined by formulas found in section 14 of the Regulation, summarized in the table below:

Performance Year Supply Report Year Formula 2025 2024 (2020 supply + 2021 supply + 2022 supply) / 3×65%* 2026 2025 (2021 supply + 2022 supply + 2023 supply) / 3×65% 2027 2026 (2022 supply + 2023 supply + 2024 supply) / 3×65% 2028 2027 (2023 supply + 2024 supply + 2025 supply) / 3×65% 2029 2028 (2024 supply + 2025 supply + 2026 supply) / 3×65% 2030 2029 (2025 supply + 2026 supply + 2027 supply) / 3×70% *For reports submitted in 2024, producers should use RPRA’s manual calculator

It is important to note that producers must ensure that all ITT/AV collected is managed regardless of what their minimum management requirement is.

Note: Producers with a management requirement below a certain threshold may be exempt from registering with and reporting to RPRA. See our FAQ ‘How do I determine if I am an exempt ITT/AV producer?’ to learn more.

-

An ITT/AV producer qualifies for an exemption if their average weight of supply for that calendar year is less than or equal to 5,000 kg.

Average supply weight is determined using the following formula:

Average weight of ITT/AV supply = (Y3 + Y4 + Y5) / 3

Eg. 2025 average weight of supply = (2022 + 2021 + 2020) / 3

ITT/AV producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of ITT/AV supplied into Ontario each year and provide them to the RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 833-600-0530 or registry@rpra.ca.

-

As of January 1, 2021, producers are required to establish and operate a collection system for ITT/AV that meets the accessibility requirements in the regulation. Producers must ensure that all ITT/AV collected is managed regardless of what their minimum management requirements are.

Producers have the choice of establishing and operating their own collection and management systems or working with one or more producer responsibility organizations (PROs) registered with the Authority to meet their obligations.

Please contact the Compliance Team at 833-600-0530 or registry@rpra.ca to discuss other requirements under the EEE Regulation.

-

You may have obligations as an ITT/AV producer. To determine if you are a producer, see the FAQ Am I an ITT/AV producer?

If you are not a producer, then under the EEE Regulation you are not required to report supply data to the Authority or anyone else.

-

No. RPRA is the regulator for the purposes of the new EEE Regulation. Producers and PROs are required to register with RPRA and meet the mandatory performance and reporting requirements under the regulation. RPRA is responsible for overseeing compliance with the regulation and has a range of enforcement tools that include compliance orders, administrative penalties, and prosecutions.

As a regulator, RPRA will not provide collection and management services. Instead, producers will be served by a competitive market comprised of processors, refurbishers, haulers, and PROs. Producers can contract with PROs to meet their obligations under the EEE Regulation, but producers will always remain responsible for meeting those requirements regardless of who they contract with.

-

No. The list of products obligated under the EEE Regulation is different from the list of products included in the OES Program. The OES Program required producers to report the number of units they supplied, while the EEE Regulation requires producers to report the total weight of products.

To help producers calculate the weight of their products, we have included weight conversion factors in our Verification and Audit procedure, which is included as a weight conversion tool on the registration form. Once a producer determines the units of products on which they are obligated to report, they can enter the units into the conversion tool to get a calculated weight to report to the Authority.

For more information, see the Determining Supply Data section of the Registry Procedure: EEE Verification and Audit.

-

Businesses have the choice to recover the cost of recycling their products by incorporating those costs into the overall cost of their product (as they do with other costs, such as materials, labour, other regulatory compliance costs, etc.) or by charging it as a separate fee to consumers.

Environmental fees are not mandatory and are applied at the discretion of the business charging them, including the amount of the fee.

-

Consumer protection laws in Ontario prohibits the misrepresentation of charges, which means that producers or retailers cannot misrepresent any visible fees as a regulatory charge, tax, RPRA fee or something similar. Consumers who have questions or concerns about a specific transaction or want to report a misrepresentation can contact the Ministry of Public and Business Service Delivery at 1-800-889-9768.

As of March 2023, the promotion and education requirements related to environmental fees have been removed from the Tires, Batteries, Electrical and Electronic Equipment, and Hazardous and Special Products regulations. No changes were made to the Blue Box Regulation as it never contained promotion and education requirements related to these fees.

RPRA’s compliance bulletin Charging Tire Fees to Consumers has since been revoked and RPRA has ceased its enforcement of promotion and education requirements for visible fees across all materials.

-

There is no set environmental fee for any product, the amount of the fee charged is decided by the business.

-

No. An environmental fee is not a government tax and cannot be represented as mandatory, a regulatory charge, or a RPRA fee. It is a fee charged at the discretion of a business to recover their costs related to recycling the product.

-

If you are concerned about the fee you were charged, you should contact the business that charged you the fee to request a more detailed explanation of how the fee was determined.

-

Under the Blue Box Regulation, blue box product packaging includes:

- Primary packaging is for the containment, protection, handling, delivery and presentation of a product at the point of sale, including all packaging components, but does not include convenience packaging or transport packaging (e.g., film and cardboard used to package a 24-pack of water bottles and the label on the water bottle).

- Transportation packaging which is provided in addition to primary packaging to facilitate the handling or transportation of one or more products such as a pallet, bale wrap or box, but does not include a shipping container designed for transporting things by road, ship, rail or air.

- Convenience packaging includes service packaging and is used in addition to primary packaging to facilitate end users’ handling or transportation of one or more products. It also includes packaging that is supplied at the point of sale by food-service or other service providers to facilitate the delivery of goods and includes items such as bags and boxes that are supplied to end users at check out, whether or not there is a separate fee for these items.

- Service accessories are products supplied with a food or beverage product and facilitate the consumption of that food or beverage product and are ordinarily disposed of after a single use, whether or not they could be reused (e.g., a straw, cutlery or plate).

- Ancillary elements are integrated into packaging (directly hung or attached to packaging) and are intended to be consumed or disposed of with the primary packaging. Ancillary elements help the consumer use the product. Examples of ancillary packaging include a mascara brush forming part of a container closure, a toy on the top of candy acting as part of the closure, devices for measuring dosage that form part of a detergent container cap, or the pouring spout on a juice or milk carton.

-

Under the Blue Box Regulation, paper products include printed and unprinted paper, such as a newspaper, magazine, greeting cards, calendars (promotional or purchased), notebooks and daily planners, promotional material, directory, catalogue or paper used for copying, writing or any other general use.

Hard or soft cover books and hardcover periodicals are not considered paper products.

-

Under the Blue Box Regulation, a packaging-like product is:

- ordinarily used for the containment, protection, handling, delivery, presentation or transportation of things

- ordinarily disposed of after a single use

- not used as packaging when it is supplied to the consumer

Packaging-like products include aluminum foil, a metal tray, plastic film, plastic wrap, wrapping paper, a paper bag, beverage cup, plastic bag, cardboard box or envelope, but does not include a product made from flexible plastic that is ordinarily used for the containment, protection, or handling of food, such as cling wrap, sandwich bags, or freezer bags.

If a producer is unsure whether or not their product is a packaging-like product, they can ask themselves the following questions to help determine whether the product is obligated to be reported under the Blue Box Regulation:

- Is the product actually packaging around a separate product?

- If yes, the product is not a packaging-like product. Instead, the product is considered blue box packaging and must be reported as blue box material. If no, continue to the next question.

- Is the product used for the containment, protection, handling, delivery, presentation or transportation of a thing(s)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product typically disposed of after a single use (regardless if some may wash and reuse it)?

- If no, the product is not a packaging-like product. If yes, continue to the next question.

- Is the product made from flexible plastic that is for the containment, protection or handling of food?

- If yes, the product is not a packaging-like product. If no, the product is a packaging-like product and must be reported as blue box material.

If a producer is still unsure whether or not their product is a packaging-like product, they should contact the Compliance and Registry Team at 833-600-0530 or registry@rpra.ca.

-

As the Regulator responsible for enforcing regulations under the Resource Recovery and Circular Economy Act, 2016, the Registrar uses their discretion for when it is necessary to give registrants more time to collect the information needed for registration and/or reporting.

-

See our FAQ to understand “What is blue box product packaging?”.

Product packaging added to a product can be added at any stage of the production, distribution and supply of the product. A person adds packaging to a product if they:

- make the packaging available for another person to add the packaging to the product

- cause another person to add the packaging to a product

- combine the product and the packaging

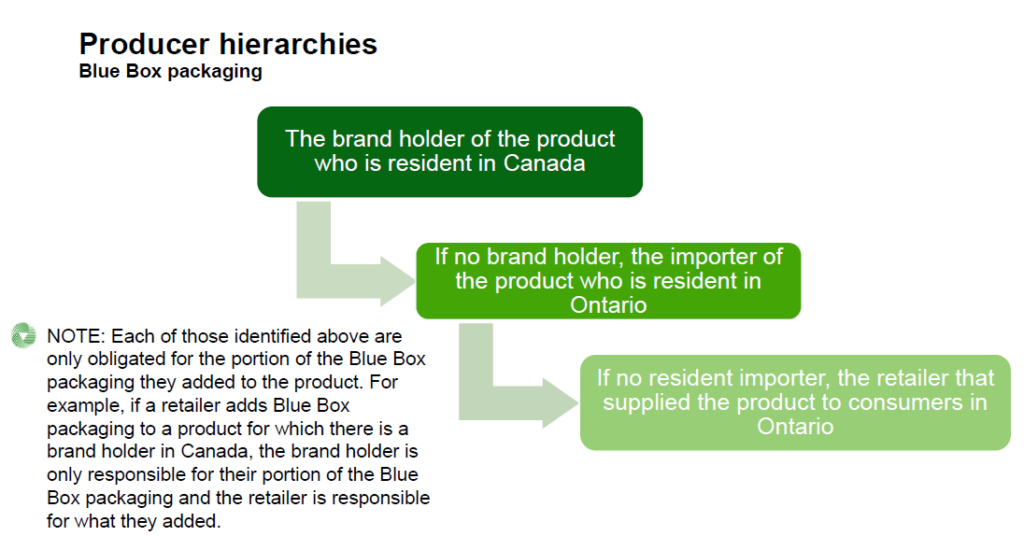

For the portion of the product packaging that a brand holder added to the product, a person is considered a producer:

- if they are the brand holder of the product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For the portion of the product packaging that an importer of the product into Ontario added to the product, a person is considered a producer:

- if they are resident in Ontario and import the product from outside of Ontario

- if no resident importer, they are the retailer that supplied the product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

For any portion of the packaging that is not described above, the producer is the retailer who supplied the product to consumers in Ontario.

-

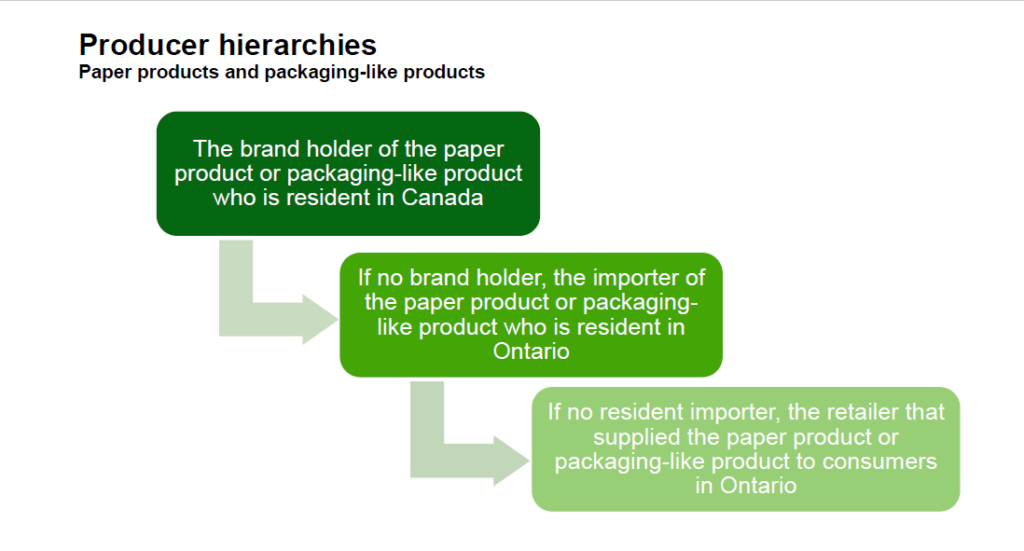

See our FAQs to understand “What are paper products?” and “What are packaging-like products?”.

For paper products and packaging-like products, a person is considered a producer:

- if they are the brand holder of the paper product or packaging-like product and are resident in Canada

- if no resident brand holder, they are resident in Ontario and import the paper product or packaging-like product from outside of Ontario

- if no resident importer, they are the retailer that supplied the paper product or packaging-like product directly to consumers in Ontario

- if the retailer who would be the producer is a marketplace seller, the marketplace facilitator is the obligated producer

- if the producer is a business that is a franchise, the franchisor is the obligated producer, if that franchisor has franchisees that are resident in Ontario

-

No, transport packaging is only obligated when supplied to a consumer in Ontario. Any transport packaging removed by a retailer or other entity before the product is supplied to a consumer is not obligated under this regulation.

-

No, products or packaging designated as Hazardous and Special Products (HSP) are not obligated under the Blue Box Regulation. For example, primary packaging for paints and coatings are HSP and therefore not obligated as Blue Box materials.

Some packaging for HSP products may still be obligated. For example, the packaging that contains an oil filter is obligated as Blue Box materials.

Consult the HSP Regulation or the Compliance and Registry Team for further information.

-

The brand holder is the obligated producer.

A marketplace facilitator only becomes obligated for products supplied through its marketplace where the producer would have been a retailer. If the producer is a brand holder or an importer, they remain the obligated producer even when products are distributed by a marketplace facilitator.

A retailer is a business that supplies products to consumers, whether online or at a physical location.

-

Blue Box materials supplied to a business (e.g., the operators of a long-term care home) are not obligated, however, there are no deductions available for materials supplied to a consumer in an IC&I setting (e.g., a resident of a long-term care home).

Any Blue Box materials supplied to consumers in Ontario are obligated. Blue Box materials supplied to the IC&I sector are not obligated (except beverage containers which are obligated regardless of the sector supplied into).

-

RPRA does not vet PROs before listing them on the website. Any business that registers as a PRO will be listed. Producers should do their own due diligence when determining which PRO to work with.

-

Sections 54 and 55 of the Blue Box Regulation require municipalities and First Nations to submit the information in the Initial Report and Transition Report to the Authority.

Under the Blue Box Regulation, producers will be fully responsible for the collection and management of Blue Box materials that are supplied into Ontario. To ensure that all communities continue to receive Blue Box collection services, communities will be allocated to producers, or PROs on their behalf, who are obligated to provide collection services. The information that is submitted in the Initial and Transition Reports will be used by PROs to plan for collection in each eligible community.

The Authority will also use the information provided by municipalities and First Nations to ensure that producers are complying with their collection obligations under the Blue Box Regulation.

It is important that municipalities and First Nations complete these reports accurately so that all eligible sources (residences, facilities, and public spaces) in their communities continue to receive Blue Box collection after their community transitions to full producer responsibility.

-

There are three reports for eligible communities under the Blue Box Regulation: an Initial Report, a Transition Report and Change Reports.

- The Initial Report will be submitted by all communities in 2021. It will provide an overview of the communities and of the WDTA Blue Box program that operates in that community.

- The Transition Report will be submitted by communities 2 years prior to their transition year. It provides more detailed information about the WDTA Blue Box program that operates in the community.

- Local municipalities and local services boards are not required to submit Change Reports to update information provided in their Initial or Transition Reports. Any changes should be addressed with Circular Materials in their role as the Administrator of the common collection system. Contact operations@circularmaterials.ca for more information.

These reports need to be completed by all eligible communities under the Blue Box Regulation.

An eligible community is a local municipality or local services board area that is not located in the Far North, or a reserve that is registered by a First Nation with the Authority and not located in the Far North.

- The Far North has the same meaning as in the Far North Act, 2010. To determine whether a community is in the Far North, use this link.

- A local municipality means a single-tier municipality or a lower-tier municipality. A local services board has the same meaning as “Board” in the Northern Services Boards Act.

- A First Nation means a council of the Band as referred to in subsection 2(1) of the Indian Act (Canada).

If you are an upper-tier municipality or waste association, these reports must be submitted separately for each eligible community in your program.

Visit the Municipal and First Nation webpages for more information.

-

Yes, all eligible communities must submit these reports to the Authority. The Datacall is the source of data for determining the net Blue Box system cost and for allocating funding under the Blue Box Program Plan. The Initial and Transition reports are for a separate and distinct program than Datacall and are required under the new Blue Box Regulation, which requires eligible communities to submit these reports.

While some of the required information in these reports was reported to Datacall, much of the information was not. Where there is overlap between what was reported to Datacall and the information that is required in these reports, please see the guidance below on where to find this information in your Datacall report.

-

First Nation communities interested in receiving producer-run Blue Box services must register with the Authority. To register, communities must submit contact information of the person responsible for waste management in the community using the First Nation community registration form. Once completed, the registration form should be submitted by email to registry@rpra.ca.

Visit our First Nation webpage for more information.

-

Under the Blue Box Regulation, consumers are individuals who use a product and its packaging for personal, family or household purposes, or persons who use a beverage and its container for personal, family, household, or business purposes.

-

A marketplace facilitator is a person who contracts with a marketplace seller to facilitate the supply of the marketplace seller’s products by:

- Owning or operating an online consumer-facing marketplace or forum in which the marketplace seller’s products are listed or advertised for supply and where offer and acceptance are communicated between a marketplace seller and a buyer (e.g., a website), and

- Providing for the physical distribution of a marketplace seller’s products to the consumer (e.g., storage, preparation, shipping of products).

Under the Blue Box Regulation, if a retailer (online or at a physical location) is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer. A marketplace seller is a person who contracts with a marketplace facilitator to supply its products.

-

As an obligated Blue Box producer, you are required to:

- Register with RPRA

- Report supply data to RPRA annually

- Meet mandatory and enforceable requirements for Blue Box collection systems

- Meet mandatory and enforceable requirements for managing collected Blue Box materials, including meeting a management requirement set out in the regulation

- Meet mandatory and enforceable requirements for promotion and education

- Provide third-party audits of actions taken towards meeting your collection and management requirements, and report on those actions to RPRA through annual performance reports

-

Yes, there have been some key changes to the producer hierarchies which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- If a retailer is determined to be the producer based on hierarchies, but they are a marketplace seller, the marketplace facilitator is the obligated producer.

- Brand holders that are resident in Canada are obligated, which varies from the Stewardship Ontario program where brand holders that are resident in Ontario are obligated.

See our FAQ to understand “Who is a marketplace facilitator?”.

-

There is an exemption in the Blue Box Regulation for producers whose gross annual revenue generated from products and services in Ontario is less than $2 million. The following sources are excluded for the purpose of determining revenue:

- Government tax revenue

- Property taxes

- General assistance funding received under the Ontario Municipal Partnership Fund

- Payments in lieu of taxes

- Canadian or Ontarian government grants available to municipalities with the intent of investing in public infrastructure

-

There is an exemption in the Blue Box regulation for producers whose gross annual revenue generated from products and services in Ontario less than $2 million. The revenue that counts towards the exemption is revenue from products and services. Charitable donations are not revenue from products and services and therefore does not count towards the exemption. Revenue other than charitable donations that are recorded from registered charities will be considered revenue from products and services.

-

Under the Blue Box Regulation, there are three types of exemptions that apply to producers:

- Based on a producer’s gross annual revenue,

- based on the weight of Blue Box materials supplied into Ontario, and

- for producers of newspaper

1. Any producer whose gross annual Ontario revenue from products and services is less than $2,000,000 is exempt from all producer requirements under the regulation. In the case where the producer is a franchisor, it is the gross annual revenue of the system that is used to determine if an exemption applies.

Any producer who meets the exemption must keep any records that demonstrate its gross annual Ontario revenue is less than $2,000,000 in a paper or electronic format that can be examined or accessed in Ontario for a period of five years from the date of creation.

See our FAQs to understand what revenues municipalities and registered charities should consider when determining whether or not they are an exempt producer.

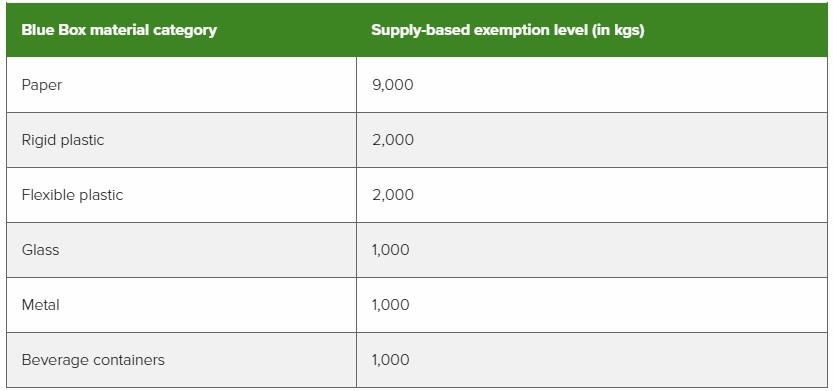

2. A producer who is above the revenue-based exemption level may still be exempt from performance requirements (collection, management and promotion and education) if their supply weight is below the exemption levels outlined in the table below.

If a producer’s annual revenue is more than $2,000,000 and supply weight in all material categories is less than the tonnage exemption threshold, the producer is required to register and report.

If a producer’s annual revenue is more than $2,000,000 and supply weight in at least one material category is above the tonnage exemption threshold, the producer is required to meet all obligations (registration, reporting, collection, management, and promotion and education). However, producers are only required to meet their minimum management requirement in material categories where they are above the exemption level.

3. As outlined in the amended Blue Box Regulation (released April 19, 2022), producers of newspapers may be exempt from collection, management, and promotion and education requirements. For the purposes of this exemption, “newspapers” includes newspapers and any protective wrapping and any supplemental advertisements and inserts that are provided along with the newspapers.

For a producer to qualify for this exemption, newspapers must account for more than 70% of their total weight of Blue Box materials supplied to consumers in Ontario in a calendar year. If exempt, the producer is not required to meet collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario in the following two calendar years.

A producer whose newspaper supply accounts for 70% or less of their total weight of Blue Box materials is subject to collection, management, and promotion and education requirements for all Blue Box materials they supply in Ontario.

-

The following are the types of Blue Box Materials obligated under the Blue Box Regulation:

- Blue box packaging (primary, transport, convenience, service accessories, ancillary elements)

- Paper products

- Packaging-like products

-

Producers are required to register with RPRA by October 1, 2021, as outlined in the Blue Box Regulation.

After this date, new businesses are required to register within 30 days of becoming a producer.

-

Producers are required to provide the following information when registering with RPRA:

- Contact information

- PRO information (if a PRO has been retained at time of reporting), including what services they have retained a PRO for

- Their 2020 supply data in each of the seven material categories– beverage container, glass material, flexible plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

Please note that this information must be submitted to RPRA directly.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

You are a hazardous and special products (HSP) producer if you market antifreeze and oil filters (excluding those provided in new vehicles, for which a separate hierarchy applies as outlined below), oil containers, solvents, paints and coatings, pesticides, fertilizers, pressurized containers or refillable propane containers to consumers in Ontario and:

- You are the brand holder and have residency in Canada;

- If there is no resident brand holder, you have residency in Ontario and import from outside of Ontario;

- If there is no resident importer, you have residency in Ontario and market directly to consumers in Ontario (e.g., online sales); or

- If there is no resident marketer, you do not have residency in Ontario and market directly to consumers in Ontario (e.g., online sales).

You are a hazardous and special products (HSP) producer if you market oil filters and antifreeze provided in new vehicles into Ontario and:

- You are the manufacturer of the new vehicle and have residency in Canada;

- If there is no resident vehicle manufacturer, you have residency in Ontario and import the vehicle from outside of Ontario;

- If there is no resident importer, you have residency in Ontario and market the vehicle directly to consumers in Ontario; or

- If there is no resident marketer, you do not have residency in Ontario and market the vehicle directly to consumers in Ontario.

You are a hazardous and special products (HSP) producer if you market mercury-containing barometers, thermometers or thermostats into Ontario and:

- You are the brand holder and have residency in Canada; or

- You are the brand holder of barometers, thermometers or thermostats marketed to consumers in Ontario that do not contain mercury

You are a hazardous and special products (HSP) producer if you market fertilizers into Ontario and:

- You are the brand holder and have residency in Canada

Even if you do not meet the above definitions, there may be circumstances where you qualify as a producer. Read the Hazardous and Special Products Regulation for more details or contact the Compliance Team for guidance at registry@rpra.ca or toll-free at 1- (833) 600-0530.

Related FAQs:

-

Starting in 2022, producers are required to report their supply data annually to RPRA.

Each year, producers will need to provide the previous years’ supply data in each of the seven material categories – beverage container, glass material, flexible plastic, rigid plastic, metal material, paper material, and certified compostable products and packaging material – as well as any deductions.

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”

-

RPRA’s Registry fees cover the costs related to compliance and enforcement and other activities required to administer the regulations under the RRCEA, and building and operating the Registry.

The Registry fees cover expenses in a given year (e.g., 2021 fees cover 2021 expenses). 2021 fees for Blue Box cover the Authority’s costs to undertake activities to implement the regulation in 2021, which include:

- helping obligated parties understand their requirements

- ensuring producers register and report their supply data by the deadline in the regulation

- compliance, enforcement, and communication activities

-

An HSP producer qualifies for an exemption if their average weight of supply for the previous calendar year is less than or equal to the weight specified in the chart below:

Exempt (Less than <) Oil Filters 3.5 Non-refillable Pressurized Containers 3 Antifreeze 20 Oil Containers 2 Solvents 3 Paints and Coatings 10 Pesticides 1 Refillable Pressurized Containers N/A Mercury-containing Devices Fertilizers Propane Containers (refillable) See our FAQ “Am I a small, large, or exempt HSP producer?” to determine how to calculate if you are an exempt HSP producer.

HSP producers that meet the exemption criteria are exempt from:

- Registering and reporting to RPRA

- Establishing a collection and management system

- Meeting a management requirement

- Promotion and education requirements

Producers must verify that they continue to meet the exemption annually, since their average weight of supply will change from year to year.

Exempt producers must keep records related to the weight of HSP supplied into Ontario each year and provide them to RPRA upon request.

Producers are advised to confirm their exemption with the Compliance Team at 1-833-600-0530 or registry@rpra.ca.

-

There are only two allowable deductions for Blue Box materials. There are for materials that are:

- collected from an eligible source at the time a related product was installed or delivered (e.g., packaging that is removed from the house by a technician installing a new appliance). This is the “installation deduction”.

- deposited into a receptacle at a location that is collected from a business or institution where Blue Box collection services are not provided under the regulation. This is the “ineligible source deduction” that was expanded by the regulation amendment in July 2023.

Ineligible source deductions:

Blue Box Producers may deduct materials that are collected from a business or institution where producers are not required to provide Blue Box collection services. Examples include offices, stores and shopping malls, restaurants, community centres, recreation facilities, sports and entertainment venues, universities and colleges, and manufacturing facilities.

Producers cannot deduct the following materials collected through the collection systems established under the Blue Box Regulation:

- Material that is generated at a facility (including multi-residential buildings, retirement homes, long-term care homes and schools).

- Material that is collected from a residence through a curbside or depot collection service.

- Material that is collected from a public space (including an outdoor area in a park, playground or sidewalk, or a public transit station).

- Material collected under an alternative or supplemental collection system.

- Beverage containers cannot be deducted.

Materials that are deducted cannot count toward a producer’s management requirement.

Please see the Reporting Guidance Ineligible Source Deductions for the 2024 Blue Box Supply Report for more information on how to determine and use these deductions.

-

A hauler is a person who arranges for the transport of HSP that are used by consumers in Ontario and are destined for processing, reuse, refurbishing or disposal, but does not include a person who arranges for the transport of HSP initially generated by that person

-

A processor is a person who processes, for the purpose of resource recovery, HSP used by consumers in Ontario

-

A disposal facility means a facility at which pesticides are disposed of.

-

Yes, there are some key changes to the data reported to Stewardship Ontario and what needs to be reported under the new regulation, which may affect what a producer is obligated for and should be considered if using data previously reported to Stewardship Ontario:

- There are fewer reporting categories than under the Stewardship Ontario program

- Certified compostable packaging and products now must be reported separately, but this category does not have management requirements

- There are only two deductions permitted under the Blue Box Regulation, and producers must report total supply and then report any weight to be deducted separately

- Exemptions are based on tonnage supply under each material category instead of a total supply weight threshold of less than 15 tonnes as in Stewardship Ontario’s program

See our FAQ to understand “What deductions are available to producers under the Blue Box Regulation?”; “Are there exemptions for Blue Box producers?“; “Are there any differences in Blue Box producer hierarchies between the current Stewardship Ontario program and the new Blue Box Regulation?”; and “Are there are any differences in obligated Blue Box materials between the current Stewardship Ontario program and the new Blue Box Regulation?”

-

The rule and allocation table creation process has been removed from the Blue Box Regulation and is therefore no longer required to create and maintain the system for collecting Blue Box materials across the province, as per regulatory amendments made by the government on April 14, 2022. As such, rule creators are no longer applicable under the regulation. Learn more about the amendments.

To replace these tools, the amended regulation now requires PROs to submit a report that outlines how they will operate the Blue Box collection system on behalf of producers, ensuring that materials are collected from all eligible communities (i.e., communities outside of the Far North) across the province. Learn more about what PROs need to include in the report.

-

Yes, a producer can change PROs at any time. Producers must notify RPRA of any change in PROs within 30 days of the change.

-

Account Admins must add any new, or manage existing, Primary Contacts under the program they wish to give them access to in order for the Primary Contact to be able to submit a report (e.g., permissions to view and complete reports).

To Manage contacts on your Registry account, please see the following steps:

- Log into your account

- Once you are logged in, click on the drop-down arrow in the top right corner and select Manage Users

- Under Actions, click Manage to update preferences of existing users

- Click Add New User to add an additional contact to your account

- To give reporting access to a Primary Contact, select the program from the drop-down that you would like to grant them access to

-

No. As of October 1, 2021, it is up to the municipality to decide if they will participate in the HSP Regulation. Those that decide to participate will need to work with a PRO or a producer.

-

No. RPRA is a Regulator that enforces the HSP Regulation and does not provide or play a role in the reimbursement or compensation of the obligated products. Contact your PRO for further details.

-

Producers can reference the chart below to determine if they are a small, large or exempt HSP producer.

Producer categories use the average weight of material (in tonnes) supplied in Ontario in the previous calendar year.

Type of HSP Exempt (Less than <) Small Producer Large Producer (Equal to or greater than >) Oil Filters 3.5 ⟷ 100 Non-refillable Pressurized Containers 3 ⟷ 100 Antifreeze 20 ⟷ 300 Oil Containers 2 ⟷ 55 Solvents 3 ⟷ 70 Paints and Coatings 10 ⟷ 1,000 Pesticides 1 ⟷ 9 Refillable Pressurized Containers N/A Mercury-containing Devices Fertilizers Propane Containers (refillable) Note that ‘⟷’ indicates a value greater than ‘Exempt’ but less than ‘Large Producer’ threshold.

Average supply weight is determined using the following formula:

Average weight of HSP supply = (Y1 + Y2 + Y3) / 3

E.g. 2025 average weight of supply = (2024 + 2023 + 2022) / 3

-

As required under the regulation, Project Leaders, Owners and Site Operators are required to use the Excess Soil Registry to file notices for certain Project Areas, Reuse Sites, and Residential Development Soil Depot sites where Excess Soil is generated, transported, temporarily placed, and deposited.

Project Leaders, Owners and Site Operators can also assign an Authorized Person to file a notice and pay fees in the Registry on their behalf.

Role definitions

Project Leader

In O. Reg. 406/19, the Project Leader means, in respect of a project, the person or persons who are ultimately responsible for making decisions relating to the planning and implementation of the project.

The Project Leader is responsible for ensuring that a Project Area Notice is filed if required. They must always complete and sign the required declarations that are a component of the notice being filed and pay Registry fees.

Owner

A person who owns the land, with an interest upon whose credit, behalf, privity or direct benefit an improvement is made to the premises.

For a Reuse Site or a Residential Development Soil Depot, an Operator may complete all aspects of the relevant notice filing in the Registry.

Operator

A person who has the charge, management, or control of a site. An Operator may be an owner of a property, lease a property or be contracted to operate a Project Area Site, Reuse Site or Residential Development Soil Depot.

For a Reuse Site or a Residential Development Soil Depot, an Operator may complete all aspects of the relevant notice filing in the Registry.

Authorized Person

A person who is authorized by the Project Leader, Owner, or Operator of a site, to complete a notice filing and pay fees on their behalf.

The Authorized Person can initiate a notice in the Registry if permitted to by the Project Leader, Owner, or Operator of a site, and can complete all required notice information and pay applicable fees on their behalf.

Qualified person (QP)

QPs under the regulation have the same meaning as section 5 and 6 of Ontario Regulation 153/04 (O. Reg. 153/04).

Section 5 of O. Reg. 153/04 defines a Qualified Person as professional engineers and geoscientists – these are the persons who may oversee or conduct environmental site assessments or complete certifications in a Record of Site Condition. Section 6 of O. Reg. 153/04 sets out the requirements for Qualified Persons who conduct or oversee a risk assessment.

A QP may be designated as an Authorized Person by the Project Leader or by an Owner/Operator to file a notice to the Excess Soil Registry on their behalf.

-

The regulation requires notices to be filed for three types of activities:

1. Notice filings for excess soil from Project Areas that can be made by a Project Leader or Authorized Person and may require retaining a Qualified Person. These notices will be required starting January 1st, 2022, before soil that will become excess soil is removed from the Project Area. There will be two fillings for each notice:

- An initial filing before the soil is removed, which will require the following information to be provided:

-

- a description of the project and Project Area including the location of each property within the project area

- the contact information of the Project Leader, Operator or Authorized Person and the person responsible for transportation, and if applicable, the qualified person

- an estimated amount of the soil that will be generated broken down by quality standard

- a list of substances/materials that were added to the soil

- the location of temporary or final sites that the soil will be transported to

- details of the Reuse Site(s) where the soil will be moved to

- information on any peer review or certification processes if applicable

- and a declaration by the Project Leader.

Exceptions

The Project Leader, Operator or Authorized Person may file a notice after soil that will become excess soil has been removed from the project area if:

- conducting the required sampling and analysis at the project area is impractical

- the soil is removed from the project area and delivered to a temporary site to conduct the required sampling, and

- the Project Leader, Operator or Authorized Person makes sure the required sampling is conducted as soon as the soil is delivered to the temporary site

If soil is removed before a notice is filed in the Registry, the Project Leader, Operator, or Authorized Person is required to ensure that the notice is filed in the Registry before the soil that has become excess soil is transported from the temporary site to the final site.

More information about when this type of notice filing is not required can be found under Schedule 2 of the regulation.